- Australia

- /

- Healthtech

- /

- ASX:PME

Exploring Infomedia And 2 Promising High Growth Tech Stocks In Australia

Reviewed by Simply Wall St

The Australian market remained flat over the last week but has seen a 17% increase over the past year, with earnings forecasted to grow by 13% annually. In this context, identifying high growth tech stocks like Infomedia and others can be crucial for investors seeking opportunities that align with these positive market trends.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.16% | ★★★★★☆ |

| Pureprofile | 14.31% | 71.53% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| Telix Pharmaceuticals | 21.55% | 38.32% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| AVA Risk Group | 25.54% | 77.32% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 37.21% | 98.46% | ★★★★★★ |

| Senetas | 14.33% | 118.52% | ★★★★★☆ |

| SiteMinder | 18.84% | 60.66% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Infomedia (ASX:IFM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry globally, with a market cap of approximately A$504.05 million.

Operations: The company's primary revenue stream comes from publishing periodicals, generating A$140.83 million.

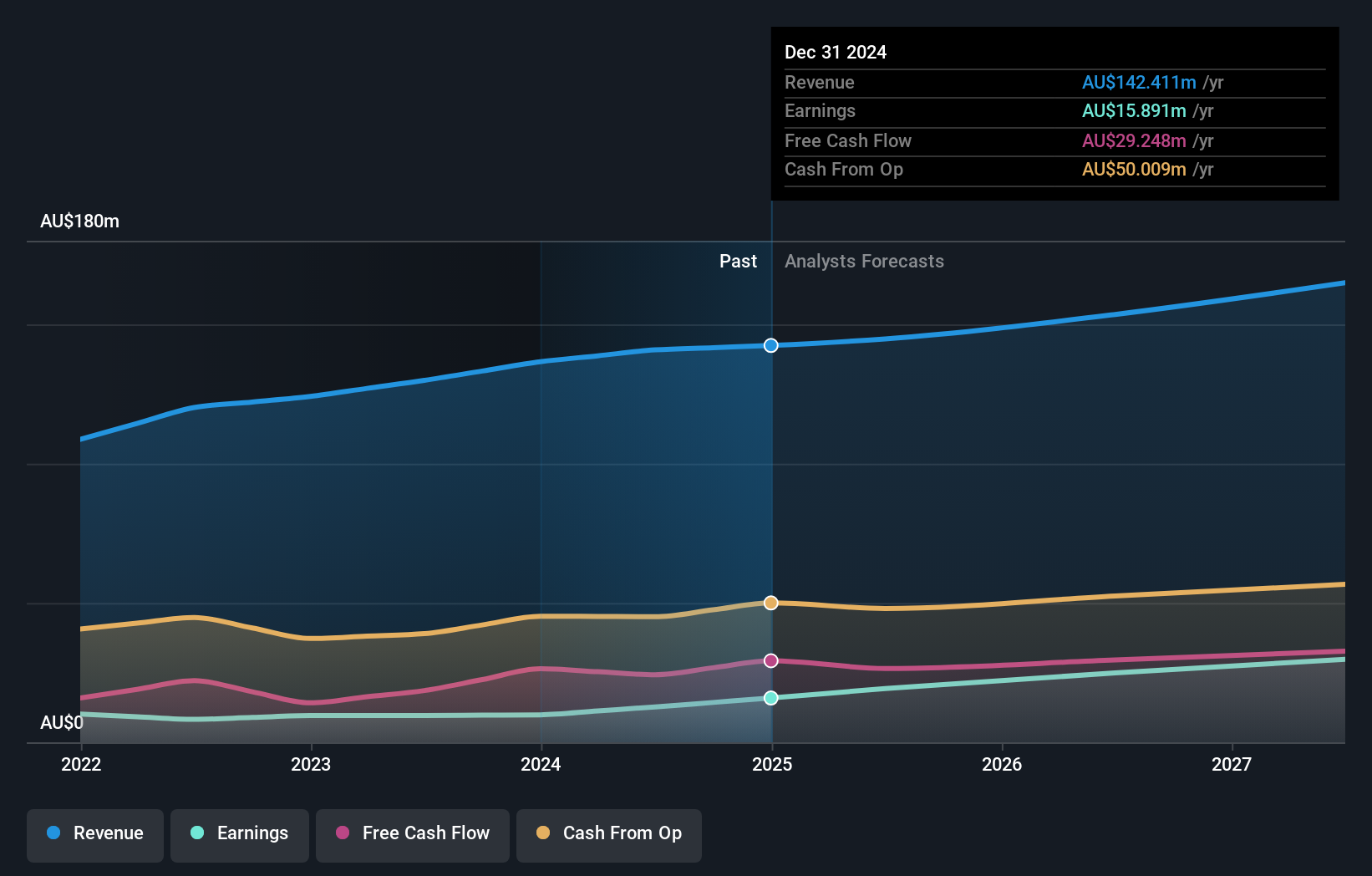

Infomedia, a player in the tech sector, has shown robust performance with a 32.4% earnings growth over the past year, outpacing the software industry's average of 6.8%. This growth is supported by significant R&D investment, aligning with its strategic focus on innovation to stay ahead in competitive markets. The company's revenue is also expected to grow at 6.8% annually, faster than the Australian market average of 5.7%. Recently appointed board member Joe Powell brings extensive digital and educational business experience, potentially steering Infomedia towards new opportunities and enhancing governance as it scales operations globally. With earnings forecasted to surge by 21% annually over the next three years, Infomedia is positioning itself as a formidable entity in high-growth tech sectors despite facing challenges like a one-off loss of A$8.6 million last fiscal year.

- Take a closer look at Infomedia's potential here in our health report.

Examine Infomedia's past performance report to understand how it has performed in the past.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging and radiology information system software to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market capitalization of approximately A$21.79 billion.

Operations: The company generates revenue primarily from producing integrated software applications for the healthcare industry, amounting to A$161.50 million. It operates in key markets including Australia, North America, and Europe.

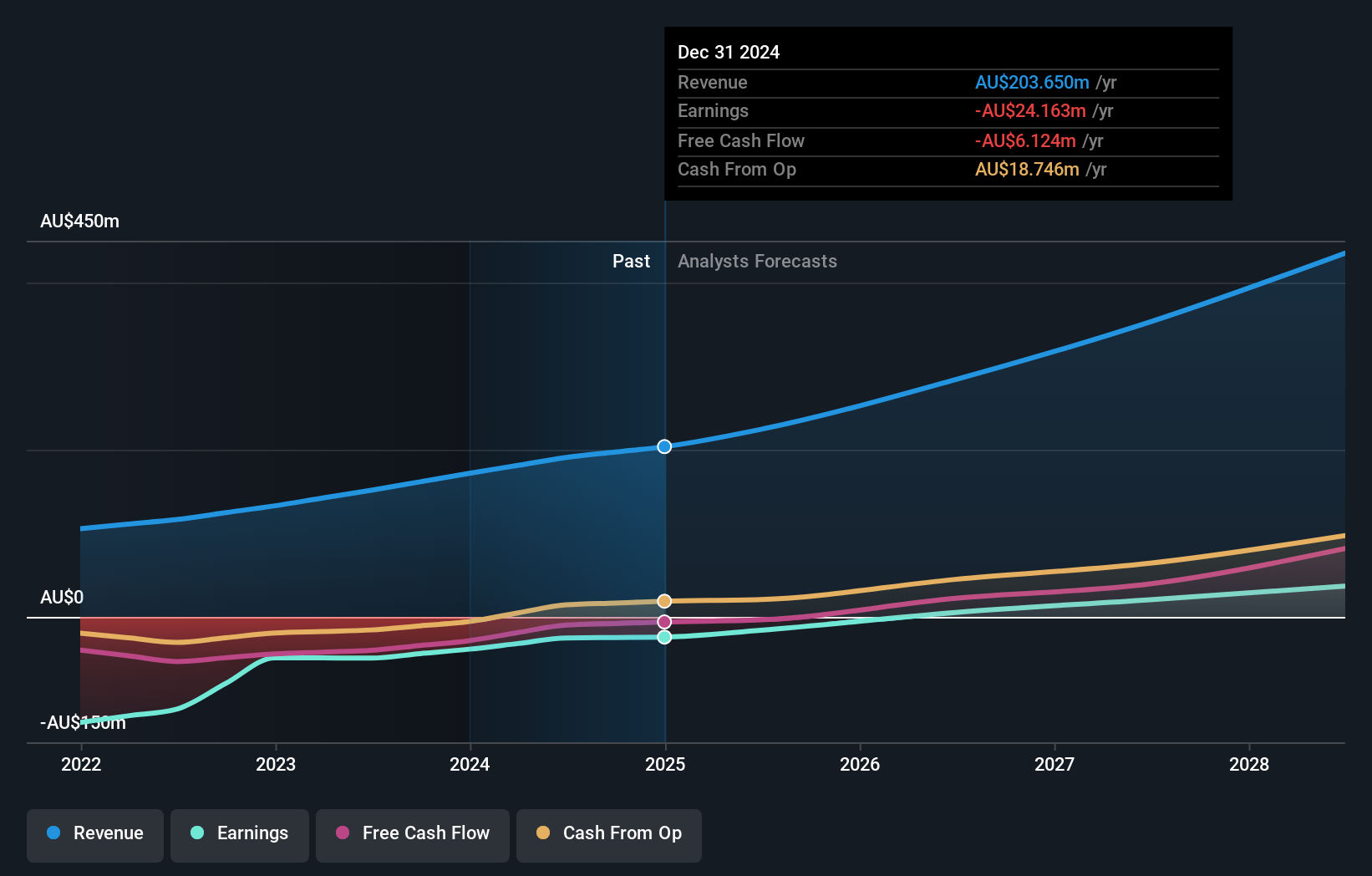

Pro Medicus, a trailblazer in the Australian tech landscape, has demonstrated impressive financial health with a 36.5% surge in earnings over the last year, significantly outpacing its industry's growth. The company's commitment to innovation is evident from its strategic R&D investments which have been pivotal in driving these results. Notably, Pro Medicus forecasts an annual revenue increase of 17.1% and earnings growth of 19.1%, both figures robustly surpassing broader market expectations of 5.8% and 12.5%, respectively. This growth trajectory is supported by high-quality non-cash earnings and an exceptional projected return on equity of 47.8% in three years, positioning Pro Medicus well within a competitive tech sphere that values rapid evolution and sustainability.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited is an Australian company that provides online guest acquisition platforms and commerce solutions for accommodation providers globally, with a market cap of A$1.83 billion.

Operations: SiteMinder generates revenue primarily through its software and programming segment, which reported A$190.84 million. The company's focus is on developing and marketing solutions that enhance guest acquisition for accommodation providers both in Australia and internationally.

SiteMinder, amidst a transformative phase in the Australian tech sector, has shown resilience with a notable reduction in net loss to AUD 25.13 million from AUD 49.3 million year-over-year and an increase in sales to AUD 190.67 million. This performance is underpinned by strategic R&D investments that align with industry shifts towards digital and automated solutions, enhancing operational efficiencies across global hospitality sectors. The company's focus on innovation is evident as it navigates through leadership changes, ensuring continuity in its growth trajectory which forecasts revenue increases at an annual rate of 18.8% and earnings growth projected at a compelling 60.7%. These figures suggest SiteMinder is adapting well to market demands while positioning itself for future profitability within the competitive landscape of tech-driven business solutions.

- Unlock comprehensive insights into our analysis of SiteMinder stock in this health report.

Gain insights into SiteMinder's historical performance by reviewing our past performance report.

Make It Happen

- Click here to access our complete index of 58 ASX High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PME

Pro Medicus

A healthcare informatics company, engages in the development and supply of healthcare imaging software, and radiology information (RIS) system software and services to hospitals, imaging centers, and health care groups in Australia, North America, and Europe.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives