The Australian market has recently experienced a mix of highs and lows, with the ASX200 showing a 1.5% increase over the past month despite some setbacks from major players like CSL, which contributed to a downturn on Tuesday. In this dynamic environment, high-growth tech stocks stand out for their potential to capitalize on emerging trends and innovations, making them an intriguing focus for investors seeking opportunities in sectors that have shown resilience and upward momentum amidst broader market fluctuations.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 6.81% | 19.84% | ★★★★☆☆ |

| Pureprofile | 13.56% | 27.72% | ★★★★☆☆ |

| Pro Medicus | 19.62% | 21.46% | ★★★★★☆ |

| BlinkLab | 51.57% | 52.67% | ★★★★★★ |

| Echo IQ | 49.20% | 51.35% | ★★★★★★ |

| Kinatico | 12.26% | 51.47% | ★★★★☆☆ |

| Immutep | 70.84% | 42.55% | ★★★★★☆ |

| PYC Therapeutics | 12.55% | 24.30% | ★★★★★☆ |

| Xero | 12.82% | 23.77% | ★★★★☆☆ |

| Frontier Digital Ventures | 13.82% | 100.02% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our ASX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★★☆

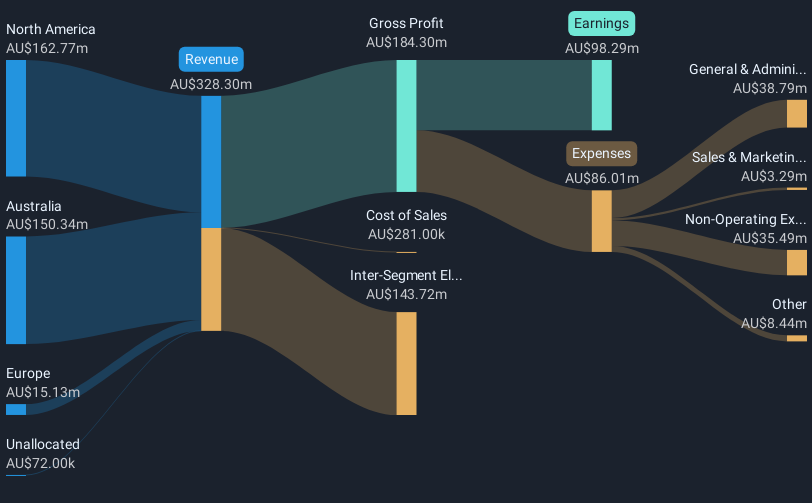

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies healthcare imaging software and radiology information system software to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$33.22 billion.

Operations: The company generates revenue primarily from producing integrated software applications for the healthcare industry, amounting to A$212.98 million.

Pro Medicus, a leader in healthcare imaging software, has demonstrated robust financial performance with a significant uptick in sales and net income, reporting AUD 212.98 million and AUD 115.22 million respectively for FY 2025. This represents a sharp increase from the previous year's figures of AUD 161.5 million in sales and AUD 82.79 million in net income, underscoring a growth trajectory that outpaces the broader Australian market's average. Notably, its earnings per share also saw substantial growth from AUD 0.793 to AUD 1.103 over the same period. The company recently announced an increased dividend payout of 30 cents per share, reflecting confidence in ongoing profitability and cash flow stability—a positive signal for stakeholders interested in the vitality and future prospects of high-tech investments within Australia’s healthcare sector.

- Click here and access our complete health analysis report to understand the dynamics of Pro Medicus.

Understand Pro Medicus' track record by examining our Past report.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

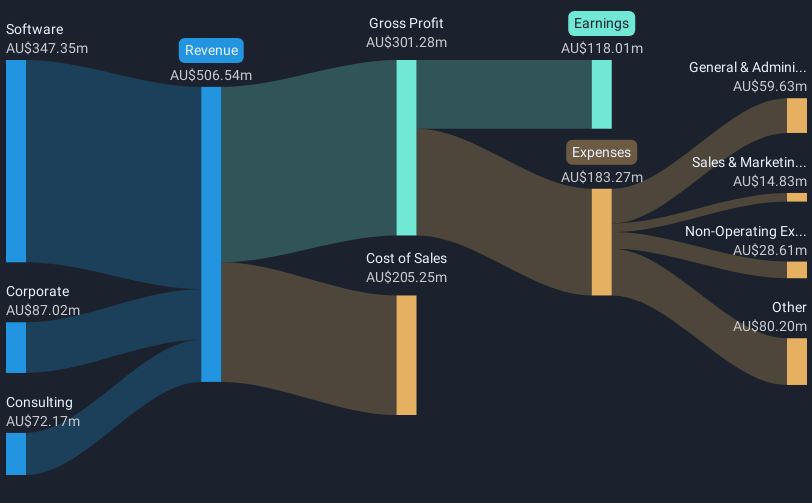

Overview: Technology One Limited is an enterprise software company that develops, markets, sells, implements, and supports integrated business solutions globally, with a market cap of A$12.74 billion.

Operations: The company generates revenue primarily from software, corporate, and consulting segments, with software contributing A$378.25 million. The focus on integrated enterprise solutions supports its operations both in Australia and internationally.

Technology One Limited has shown a commendable financial trajectory with its revenue surging to AUD 285.69 million, up from AUD 240.55 million year-over-year, reflecting a robust annual growth rate of 13.2%. This growth is complemented by an increase in net income to AUD 62.97 million from the previous year's AUD 48 million, marking a significant earnings growth of 21.3%. The firm’s commitment to innovation is evident in its R&D investments, which are pivotal in maintaining its competitive edge within the tech sector. Recent executive changes and consistent dividend payouts signal strong governance and shareholder confidence respectively, reinforcing Technology One’s solid market position amidst dynamic industry shifts.

- Delve into the full analysis health report here for a deeper understanding of Technology One.

Explore historical data to track Technology One's performance over time in our Past section.

Xero (ASX:XRO)

Simply Wall St Growth Rating: ★★★★☆☆

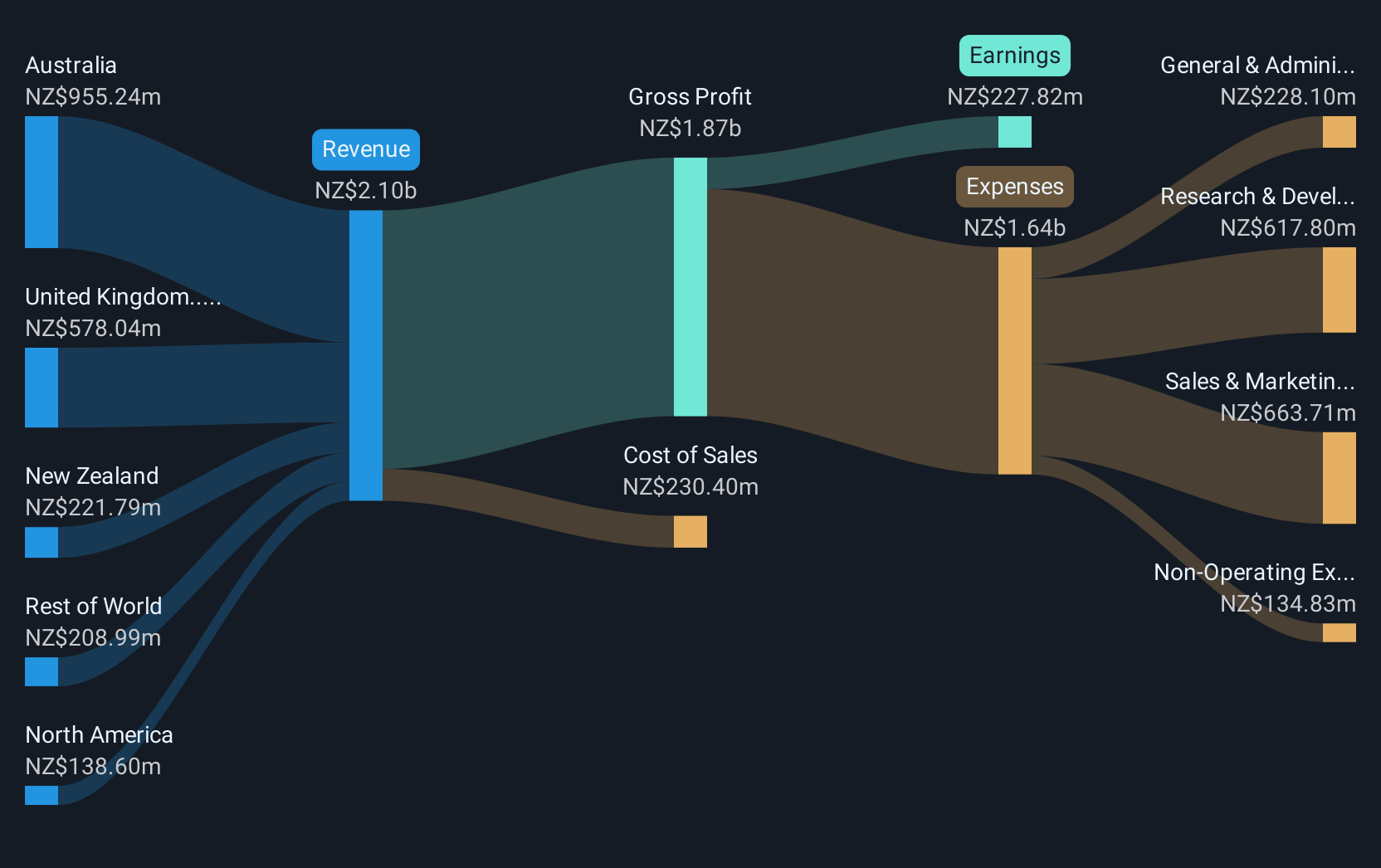

Overview: Xero Limited offers online business solutions tailored for small businesses and their advisors across Australia, New Zealand, the United Kingdom, North America, and other international markets, with a market cap of A$28.36 billion.

Operations: The company generates revenue primarily through providing online solutions for small businesses and their advisors, amounting to NZ$2.10 billion. The focus is on delivering tailored digital services across multiple regions, including Australia, New Zealand, the UK, and North America.

Xero Limited, a frontrunner in the Australian tech landscape, has demonstrated remarkable financial and operational growth. With earnings up by 30.4% over the past year and an expected annual growth rate of 23.8%, Xero outpaces both its industry and national averages significantly. Recent strategic moves include a massive AUD 1.85 billion follow-on equity offering, positioning the company for further expansion while enhancing its product offerings like Integra Balance.AI on the Xero App Store—a testament to its commitment to integrating cutting-edge AI technologies that streamline accounting processes for global clients. This blend of robust financial performance and strategic market expansions underpins Xero's strong position in high-growth tech sectors.

- Unlock comprehensive insights into our analysis of Xero stock in this health report.

Assess Xero's past performance with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 19 ASX High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:XRO

Xero

Provides online business solutions for small businesses and their advisors in Australia, New Zealand, the United Kingdom, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives