- Australia

- /

- Medical Equipment

- /

- ASX:OIL

Optiscan Imaging (ASX:OIL investor one-year losses grow to 31% as the stock sheds AU$16m this past week

Over the last month the Optiscan Imaging Limited (ASX:OIL) has been much stronger than before, rebounding by 34%. But that doesn't change the reality of under-performance over the last twelve months. The cold reality is that the stock has dropped 31% in one year, under-performing the market.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

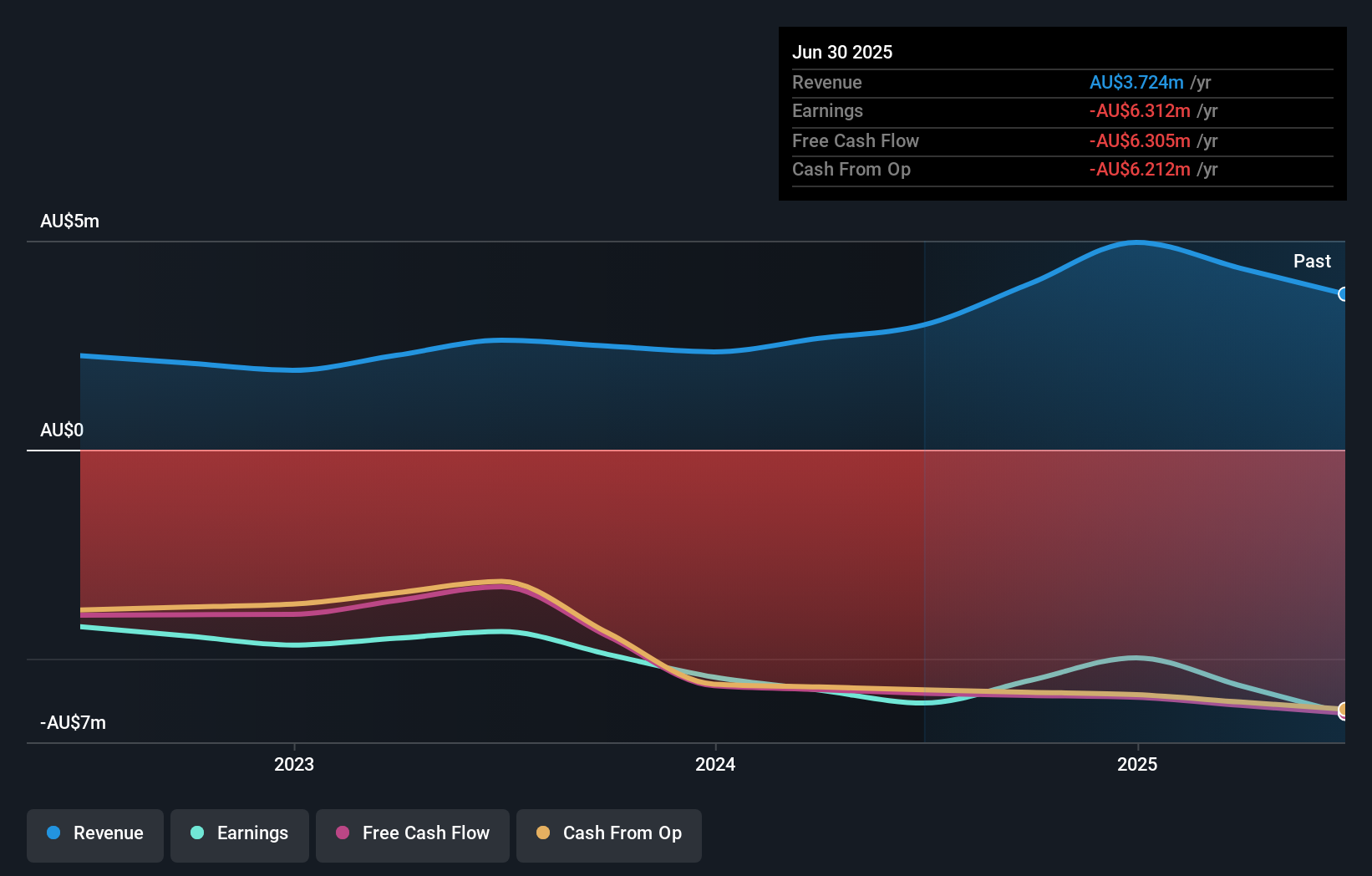

Because Optiscan Imaging made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Optiscan Imaging increased its revenue by 25%. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 31%. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Optiscan Imaging's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Optiscan Imaging had a tough year, with a total loss of 31%, against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Optiscan Imaging better, we need to consider many other factors. For instance, we've identified 5 warning signs for Optiscan Imaging (1 shouldn't be ignored) that you should be aware of.

Optiscan Imaging is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:OIL

Optiscan Imaging

Engages in the development, manufacture, and commercialization of endomicroscopic digital imaging technology solutions for medical, translational, and pre-clinical applications in Germany, China, Australia, and the United States.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives