- Australia

- /

- Medical Equipment

- /

- ASX:MX1

Slammed 27% Micro-X Limited (ASX:MX1) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Micro-X Limited (ASX:MX1) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

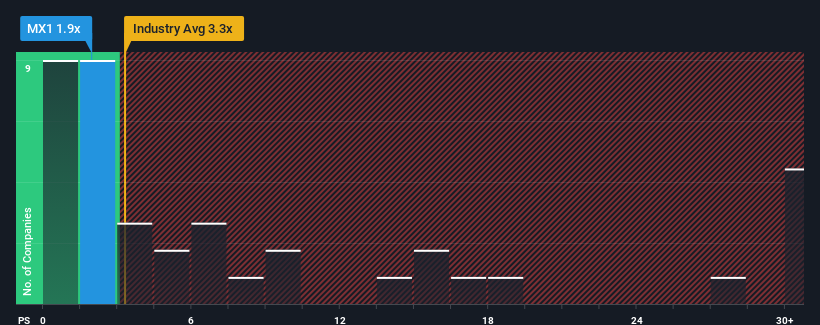

Following the heavy fall in price, Micro-X's price-to-sales (or "P/S") ratio of 1.9x might make it look like a buy right now compared to the Medical Equipment industry in Australia, where around half of the companies have P/S ratios above 3.3x and even P/S above 16x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Micro-X

How Micro-X Has Been Performing

Micro-X could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Micro-X will help you uncover what's on the horizon.How Is Micro-X's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Micro-X's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The latest three year period has seen an incredible overall rise in revenue, in spite of this mediocre revenue growth of late. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 51% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 11% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Micro-X's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Micro-X's P/S

Micro-X's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Micro-X's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Micro-X (of which 1 doesn't sit too well with us!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MX1

Micro-X

Designs, develops, manufactures, and commercializes imaging products for healthcare, defense, and security markets through cold cathode X-ray technology.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives