- Australia

- /

- Metals and Mining

- /

- ASX:GRX

Spotlight On GreenX Metals And 2 Prominent ASX Penny Stocks

Reviewed by Simply Wall St

As the 2025 trading season begins, the Australian market is experiencing a mixed start, with the ASX 200 opening lower following global trends. Despite this cautious beginning, investors continue to seek opportunities in various sectors, including penny stocks—an area often overlooked but rich with potential. Although considered a somewhat outdated term, penny stocks still offer intriguing possibilities for growth when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$205.65M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$112.19M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

GreenX Metals (ASX:GRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GreenX Metals Limited focuses on the exploration and evaluation of mineral properties in Greenland, Poland, and Germany, with a market cap of A$190.06 million.

Operations: The company's revenue segment is derived entirely from Mineral Exploration, amounting to A$0.46 million.

Market Cap: A$190.06M

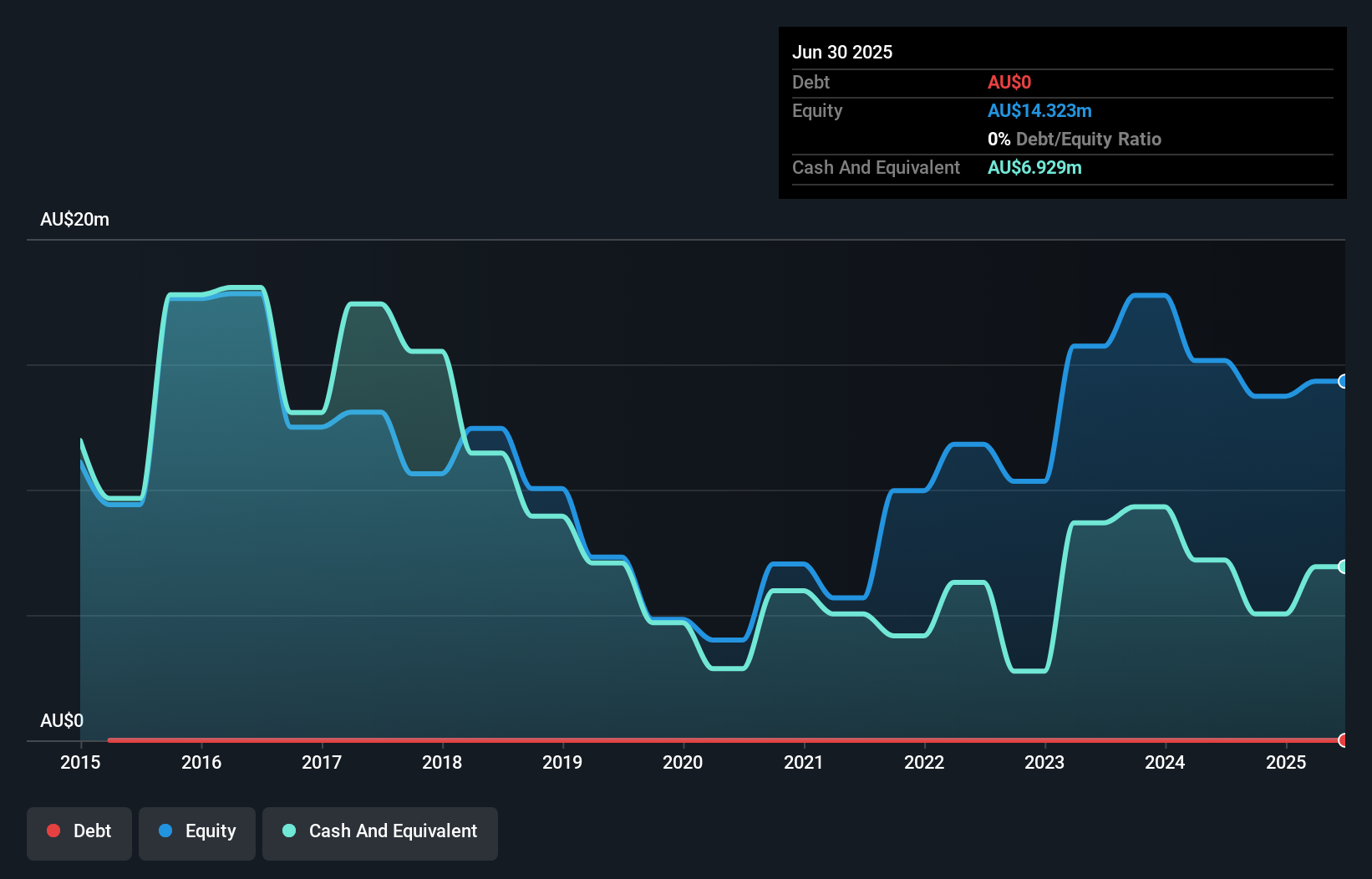

GreenX Metals Limited, with a market cap of A$190.06 million, is currently pre-revenue and focused on mineral exploration in Greenland, Poland, and Germany. The company has no debt and maintains a sufficient cash runway for over a year based on current free cash flow levels. Recent developments at its Eleonore North project in Greenland have highlighted significant antimony-gold mineralisation potential amidst rising antimony prices due to China's export controls. This positions GreenX well to capitalize on strategic interest in critical raw materials like antimony, though the company remains unprofitable with past earnings declining annually by 8.7%.

- Dive into the specifics of GreenX Metals here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into GreenX Metals' track record.

Microba Life Sciences (ASX:MAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Microba Life Sciences Limited offers microbiome testing, supplements, and analysis services across various regions including Australia, Europe, New Zealand, the UAE, the UK, the US, Asia, and Ireland with a market cap of A$87.33 million.

Operations: The company generates revenue of A$12.09 million from its testing services and supplements segment.

Market Cap: A$87.33M

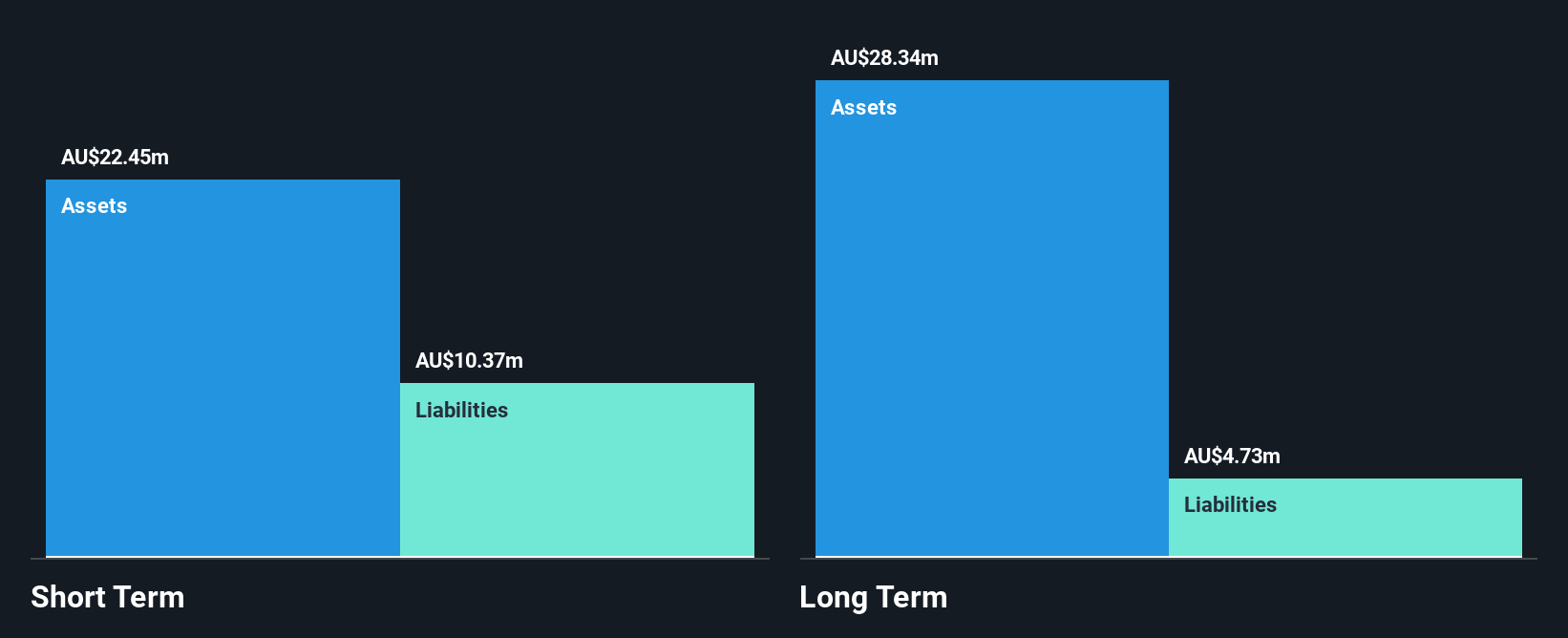

Microba Life Sciences Limited, with a market cap of A$87.33 million, generates A$12.09 million in revenue from its microbiome testing and supplements segment. Despite being unprofitable with increasing losses over the past five years, the company's strategic focus on microbiome diagnostics and therapeutics is strengthened by transferring its Research Services business unit to Clinical Microbiomics A/S. This agreement ensures retained revenue from existing contracts and potential milestone payments over four years. Short-term assets cover liabilities comfortably, but cash runway concerns persist if free cash flow continues to decline at historical rates of 29.5% annually.

- Click here to discover the nuances of Microba Life Sciences with our detailed analytical financial health report.

- Examine Microba Life Sciences' earnings growth report to understand how analysts expect it to perform.

Mastermyne Group (ASX:MYE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mastermyne Group Limited operates in Australia, offering mine operation, contracting, training, and related services within the mining and supporting industries, with a market cap of A$50.98 million.

Operations: The company generated A$294.39 million in revenue from its operations and services within the mining and supporting industries in Australia.

Market Cap: A$50.98M

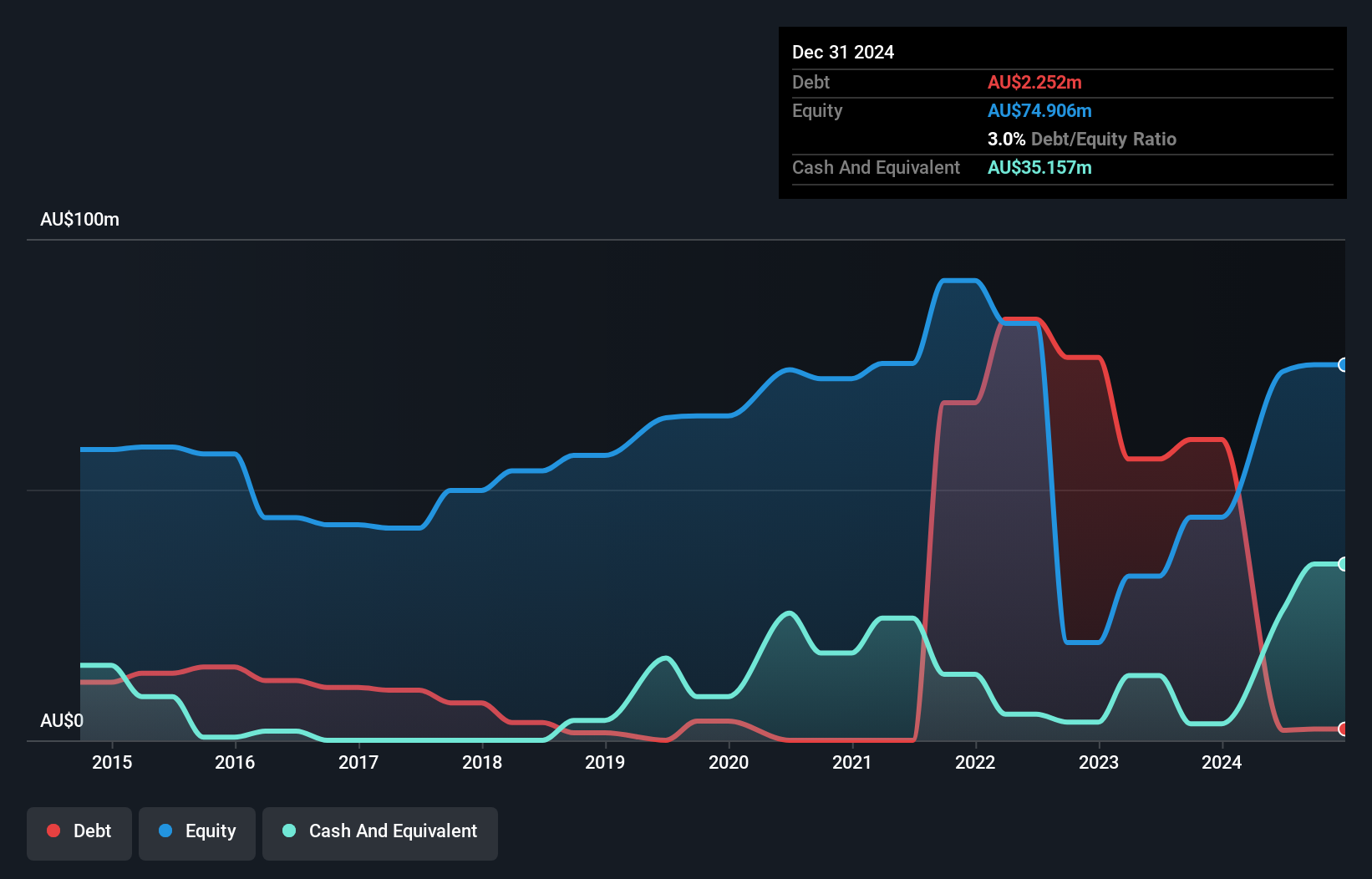

Mastermyne Group, with a market cap of A$50.98 million, has shown financial resilience by becoming profitable recently and maintaining strong cash flow coverage for its debt at 848.7%. Its short-term assets significantly exceed liabilities, indicating solid liquidity. However, the company's earnings were impacted by a one-off gain of A$3.3 million in the past year. The Price-To-Earnings ratio is notably low at 2.4x compared to the broader Australian market, suggesting potential undervaluation. Recent leadership changes include appointing Peter Barker as Chair and Matt Ruhl as CFO, which could influence strategic direction amidst ongoing contract adjustments with Anglo American mines.

- Click here and access our complete financial health analysis report to understand the dynamics of Mastermyne Group.

- Gain insights into Mastermyne Group's historical outcomes by reviewing our past performance report.

Where To Now?

- Get an in-depth perspective on all 1,052 ASX Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GRX

GreenX Metals

Engages in the exploration and evaluation of mineral properties in Greenland, Poland, and Germany.

Flawless balance sheet very low.

Market Insights

Community Narratives