- Australia

- /

- Medical Equipment

- /

- ASX:LDX

There Is A Reason Lumos Diagnostics Holdings Limited's (ASX:LDX) Price Is Undemanding

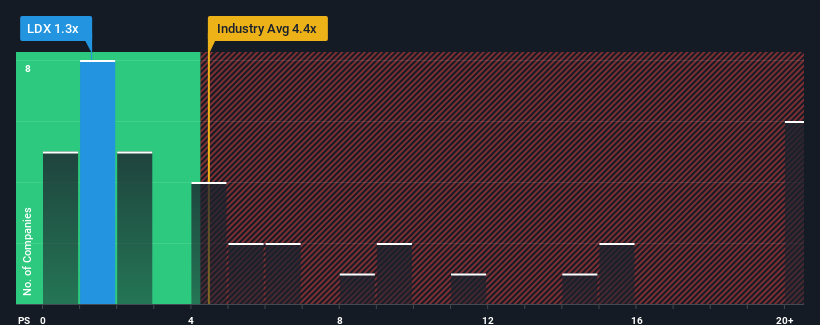

You may think that with a price-to-sales (or "P/S") ratio of 1.3x Lumos Diagnostics Holdings Limited (ASX:LDX) is definitely a stock worth checking out, seeing as almost half of all the Medical Equipment companies in Australia have P/S ratios greater than 4.4x and even P/S above 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Lumos Diagnostics Holdings

How Has Lumos Diagnostics Holdings Performed Recently?

Lumos Diagnostics Holdings has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Lumos Diagnostics Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Lumos Diagnostics Holdings?

The only time you'd be truly comfortable seeing a P/S as depressed as Lumos Diagnostics Holdings' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 5.7%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 41% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 14% shows it's an unpleasant look.

In light of this, it's understandable that Lumos Diagnostics Holdings' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Lumos Diagnostics Holdings maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 4 warning signs for Lumos Diagnostics Holdings (1 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LDX

Lumos Diagnostics Holdings

Develops, manufactures, and commercializes point-of-care diagnostic products for diagnosis and management of infectious diseases in the United States.

Adequate balance sheet with limited growth.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)