Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies LBT Innovations Limited (ASX:LBT) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for LBT Innovations

What Is LBT Innovations's Net Debt?

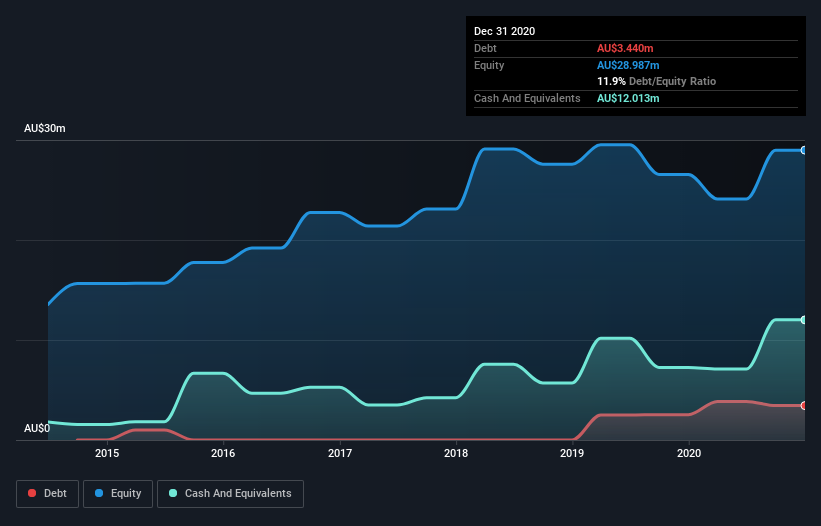

As you can see below, at the end of December 2020, LBT Innovations had AU$3.44m of debt, up from AU$2.53m a year ago. Click the image for more detail. However, it does have AU$12.0m in cash offsetting this, leading to net cash of AU$8.57m.

A Look At LBT Innovations' Liabilities

Zooming in on the latest balance sheet data, we can see that LBT Innovations had liabilities of AU$1.99m due within 12 months and liabilities of AU$6.80m due beyond that. Offsetting these obligations, it had cash of AU$12.0m as well as receivables valued at AU$1.86m due within 12 months. So it actually has AU$5.08m more liquid assets than total liabilities.

This excess liquidity suggests that LBT Innovations is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, LBT Innovations boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is LBT Innovations's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Since LBT Innovations doesn't have significant operating revenue, shareholders must hope it'll ramp sales of its new medical tech as soon as possible.

So How Risky Is LBT Innovations?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year LBT Innovations had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through AU$2.6m of cash and made a loss of AU$5.8m. But at least it has AU$8.57m on the balance sheet to spend on growth, near-term. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 5 warning signs for LBT Innovations (2 can't be ignored!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading LBT Innovations or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CC5

Clever Culture Systems

Engages in the research, development, and commercialization of technology solutions for medical industry in Australia, the United States, Sweden, the United Kingdom, China, Netherlands, and Germany.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.