- Australia

- /

- Medical Equipment

- /

- ASX:EYE

Improved Revenues Required Before Nova Eye Medical Limited (ASX:EYE) Stock's 43% Jump Looks Justified

Those holding Nova Eye Medical Limited (ASX:EYE) shares would be relieved that the share price has rebounded 43% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

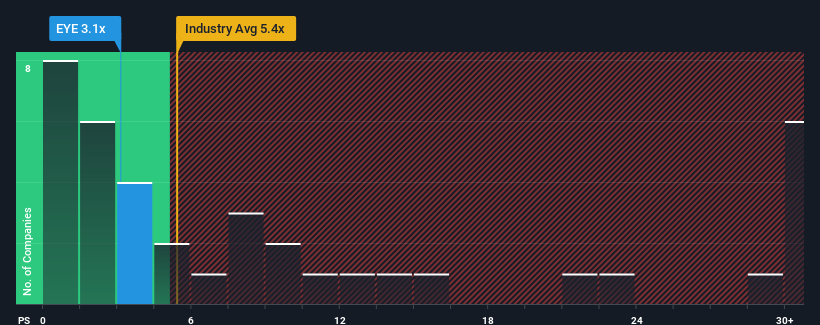

Although its price has surged higher, Nova Eye Medical may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.1x, considering almost half of all companies in the Medical Equipment industry in Australia have P/S ratios greater than 5.4x and even P/S higher than 16x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Nova Eye Medical

What Does Nova Eye Medical's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Nova Eye Medical has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nova Eye Medical.How Is Nova Eye Medical's Revenue Growth Trending?

Nova Eye Medical's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Still, revenue has fallen 3.9% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 17% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Nova Eye Medical's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Nova Eye Medical's P/S?

Despite Nova Eye Medical's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Nova Eye Medical maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 5 warning signs we've spotted with Nova Eye Medical (including 2 which are potentially serious).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Nova Eye Medical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nova Eye Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EYE

Nova Eye Medical

Designs, develops, manufactures, markets, and sells surgical devices for the treatment of glaucoma in Australia, the United States, Europe, the Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives