- Australia

- /

- Oil and Gas

- /

- ASX:FAR

Discover 3 ASX Penny Stocks Including Catapult Group International

Reviewed by Simply Wall St

The Australian market is experiencing a downturn, with the ASX 200 expected to open slightly lower, reflecting broader global economic uncertainties. Despite these challenges, investors often seek opportunities in less conventional areas like penny stocks—an investment category that remains relevant for those looking to tap into potential growth at lower price points. While traditionally associated with smaller or newer companies, penny stocks can offer significant upside when backed by strong financial health and sound fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.915 | A$311.8M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$97.91M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.59 | A$779.23M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.83 | A$102.64M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.92 | A$485.43M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Catapult Group International (ASX:CAT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company that offers technologies to optimize athlete performance, prevent injuries, and enhance return to play for sporting teams and athletes across multiple regions globally, with a market cap of A$929.23 million.

Operations: Catapult Group International generates revenue through its segments: Media & Other ($14.17 million), Tactics & Coaching ($34.43 million), and Performance & Health ($59.49 million).

Market Cap: A$929.23M

Catapult Group International, a sports science and analytics company, reported half-year sales of US$57.84 million, showing growth from the previous year's US$49.76 million. Despite this revenue increase, the company remains unprofitable with a net loss of US$7.41 million for the period. Catapult's short-term assets do not cover its short-term liabilities, but it maintains a sufficient cash runway for over three years due to positive free cash flow. While shareholders experienced dilution with shares outstanding increasing by 5.8%, Catapult's board and management teams are seasoned with significant tenure in their roles.

- Take a closer look at Catapult Group International's potential here in our financial health report.

- Explore Catapult Group International's analyst forecasts in our growth report.

Doctor Care Anywhere Group (ASX:DOC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Doctor Care Anywhere Group PLC operates in the digital healthcare sector, offering services in the United Kingdom, Australia, and the Republic of Ireland, with a market cap of A$26.41 million.

Operations: The company's revenue primarily stems from Virtual Healthcare Services, Tech Platform Licencing, and Digital Design Services, totaling £41.10 million.

Market Cap: A$26.41M

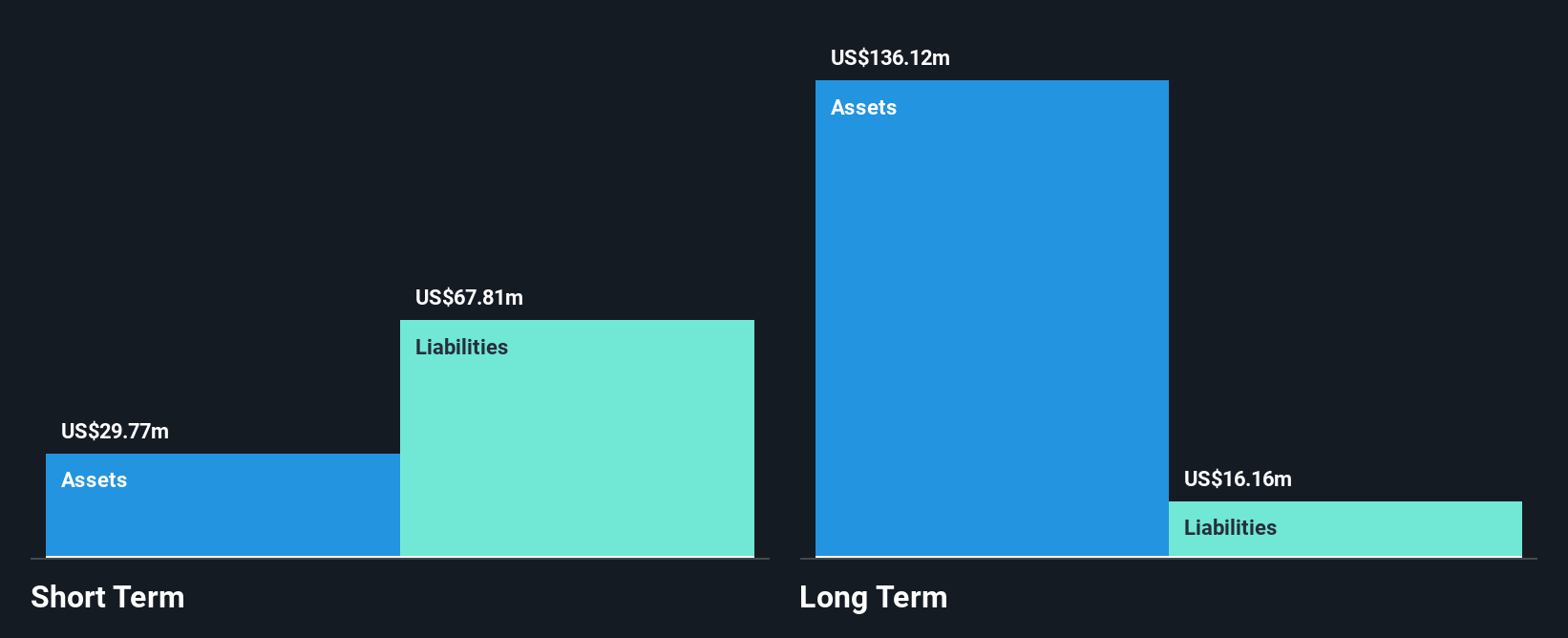

Doctor Care Anywhere Group, with a market cap of A$26.41 million, operates in the digital healthcare sector and generates revenue from Virtual Healthcare Services and Tech Platform Licencing, totaling £41.10 million. Despite being unprofitable, the company has managed to reduce losses over the past five years by 15.8% annually and is trading at a significant discount to its estimated fair value. The company's short-term assets exceed both its short-term and long-term liabilities, providing some financial stability. Recent leadership changes include Laura O'Riordan's appointment as CEO effective January 2025, bringing extensive experience in digital healthcare management.

- Click to explore a detailed breakdown of our findings in Doctor Care Anywhere Group's financial health report.

- Understand Doctor Care Anywhere Group's earnings outlook by examining our growth report.

FAR (ASX:FAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FAR Limited is an oil and gas exploration and development company operating in Africa with a market capitalization of A$48.05 million.

Operations: FAR Limited has not reported any revenue segments.

Market Cap: A$48.05M

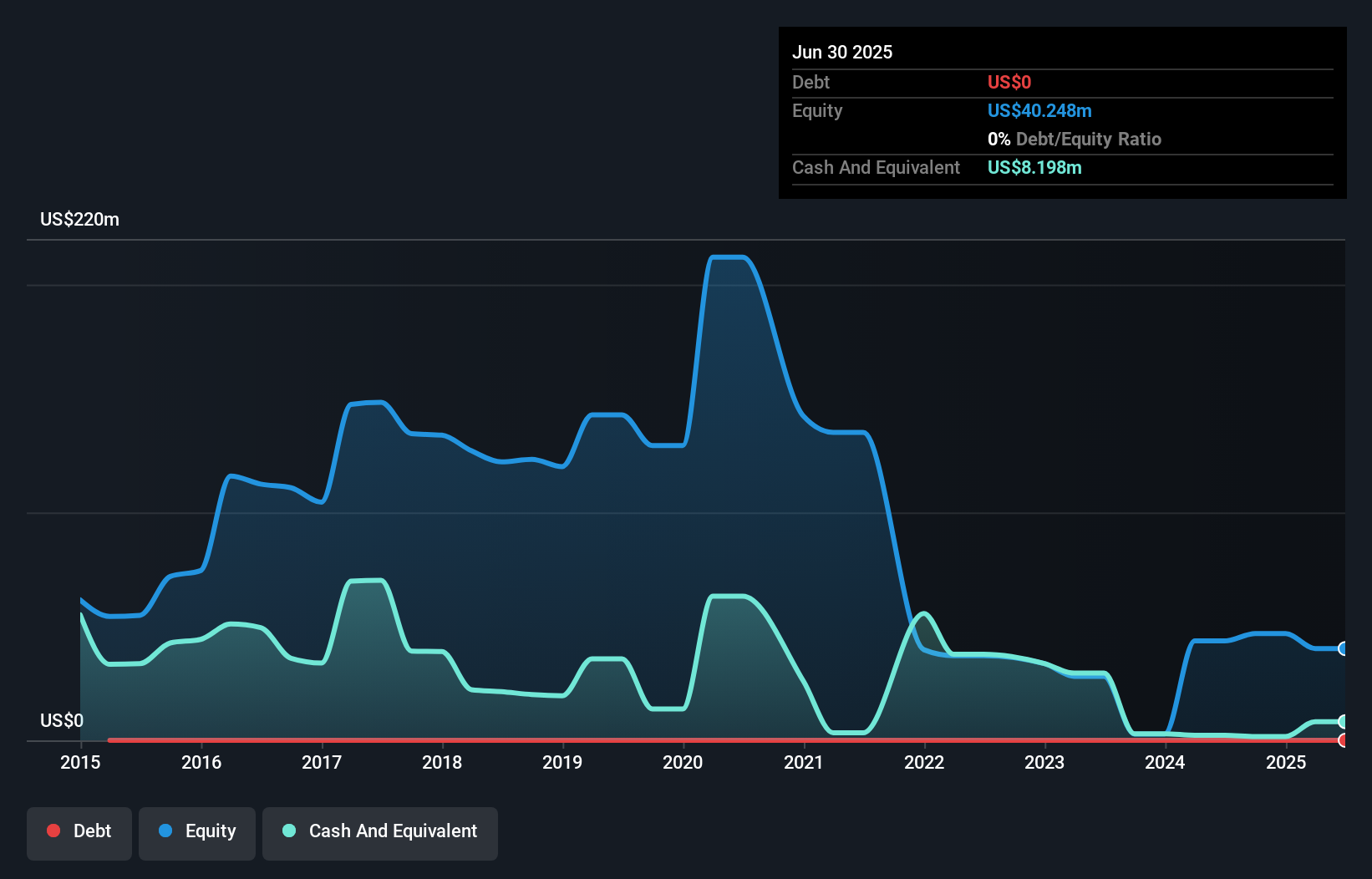

FAR Limited, with a market cap of A$48.05 million, operates as a pre-revenue oil and gas exploration company in Africa. It has no significant revenue streams but recently achieved profitability, boasting an outstanding Return on Equity of 90%. The company's short-term assets of A$9.6 million comfortably cover its short-term liabilities of A$165,000, and it remains debt-free with no long-term liabilities. FAR's Price-To-Earnings ratio is notably low at 0.8x compared to the Australian market average of 20.1x, suggesting potential value for investors seeking penny stocks with strong financial fundamentals and recent profitability milestones.

- Jump into the full analysis health report here for a deeper understanding of FAR.

- Gain insights into FAR's historical outcomes by reviewing our past performance report.

Key Takeaways

- Investigate our full lineup of 1,051 ASX Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FAR

FAR

Operates as an oil and gas exploration and development company in Africa.

Flawless balance sheet with proven track record.