Uncovering Opportunities: Acusensus And 2 Other ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market remained flat over the last week but has risen 22% over the past year, with earnings forecasted to grow by 12% annually. Despite being considered an outdated term, penny stocks still represent a compelling investment area, especially for those seeking growth opportunities in smaller or newer companies. When these stocks are supported by strong financials, they can offer significant potential for returns; let's explore some examples that stand out for their balance sheet strength and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Acusensus (ASX:ACE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Acusensus Limited develops technology for detecting and providing prosecutable evidence of traffic violations, such as distracted driving and speeding, in Australia, the United States, and the United Kingdom; it has a market cap of A$113.89 million.

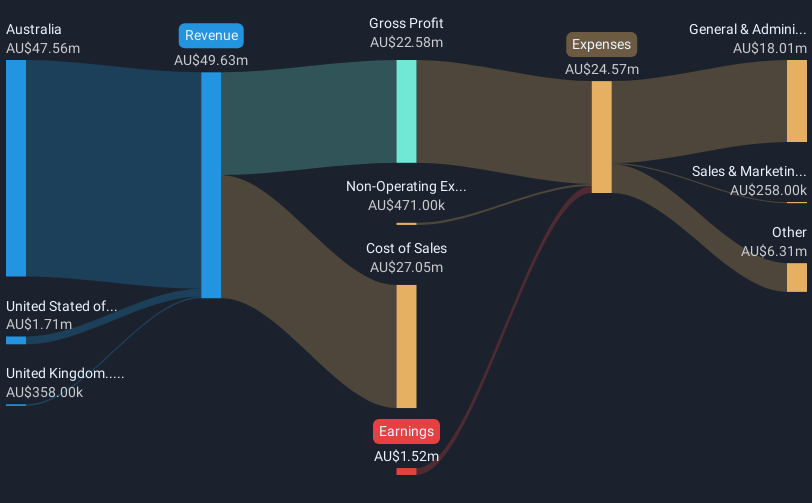

Operations: The company's revenue comes entirely from its Electronic Security Devices segment, totaling A$49.63 million.

Market Cap: A$113.89M

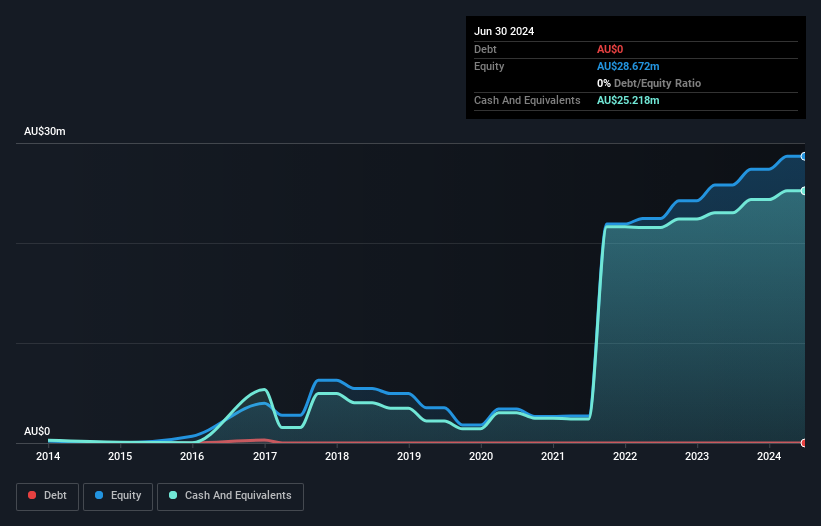

Acusensus Limited, with a market cap of A$113.89 million, focuses on electronic security devices for traffic violation detection. Despite reporting A$49.63 million in revenue for the year ended June 30, 2024, the company is currently unprofitable with a net loss of A$1.52 million and negative return on equity at -4.24%. It has no debt and its short-term assets exceed both short- and long-term liabilities significantly, indicating financial stability in covering obligations. The board is experienced with an average tenure of 4.1 years; however, the management team is relatively new with an average tenure of 1.5 years.

- Jump into the full analysis health report here for a deeper understanding of Acusensus.

- Gain insights into Acusensus' future direction by reviewing our growth report.

Cogstate (ASX:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience technology company focused on developing and commercializing digital brain health assessments for academic and industry research, with a market cap of A$158.79 million.

Operations: The company's revenue is primarily derived from Clinical Trials, including Precision Recruitment Tool & Research, which generated $39.44 million, and Healthcare, including Sport, contributing $3.99 million.

Market Cap: A$158.79M

Cogstate Limited, with a market cap of A$158.79 million, has shown strong financial performance in the past year. The company reported revenue of US$43.43 million and net income of US$5.45 million for the fiscal year ending June 30, 2024, reflecting substantial earnings growth compared to previous years. Its debt is well-covered by operating cash flow and short-term assets exceed both short- and long-term liabilities, indicating robust financial health. Recently announced share buyback plans could enhance shareholder value further, while the appointment of Dr. Kaycee Sink as Chief Medical Officer underscores strategic focus on advancing clinical trials in neurodegenerative disorders like Alzheimer's disease.

- Click here to discover the nuances of Cogstate with our detailed analytical financial health report.

- Understand Cogstate's earnings outlook by examining our growth report.

Dropsuite (ASX:DSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dropsuite Limited operates a cloud-based software platform globally and has a market capitalization of A$262.77 million.

Operations: The company generates revenue from the provision of backup services, amounting to A$35.46 million.

Market Cap: A$262.77M

Dropsuite Limited, with a market cap of A$262.77 million, has demonstrated financial stability through its debt-free status and strong asset position. The company reported half-year sales of A$18.9 million, an increase from the previous year, although net income decreased to A$0.273 million. Despite negative earnings growth over the past year and reduced profit margins at 2.9%, Dropsuite's short-term assets significantly surpass its liabilities, bolstering liquidity. Management is experienced with an average tenure of 2.1 years; however, recent significant insider selling may raise concerns about internal confidence in future performance prospects within this volatile segment.

- Click to explore a detailed breakdown of our findings in Dropsuite's financial health report.

- Gain insights into Dropsuite's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Explore the 1,027 names from our ASX Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ACE

Acusensus

Develops technology focused on the detection and provision of prosecutable evidence of distracted driving, seatbelt compliance, speeding, railway crossing compliance, and the monitoring vehicles of interest in Australia, the United States, and the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives