- Australia

- /

- Capital Markets

- /

- ASX:AVC

3 ASX Penny Stocks With Market Caps Under A$80M

Reviewed by Simply Wall St

As the Santa Rally gains momentum, the ASX 200 is expected to remain mostly positive, reflecting a broader trend of optimism in global markets despite geopolitical uncertainties. The term 'penny stocks' might feel like a relic of past market eras, but they still represent real potential for investors. These smaller or newer companies can offer a blend of affordability and growth potential when supported by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.75M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.545 | A$337.98M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.765 | A$97.63M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.61 | A$789.03M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$112.47M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.30 | A$110.99M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.84 | A$477.54M | ★★★★☆☆ |

Click here to see the full list of 1,045 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Auctus Investment Group (ASX:AVC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Auctus Investment Group Limited, formerly Yonder and Beyond Group Limited, is a private equity and venture capital firm focusing on mid-market growth sectors, real estate, and infrastructure with a market cap of A$43.75 million.

Operations: The company generates revenue of A$7.70 million from its Information Technology segment.

Market Cap: A$43.75M

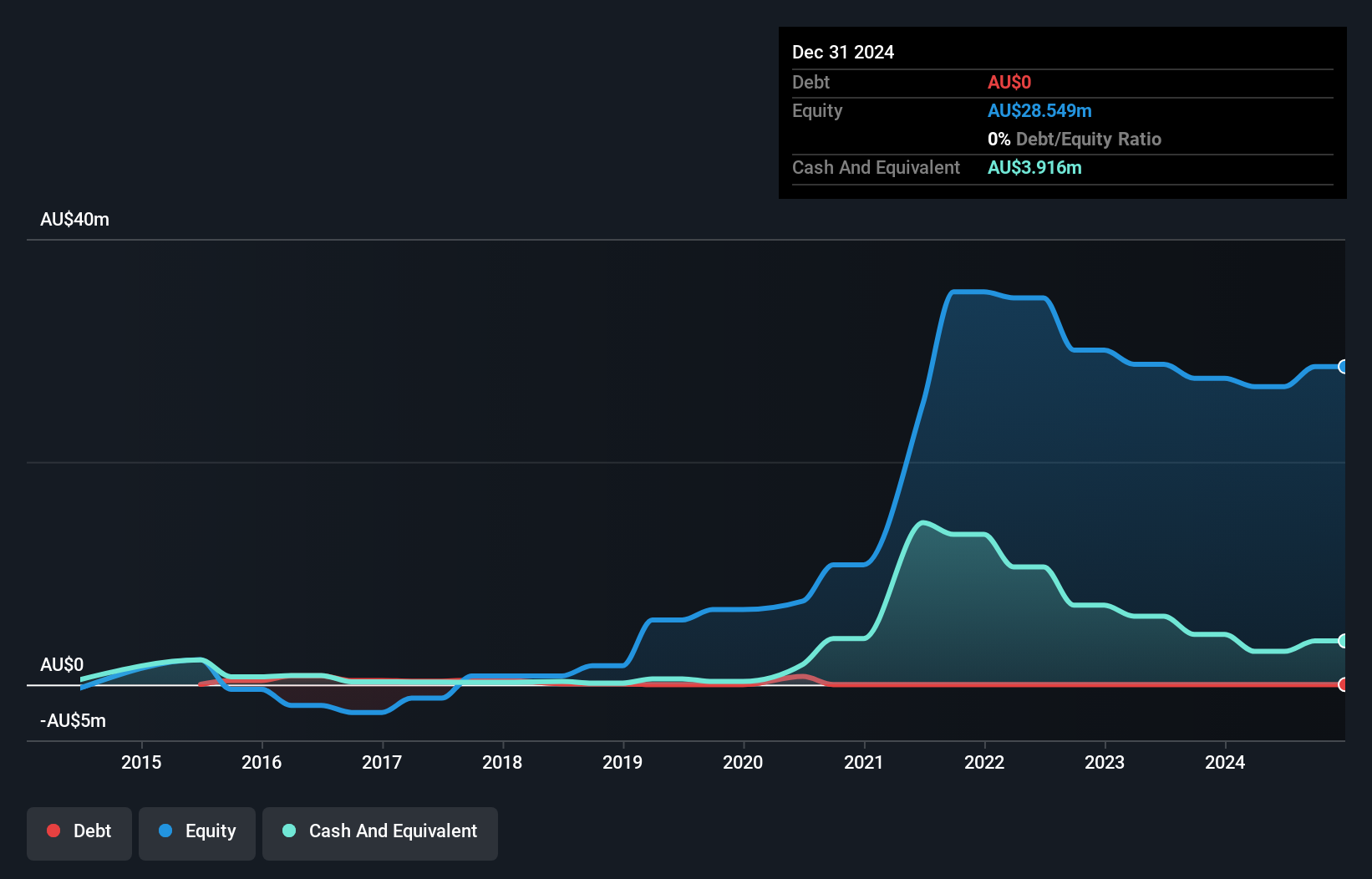

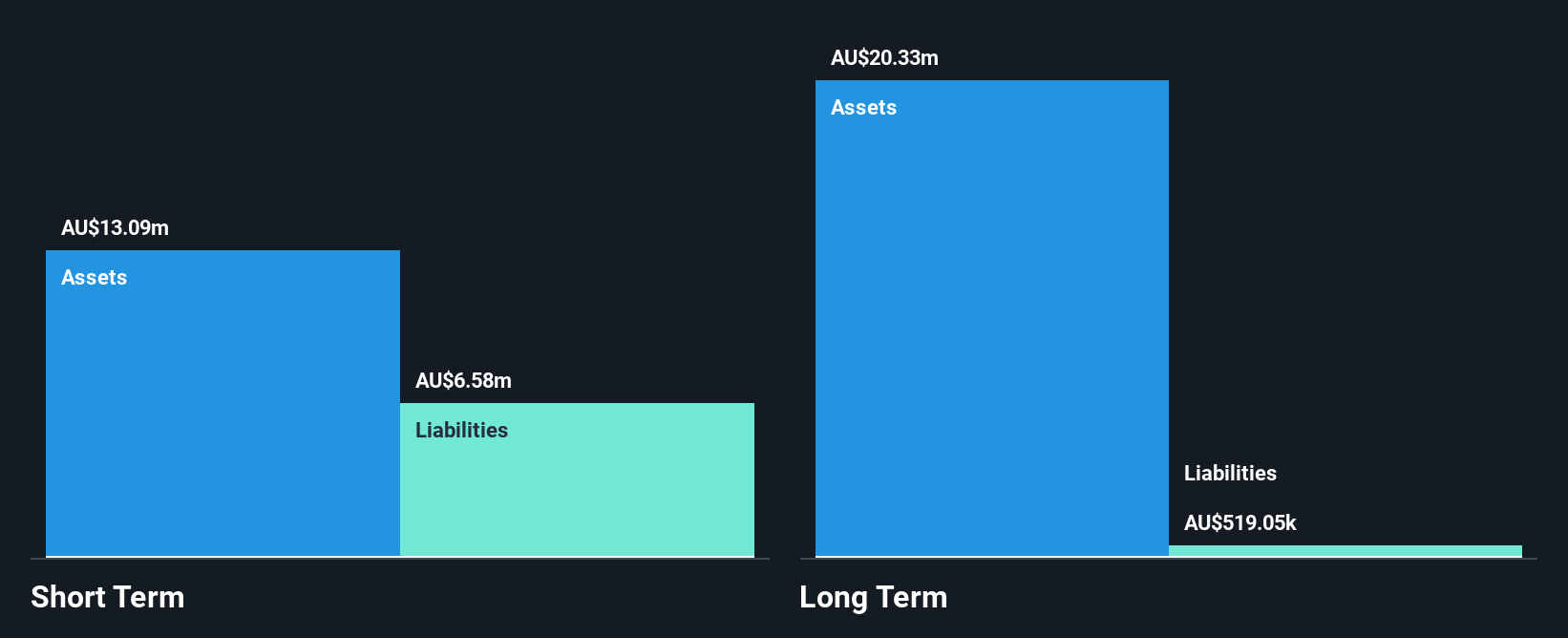

Auctus Investment Group, with a market cap of A$43.75 million, has transitioned to profitability over the past year, marking a significant milestone in its financial journey. Despite this progress, shareholders experienced dilution as shares outstanding increased by 6.3%. The company is debt-free and maintains strong short-term financial health with assets of A$9.2 million exceeding liabilities. However, it does not generate meaningful revenue from its operations (A$8 million). The management team and board are seasoned with average tenures of 6.5 and 3.1 years respectively, suggesting stability in leadership amidst ongoing growth efforts.

- Jump into the full analysis health report here for a deeper understanding of Auctus Investment Group.

- Understand Auctus Investment Group's track record by examining our performance history report.

Beamtree Holdings (ASX:BMT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beamtree Holdings Limited offers artificial intelligence-based decision support software and data insight services to the healthcare industry both in Australia and internationally, with a market cap of A$76.78 million.

Operations: The company generates revenue of A$27.60 million from its healthcare software segment.

Market Cap: A$76.78M

Beamtree Holdings Limited, with a market cap of A$76.78 million, operates in the healthcare AI and data analytics sector. The company generates A$27.60 million in revenue but remains unprofitable, with losses increasing over the past five years. Despite this, its short-term assets exceed both short and long-term liabilities, indicating sound financial health regarding debt management. Beamtree's stock trades significantly below estimated fair value and has not experienced meaningful shareholder dilution recently. Leadership transitions are underway as CEO Tim Kelsey plans to step down in March 2025 while remaining involved as chair of the Global Impact Committee post-retirement.

- Click to explore a detailed breakdown of our findings in Beamtree Holdings' financial health report.

- Learn about Beamtree Holdings' future growth trajectory here.

Kinatico (ASX:KYP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kinatico Ltd specializes in screening, verification, and SaaS-based workforce management and compliance technology systems across Australia and New Zealand, with a market cap of A$65.04 million.

Operations: The company generates revenue of A$29.10 million from its screening and verification checks segment.

Market Cap: A$65.04M

Kinatico Ltd, with a market cap of A$65.04 million, has shown significant growth in its earnings, increasing by 230% over the past year and surpassing the IT industry's average growth. The company reported record revenue of A$8 million for Q1 2025. Despite low return on equity at 3%, Kinatico's financial stability is underscored by short-term assets exceeding liabilities and being debt-free for five years. However, shareholder dilution occurred recently with shares outstanding growing by 3.6%. Trading well below estimated fair value suggests potential upside if operational improvements continue alongside its experienced management team.

- Click here and access our complete financial health analysis report to understand the dynamics of Kinatico.

- Assess Kinatico's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Navigate through the entire inventory of 1,045 ASX Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AVC

Auctus Investment Group

Auctus Investment Group Limited previously known as Yonder and Beyond Group Limited is a private equity, and venture capital firm specializing in mid-market, growth sectors, real estate, and infrastructure.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives