- Australia

- /

- Healthtech

- /

- ASX:BMT

3 ASX Penny Stocks With Market Caps Under A$200M

Reviewed by Simply Wall St

The Australian market has started the week lower, influenced by unexpected developments in U.S. employment data and a weakening Aussie dollar, while sectors like Energy have shown resilience amidst broader declines. In such fluctuating conditions, investors often turn their attention to penny stocks—smaller or newer companies that offer potential growth at lower price points. Despite being an older term, penny stocks can still provide valuable opportunities when they possess strong financials and clear growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.90 | A$240.44M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.94 | A$108.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$322.38M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$253.28M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.255 | A$107.15M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.59 | A$779.23M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.93 | A$486.42M | ★★★★☆☆ |

Click here to see the full list of 1,049 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

BNK Banking (ASX:BBC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BNK Banking Corporation Limited offers a range of retail and commercial banking products and financial services in Australia, with a market cap of A$38.58 million.

Operations: The company's revenue is derived from its banking segment, totaling A$20.85 million.

Market Cap: A$38.58M

BNK Banking Corporation Limited, with a market cap of A$38.58 million and revenue of A$20.85 million, faces challenges as it remains unprofitable with declining earnings over the past five years. Although its return on equity is negative at -5.53%, the bank benefits from low-risk funding primarily through customer deposits and maintains an appropriate loans to deposits ratio of 108%. The board is experienced with an average tenure of 3.5 years, but management lacks experience with only 1.2 years on average. Despite these hurdles, BNK's bad loan ratio remains at a healthy 0%, supported by a sufficient allowance for bad loans at 495%.

- Dive into the specifics of BNK Banking here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into BNK Banking's track record.

Beamtree Holdings (ASX:BMT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beamtree Holdings Limited offers artificial intelligence-based decision support software and data insight services to the healthcare industry both in Australia and internationally, with a market cap of A$78.23 million.

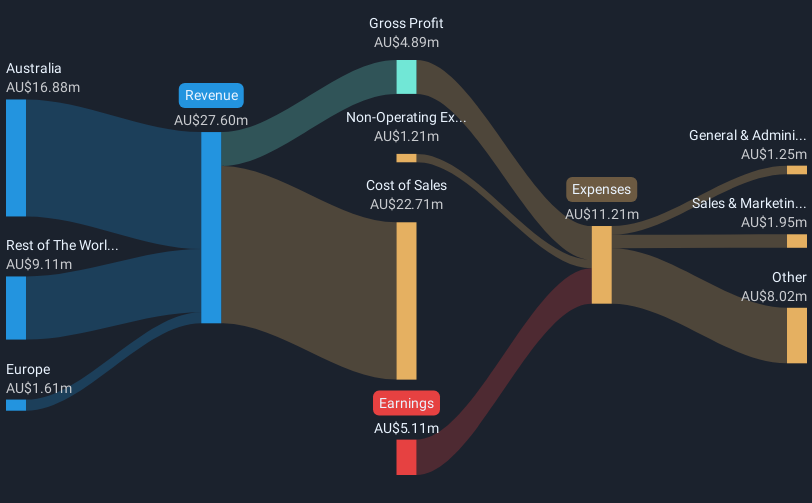

Operations: The company generates revenue of A$27.60 million from its healthcare software segment.

Market Cap: A$78.23M

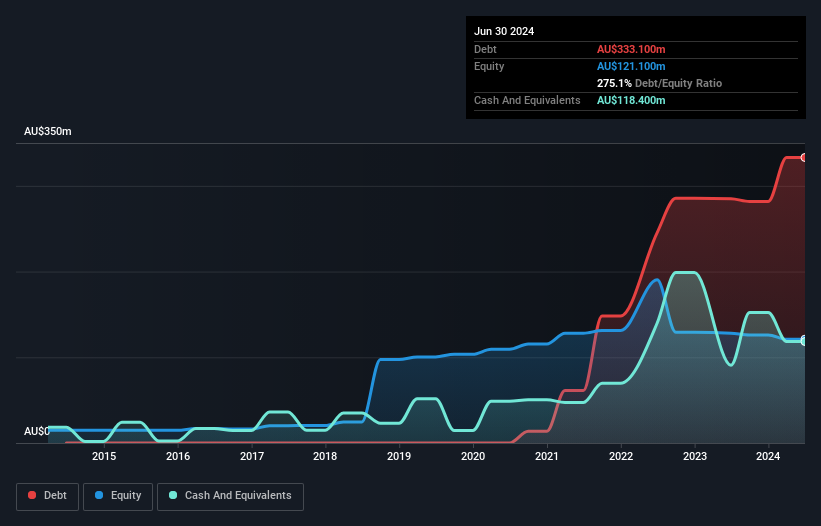

Beamtree Holdings Limited, with a market cap of A$78.23 million and revenue of A$27.60 million, is navigating the challenges common to penny stocks as it remains unprofitable with increasing losses over the past five years. Despite this, Beamtree's short-term assets exceed both its short- and long-term liabilities, providing some financial stability. The company trades significantly below its estimated fair value and has more cash than debt, offering potential upside if profitability improves. Recent executive changes include CEO Tim Kelsey stepping down in early 2025 to pursue international opportunities but remaining involved in an advisory role.

- Unlock comprehensive insights into our analysis of Beamtree Holdings stock in this financial health report.

- Gain insights into Beamtree Holdings' outlook and expected performance with our report on the company's earnings estimates.

Sandon Capital Investments (ASX:SNC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sandon Capital Investments Limited is a publicly owned investment manager with a market cap of A$116.79 million.

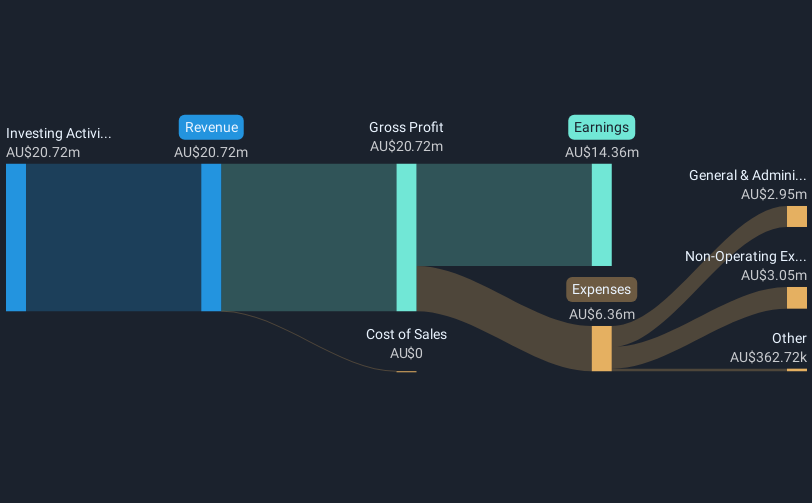

Operations: The company's revenue segment consists of Investing Activities, generating A$20.72 million.

Market Cap: A$116.79M

Sandon Capital Investments Limited, with a market cap of A$116.79 million and revenue from investing activities of A$20.72 million, has shown significant earnings growth over the past year at 657.1%, outpacing the industry average. Despite an increase in debt to equity ratio to 24% over five years, its debt is well covered by cash flow and short-term assets significantly exceed liabilities, indicating strong financial health. The company trades slightly below its fair value estimate and recently announced an inaugural quarterly dividend of 1.4 cents per share for March 2025, reflecting a commitment to shareholder returns amidst stable weekly volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Sandon Capital Investments.

- Assess Sandon Capital Investments' previous results with our detailed historical performance reports.

Next Steps

- Access the full spectrum of 1,049 ASX Penny Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beamtree Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BMT

Beamtree Holdings

Provides artificial intelligence-based decision support software and data insight services to healthcare industry in Australia and internationally.

High growth potential and good value.