- Australia

- /

- Medical Equipment

- /

- ASX:ANN

Ansell (ASX:ANN) Ticks All The Boxes When It Comes To Earnings Growth

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Ansell (ASX:ANN). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Ansell

How Quickly Is Ansell Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Ansell's EPS has grown 29% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

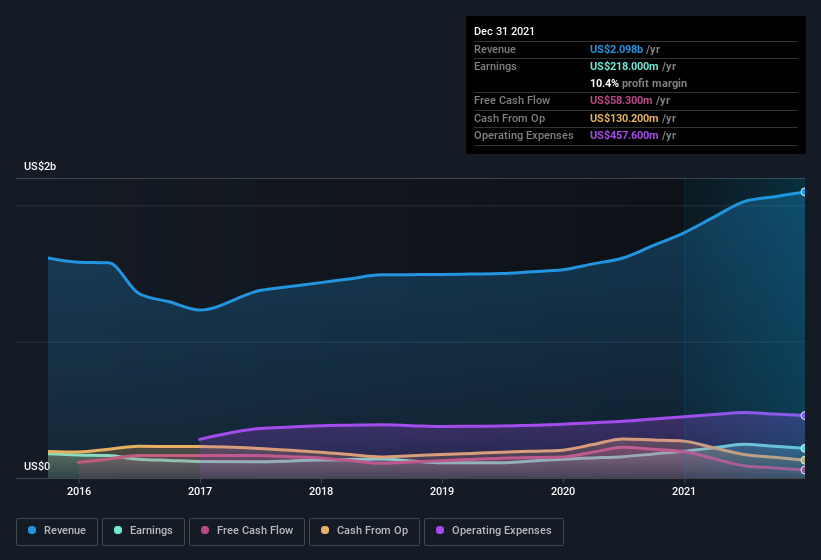

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Ansell achieved similar EBIT margins to last year, revenue grew by a solid 17% to US$2.1b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Ansell's future EPS 100% free.

Are Ansell Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Ansell shareholders is that no insiders reported selling shares in the last year. Add in the fact that Nigel Garrard, the Independent Non-Executive Director of the company, paid US$61k for shares at around US$30.61 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Along with the insider buying, another encouraging sign for Ansell is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at US$20m. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Ansell To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Ansell's strong EPS growth. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. These things considered, this is one stock worth watching. Still, you should learn about the 1 warning sign we've spotted with Ansell.

The good news is that Ansell is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ANN

Ansell

Designs, sources, develops, manufactures, distributes, and sells hand and body protection solutions in the Asia Pacific, Europe, the Middle East, Africa, Latin America, the Caribbean, and North America.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.