- Australia

- /

- Capital Markets

- /

- ASX:RPL

3 ASX Stocks Estimated To Be Up To 44% Below Their Intrinsic Value

Reviewed by Simply Wall St

As the ASX 200 closed with modest gains, buoyed by sectors like Real Estate and Healthcare, investors are keeping a close watch on inflationary pressures highlighted in the recent RBA minutes. In this environment of cautious optimism, identifying stocks that are trading below their intrinsic value can offer potential opportunities for those looking to navigate the market's complexities.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.43 | A$12.29 | 47.7% |

| Regal Partners (ASX:RPL) | A$3.57 | A$6.22 | 42.6% |

| Medibank Private (ASX:MPL) | A$3.81 | A$6.38 | 40.2% |

| Telix Pharmaceuticals (ASX:TLX) | A$25.02 | A$43.52 | 42.5% |

| Ansell (ASX:ANN) | A$33.65 | A$60.07 | 44% |

| Ingenia Communities Group (ASX:INA) | A$4.66 | A$9.20 | 49.4% |

| Charter Hall Group (ASX:CHC) | A$15.07 | A$28.72 | 47.5% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Genesis Minerals (ASX:GMD) | A$2.53 | A$4.89 | 48.3% |

| Sandfire Resources (ASX:SFR) | A$9.55 | A$16.49 | 42.1% |

Here we highlight a subset of our preferred stocks from the screener.

Ansell (ASX:ANN)

Overview: Ansell Limited is a company that designs, sources, develops, manufactures, distributes, and sells hand and body protection solutions across various regions including the Asia Pacific, Europe, the Middle East, Africa, Latin America, the Caribbean, and North America with a market cap of A$4.87 billion.

Operations: The company's revenue is divided into two main segments: Healthcare, generating $834.20 million, and Industrial (Including Specialty Markets), contributing $785.10 million.

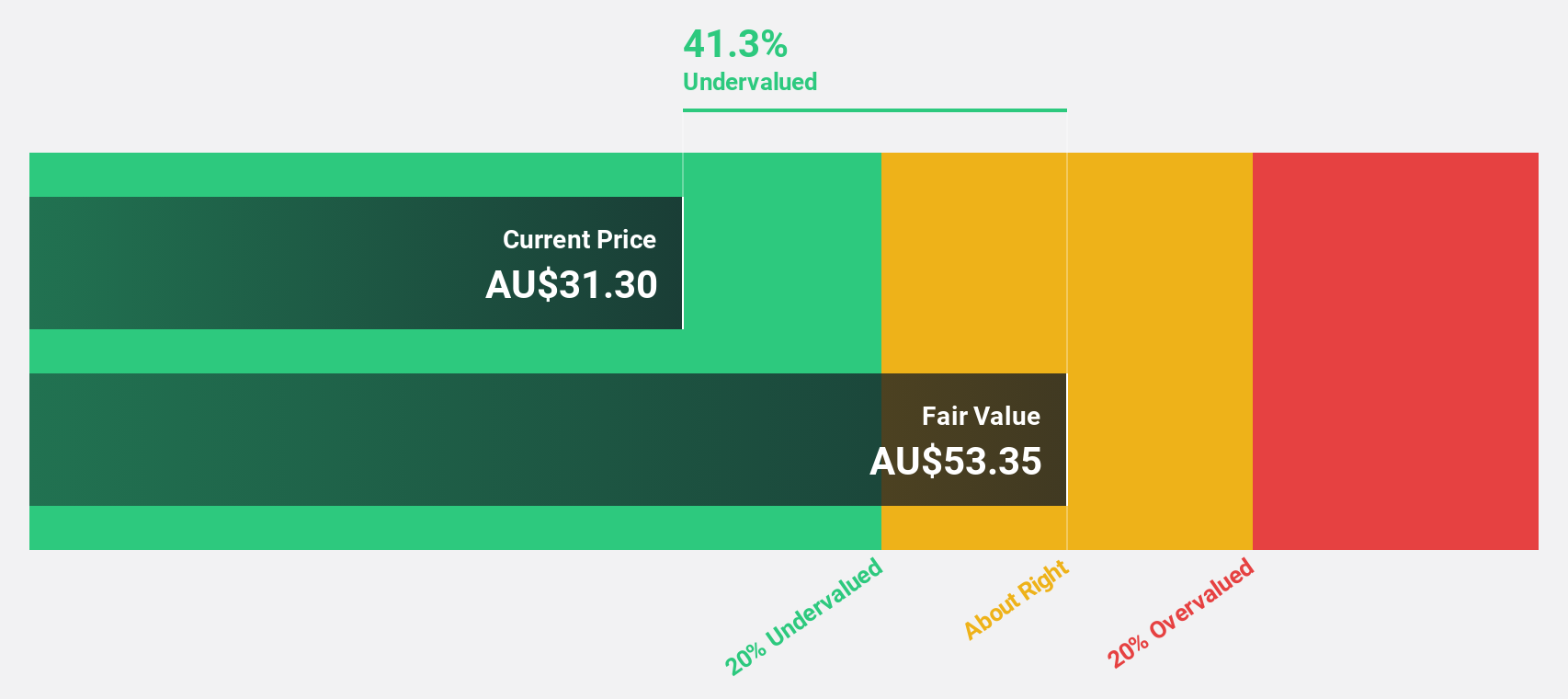

Estimated Discount To Fair Value: 44%

Ansell is trading at A$33.23, significantly below its estimated fair value of A$60.04, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 9% to 4.7%, earnings are expected to grow significantly at 22.72% annually over the next three years, outpacing the Australian market's growth rate of 12.5%. However, recent executive changes with the CFO's resignation could impact future financial stability and investor confidence.

- Our earnings growth report unveils the potential for significant increases in Ansell's future results.

- Click here to discover the nuances of Ansell with our detailed financial health report.

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.20 billion.

Operations: The company's revenue primarily comes from the provision of investment management services, amounting to A$198.50 million.

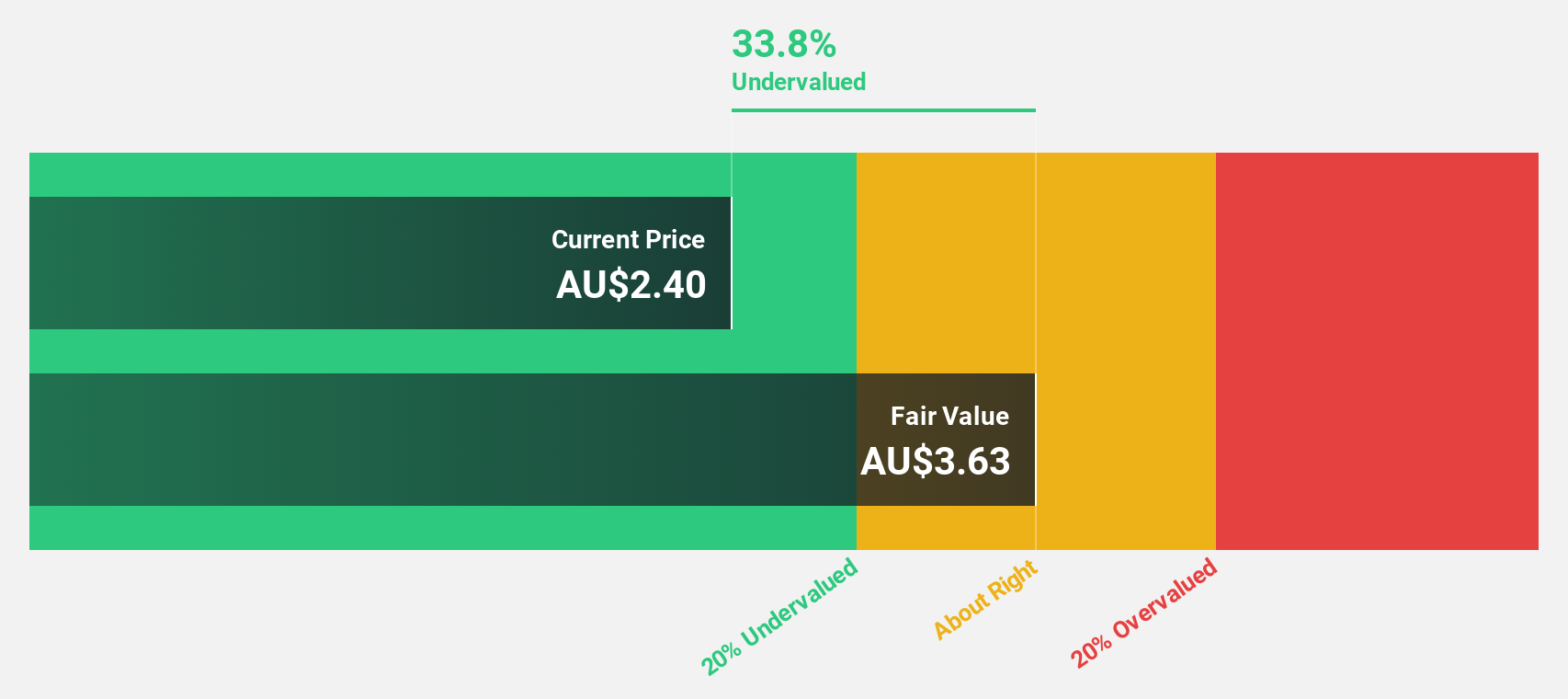

Estimated Discount To Fair Value: 42.6%

Regal Partners, trading at A$3.57, is significantly undervalued relative to its fair value estimate of A$6.22, presenting potential based on cash flows. Despite past shareholder dilution and low forecasted return on equity (15.9%), earnings are projected to grow substantially at 21.1% annually, surpassing the Australian market's growth rate of 12.5%. However, significant insider selling in recent months may raise concerns about internal confidence amidst ongoing takeover discussions with Platinum Investment Management Limited.

- In light of our recent growth report, it seems possible that Regal Partners' financial performance will exceed current levels.

- Take a closer look at Regal Partners' balance sheet health here in our report.

Technology One (ASX:TNE)

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$10.05 billion.

Operations: The company's revenue segments include Software generating A$347.35 million, Corporate contributing A$87.02 million, and Consulting providing A$72.17 million.

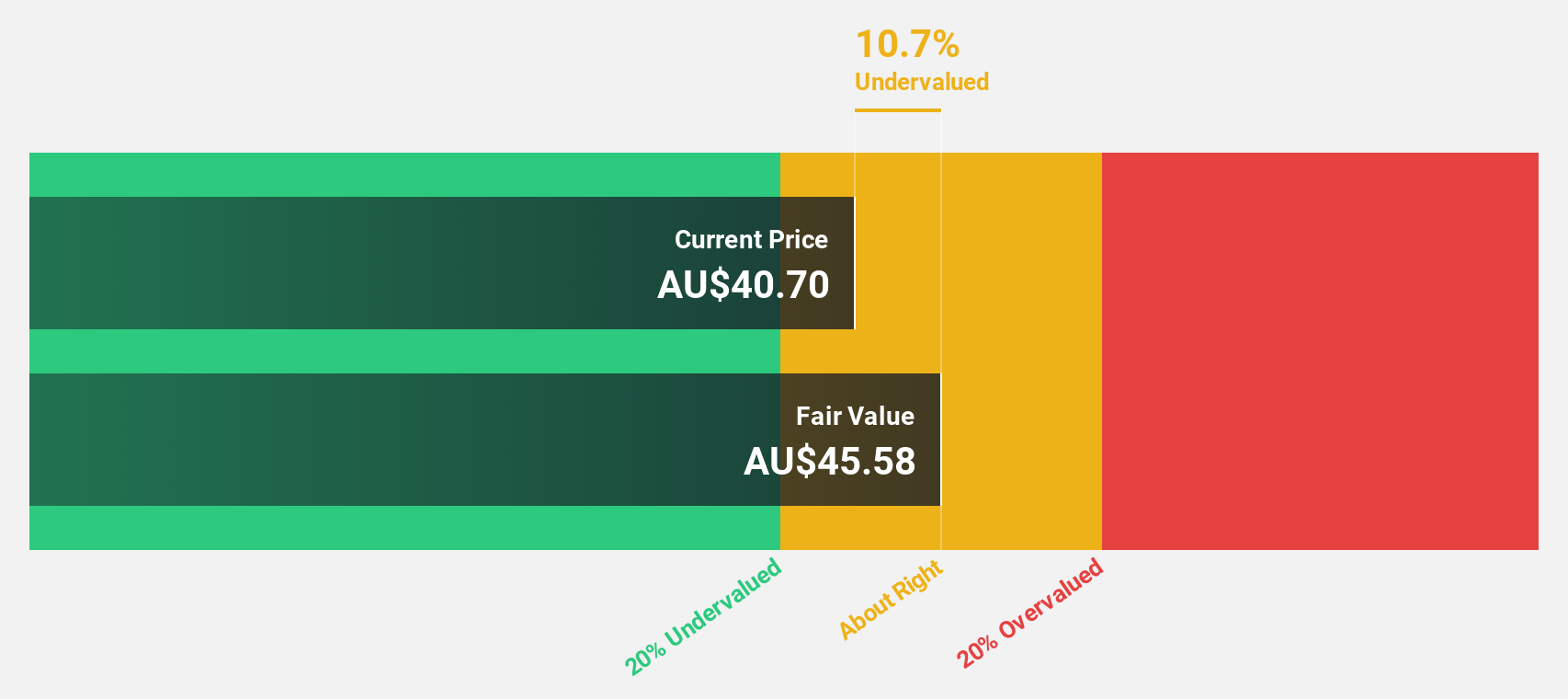

Estimated Discount To Fair Value: 30.6%

Technology One is trading at A$30.72, significantly below its fair value estimate of A$44.25, highlighting potential undervaluation based on cash flows. Recent earnings growth of 14.7% and a net income increase to A$118.01 million underscore robust performance, with forecasted annual earnings growth of 16.1%, outpacing the Australian market's 12.5%. Despite slower projected revenue growth compared to high benchmarks, strong return on equity forecasts suggest continued financial strength amidst recent dividend increases and solid revenue figures of A$506.54 million for the year ended September 2024.

- The analysis detailed in our Technology One growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Technology One.

Where To Now?

- Access the full spectrum of 36 Undervalued ASX Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RPL

Good value with reasonable growth potential.