Wide Open Agriculture's (ASX:WOA) Wonderful 400% Share Price Increase Shows How Capitalism Can Build Wealth

Wide Open Agriculture Limited (ASX:WOA) shareholders might understandably be very concerned that the share price has dropped 34% in the last quarter. But that doesn't change the fact that the returns over the last year have been spectacular. Few could complain about the impressive 400% rise, throughout the period. Arguably, the recent fall is to be expected after such a strong rise. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

Check out our latest analysis for Wide Open Agriculture

Wide Open Agriculture wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Wide Open Agriculture's revenue grew by 239%. That's stonking growth even when compared to other loss-making stocks. But the share price has really rocketed in response gaining 400% as previously mentioned. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

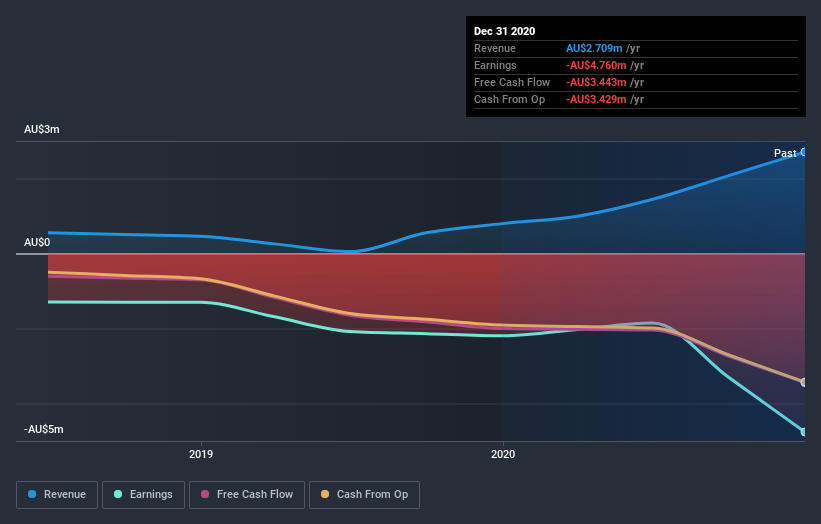

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Wide Open Agriculture's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Wide Open Agriculture shareholders should be happy with the total gain of 400% over the last twelve months. We regret to report that the share price is down 34% over ninety days. Shorter term share price moves often don't signify much about the business itself. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Wide Open Agriculture is showing 5 warning signs in our investment analysis , and 2 of those don't sit too well with us...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade Wide Open Agriculture, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wide Open Agriculture might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:WOA

Wide Open Agriculture

Develops, manufactures, and sells plant protein products in Australia, Europe, and the United States of America.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives