Have Insiders Sold Top Shelf International Holdings Ltd (ASX:TSI) Shares Recently?

Anyone interested in Top Shelf International Holdings Ltd (ASX:TSI) should probably be aware that the Co-Founder, Drew Fairchild, recently divested AU$350k worth of shares in the company, at an average price of AU$0.80 each. The eyebrow raising move amounted to a reduction of 15% in their holding.

View our latest analysis for Top Shelf International Holdings

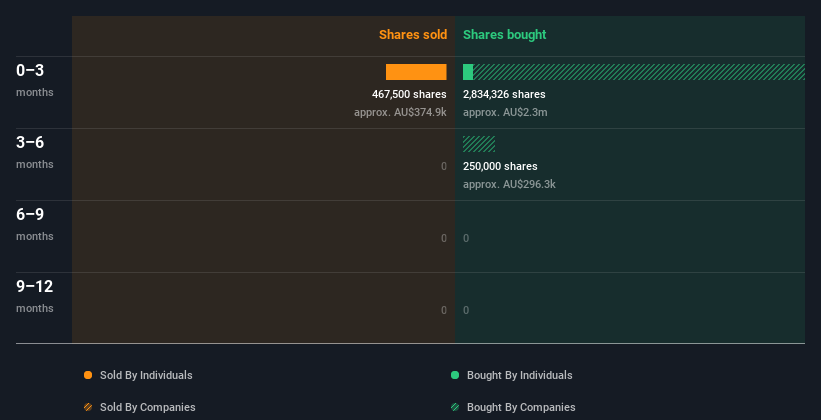

Top Shelf International Holdings Insider Transactions Over The Last Year

In fact, the recent sale by Drew Fairchild was the biggest sale of Top Shelf International Holdings shares made by an insider individual in the last twelve months, according to our records. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The good news is that this large sale was at well above current price of AU$0.70. So it may not tell us anything about how insiders feel about the current share price.

Over the last year we saw more insider selling of Top Shelf International Holdings shares, than buying. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership Of Top Shelf International Holdings

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. From our data, it seems that Top Shelf International Holdings insiders own 10% of the company, worth about AU$6.1m. But they may have an indirect interest through a corporate structure that we haven't picked up on. Whilst better than nothing, we're not overly impressed by these holdings.

So What Does This Data Suggest About Top Shelf International Holdings Insiders?

The insider sales have outweighed the insider buying, at Top Shelf International Holdings, in the last three months. Despite some insider buying, the longer term picture doesn't make us feel much more positive. When you consider that most companies have higher levels of insider ownership, we're a little wary. We'd certainly practice some caution before buying! So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Every company has risks, and we've spotted 5 warning signs for Top Shelf International Holdings (of which 1 is a bit unpleasant!) you should know about.

Of course Top Shelf International Holdings may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you're looking to trade Top Shelf International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Top Shelf International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TSI

Top Shelf International Holdings

Engages in the production, marketing, and selling of NED Australian Whisky and Grainshaker Hand Made Vodka spirit products in Australia.

Moderate and slightly overvalued.

Market Insights

Community Narratives