Here's Why I Think Lark Distilling (ASX:LRK) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Lark Distilling (ASX:LRK). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Lark Distilling

How Fast Is Lark Distilling Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Lark Distilling's EPS went from AU$0.00024 to AU$0.039 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

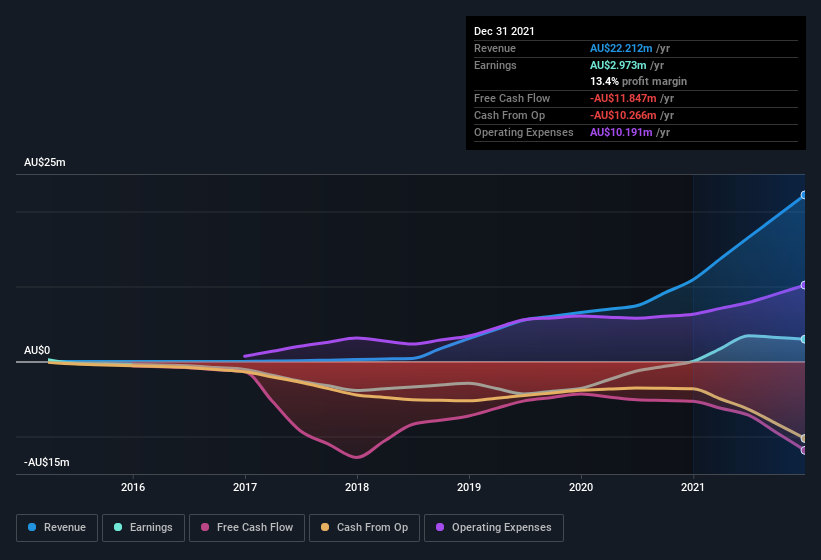

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Lark Distilling shareholders can take confidence from the fact that EBIT margins are up from 1.4% to 4.6%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Lark Distilling's forecast profits?

Are Lark Distilling Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's a pleasure to note that insiders spent AU$2.9m buying Lark Distilling shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. It is also worth noting that it was Geoff Bainbridge who made the biggest single purchase, worth AU$2.9m, paying AU$5.00 per share.

On top of the insider buying, it's good to see that Lark Distilling insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at AU$84m, they have plenty of motivation to push the business to succeed. That holding amounts to 32% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Laura McBain is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Lark Distilling with market caps between AU$139m and AU$556m is about AU$755k.

The Lark Distilling CEO received total compensation of only AU$58k in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Lark Distilling Worth Keeping An Eye On?

Lark Distilling's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Lark Distilling deserves timely attention. You still need to take note of risks, for example - Lark Distilling has 3 warning signs (and 1 which is concerning) we think you should know about.

The good news is that Lark Distilling is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LRK

LARK Distilling

Engages in the production, marketing, distribution, and sale of craft spirits.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives