Lynch Group Holdings' (ASX:LGL) Upcoming Dividend Will Be Larger Than Last Year's

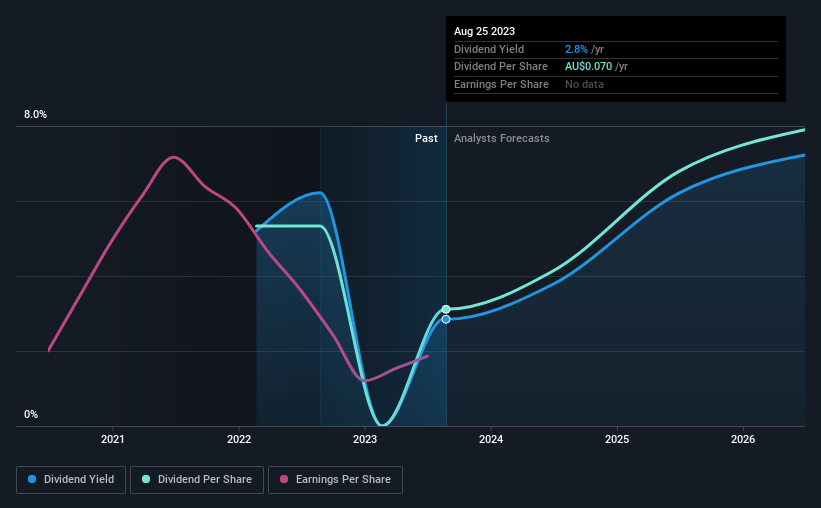

Lynch Group Holdings Limited's (ASX:LGL) dividend will be increasing from last year's payment of the same period to A$0.07 on 20th of September. Although the dividend is now higher, the yield is only 2.8%, which is below the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Lynch Group Holdings' stock price has increased by 31% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Lynch Group Holdings

Lynch Group Holdings' Earnings Easily Cover The Distributions

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Before this announcement, Lynch Group Holdings was paying out 86% of earnings, but a comparatively small 52% of free cash flows. This leaves plenty of cash for reinvestment into the business.

According to analysts, EPS should be several times higher next year. If the dividend continues along recent trends, we estimate the payout ratio will be 25%, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Lynch Group Holdings Is Still Building Its Track Record

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth May Be Hard To Achieve

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. However, Lynch Group Holdings' EPS was effectively flat over the past five years, which could stop the company from paying more every year.

Our Thoughts On Lynch Group Holdings' Dividend

Overall, we always like to see the dividend being raised, but we don't think Lynch Group Holdings will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for Lynch Group Holdings that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:LGL

Lynch Group Holdings

Operates as a grower, wholesaler, retailer, and importer of flowers and potted plants in Australia and China.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives