Stock Analysis

Three ASX Stocks Estimated To Be Trading With Intrinsic Discounts Ranging From 11.5% To 48.5%

Reviewed by Simply Wall St

Despite a relatively flat performance in the past week, the Australian market has seen a growth of 7.2% over the past year, with earnings expected to grow by 13% per annum. In this context, identifying stocks that are trading below their intrinsic value could offer potential opportunities for investors looking for growth in a steadily advancing market.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MaxiPARTS (ASX:MXI) | A$2.04 | A$3.94 | 48.2% |

| GTN (ASX:GTN) | A$0.445 | A$0.85 | 47.4% |

| Elders (ASX:ELD) | A$8.39 | A$16.28 | 48.5% |

| VEEM (ASX:VEE) | A$1.70 | A$3.51 | 51.6% |

| IPH (ASX:IPH) | A$6.25 | A$12.00 | 47.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.26 | A$6.26 | 47.9% |

| Australian Clinical Labs (ASX:ACL) | A$2.52 | A$4.74 | 46.9% |

| Core Lithium (ASX:CXO) | A$0.091 | A$0.17 | 45.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| SiteMinder (ASX:SDR) | A$5.20 | A$10.02 | 48.1% |

We're going to check out a few of the best picks from our screener tool

Elders (ASX:ELD)

Overview: Elders Limited operates primarily in Australia, offering agricultural products and services to rural and regional customers, with a market capitalization of approximately A$1.33 billion.

Operations: The company generates revenue through three main segments: Branch Network (A$2.54 billion), Wholesale Products (A$341.19 million), and Feed and Processing Services (A$120.14 million).

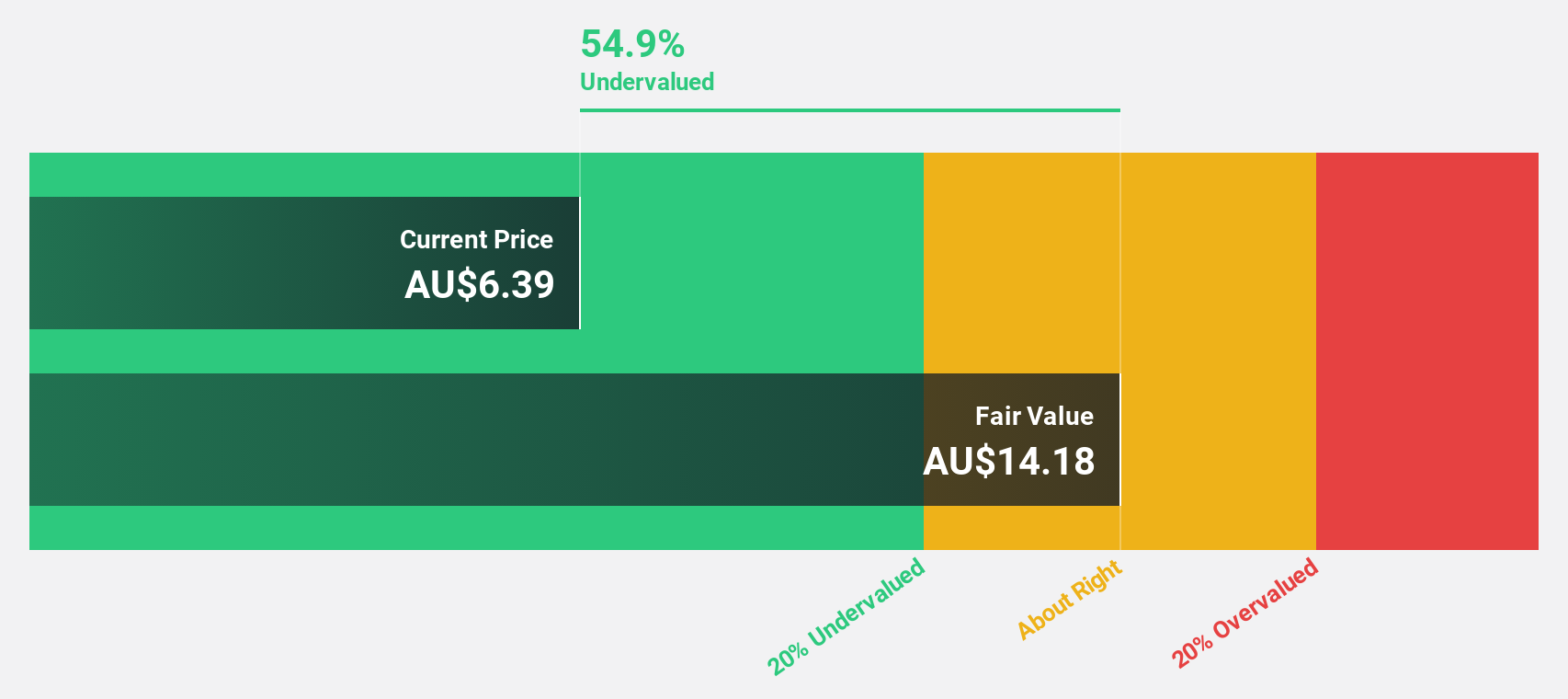

Estimated Discount To Fair Value: 48.5%

Elders Limited, currently trading at A$8.39, appears undervalued by more than 20%, with a calculated fair value of A$16.28 based on discounted cash flows. Despite a challenging year with net profit margins dropping from 3.4% to 2.1% and a significant earnings decline in the first half of 2024, Elders is forecasted to grow earnings by 22.8% annually over the next three years. However, its high level of debt and dividends not well covered by earnings pose risks that temper its attractiveness as an undervalued stock based on cash flows.

- The growth report we've compiled suggests that Elders' future prospects could be on the up.

- Navigate through the intricacies of Elders with our comprehensive financial health report here.

South32 (ASX:S32)

Overview: South32 Limited is a diversified metals and mining company with operations across multiple countries including Australia, India, and the United States, and has a market capitalization of approximately A$17.37 billion.

Operations: South32's revenue is derived from various segments including Cannington with $588 million, Cerro Matoso at $541 million, Sierra Gorda generating $649 million, Brazil Alumina contributing $443 million, Mozal Aluminium at $801 million, Worsley Alumina with $1.36 billion, Hillside Aluminium producing $1.72 billion, Australia Manganese at $651 million, Brazil Aluminium (BA) contributing $210 million, South Africa Manganese with $321 million, and Illawarra Metallurgical Coal generating $1.36 billion.

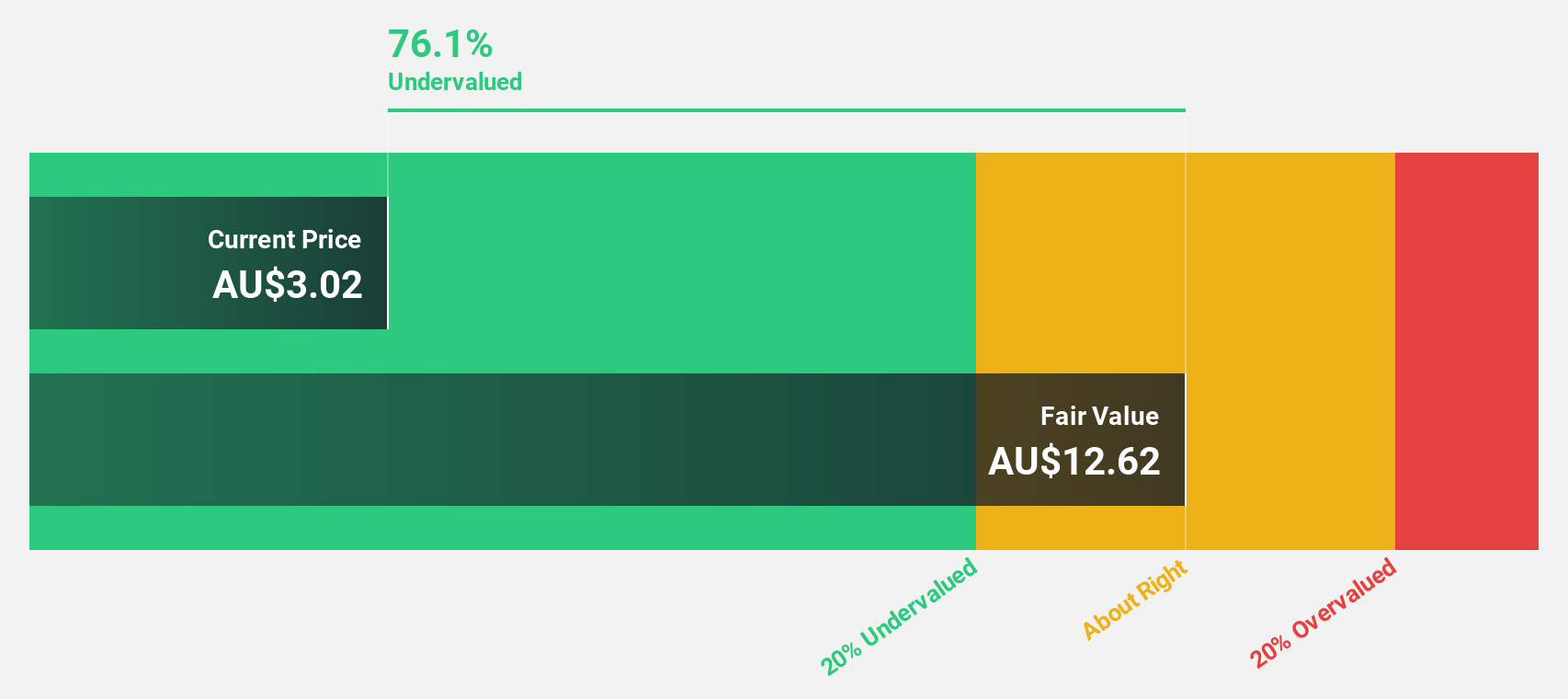

Estimated Discount To Fair Value: 34%

South32, priced at A$3.85, is assessed below its fair value of A$5.84, reflecting a significant undervaluation based on discounted cash flows. The company's earnings are expected to rise substantially, with forecasts suggesting a 55.12% annual increase and profitability anticipated within three years. South32's revenue growth is also projected to outpace the Australian market average. However, its forecasted return on equity of 11.4% in three years indicates potential limitations in financial efficiency.

- According our earnings growth report, there's an indication that South32 might be ready to expand.

- Take a closer look at South32's balance sheet health here in our report.

Webjet (ASX:WEB)

Overview: Webjet Limited operates as an online travel booking service across Australia, New Zealand, the UAE, the UK, and globally, with a market capitalization of approximately A$3.59 billion.

Operations: The company generates revenue through three primary channels: corporate travel services contributing A$0.80 million, Business to Business (B2B) travel at A$327.90 million, and Business to Consumer (B2C) travel amounting to A$142.80 million.

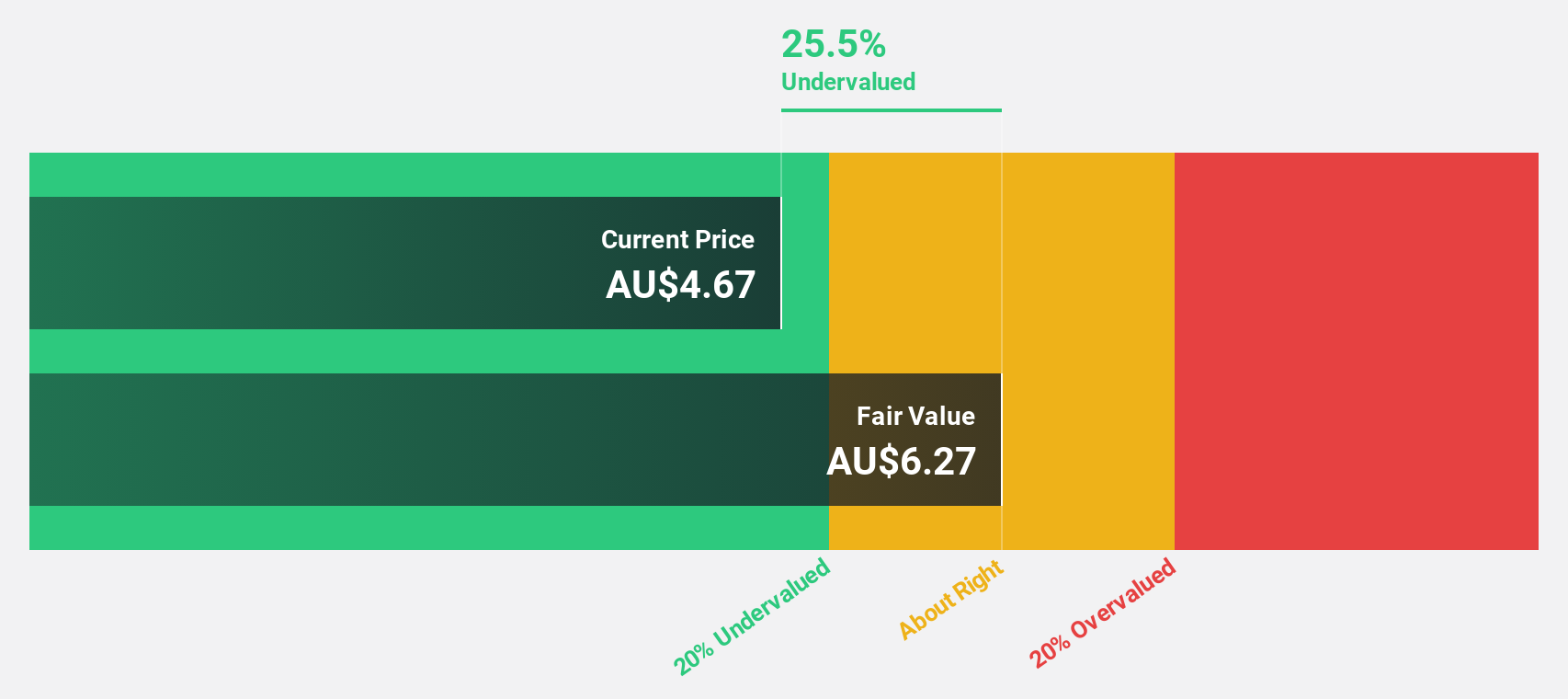

Estimated Discount To Fair Value: 11.5%

Webjet, trading at A$9.19, is considered undervalued with its market price 11.6% lower than the estimated fair value of A$10.39. The company's earnings have increased by 401.4% over the past year and are expected to continue growing at a rate of 20.25% annually, outpacing the Australian market's average growth rate. Recent strategic moves include a demerger aimed at enhancing operational focus and unlocking shareholder value, supported by significant leadership changes and advisory from Goldman Sachs on strategic financial structuring.

- Our expertly prepared growth report on Webjet implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Webjet stock in this financial health report.

Where To Now?

- Access the full spectrum of 52 Undervalued ASX Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Elders is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELD

Elders

Provides agricultural products and services to rural and regional customers primarily in Australia.

Excellent balance sheet and good value.