Exploring Undervalued Small Caps With Insider Actions In Australia July 2024

Reviewed by Simply Wall St

Over the past year, the Australian market has experienced a steady climb, rising by 11%, while recent weekly performance has shown stability with a flat trend. In this environment of anticipated earnings growth, undervalued small caps with insider buying actions present intriguing opportunities for investors seeking potential hidden gems.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 17.5x | 2.7x | 47.67% | ★★★★★★ |

| Nick Scali | 13.6x | 2.5x | 46.10% | ★★★★★★ |

| Tabcorp Holdings | NA | 0.7x | 20.11% | ★★★★★☆ |

| RAM Essential Services Property Fund | NA | 5.7x | 40.62% | ★★★★★☆ |

| Healius | NA | 0.6x | 43.33% | ★★★★★☆ |

| Elders | 21.2x | 0.4x | 47.61% | ★★★★☆☆ |

| Eagers Automotive | 9.3x | 0.3x | 35.40% | ★★★★☆☆ |

| Codan | 29.1x | 4.3x | 27.19% | ★★★★☆☆ |

| Dicker Data | 22.4x | 0.8x | -1.85% | ★★★☆☆☆ |

| Coventry Group | 283.1x | 0.4x | -16.19% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Codan (ASX:CDA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a company specializing in communications equipment and metal detection technology, with a market capitalization of approximately A$1.07 billion.

Operations: The company generates significant revenue from Communications and Metal Detection segments, totaling A$291.50 million and A$212.20 million respectively. It has experienced a notable gross profit margin trend, peaking at 59.24% in a recent quarter, indicative of its cost management and pricing strategy effectiveness.

PE: 29.1x

Codan, a lesser-known yet promising player in the Australian market, has shown robust financial health with earnings expected to climb by 16% annually. Despite relying solely on external borrowing—a riskier funding method—recent insider confidence underscores its potential; insiders have recently purchased shares, signaling their belief in the company's prospects. This move aligns with Codan's strategic positioning and growth trajectory, painting a picture of latent opportunity for discerning investors looking beyond typical large-cap offerings.

- Unlock comprehensive insights into our analysis of Codan stock in this valuation report.

Gain insights into Codan's historical performance by reviewing our past performance report.

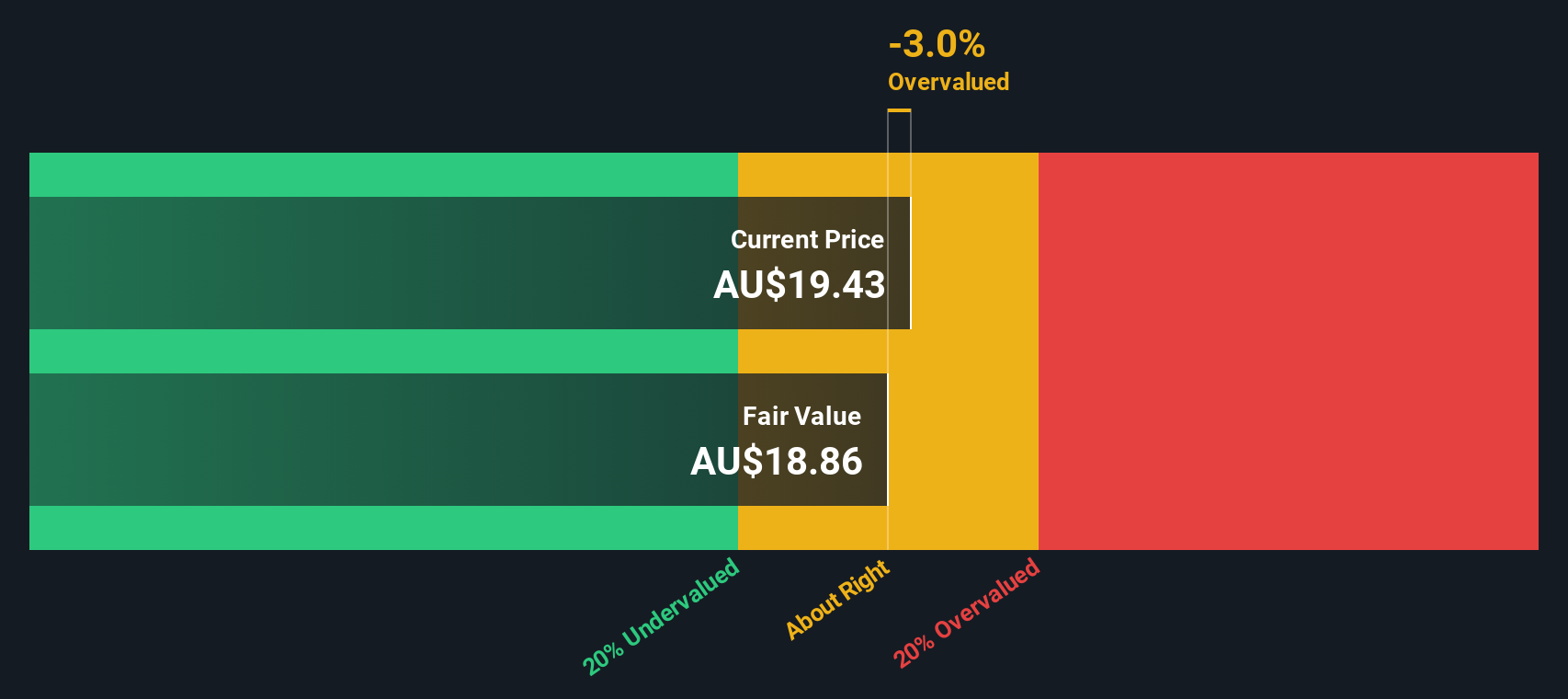

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is a distributor of computer peripherals and related technology products, with a market capitalization of approximately A$2.27 billion.

Operations: Wholesale - Computer Peripherals generated A$2.27 billion in revenue, with a gross profit margin of 14.23% as of the latest reporting period. This segment has seen a significant increase in its gross profit margin over time, reflecting an improvement from previous years.

PE: 22.4x

Dicker Data's recent dividend announcement underscores its steady financial engagement, with a forthcoming A$0.11 cash dividend signaling robust shareholder returns. Despite a high debt level, the company is poised for an annual earnings growth of nearly 8%, reflecting strong operational efficiency. Insider confidence is evident as they recently purchased shares, suggesting a bullish outlook on the firm’s prospects within its sector. This activity, combined with zero reliance on customer deposits for funding, positions Dicker Data uniquely in the market as it navigates through higher-risk external borrowing strategies.

- Click here to discover the nuances of Dicker Data with our detailed analytical valuation report.

Gain insights into Dicker Data's past trends and performance with our Past report.

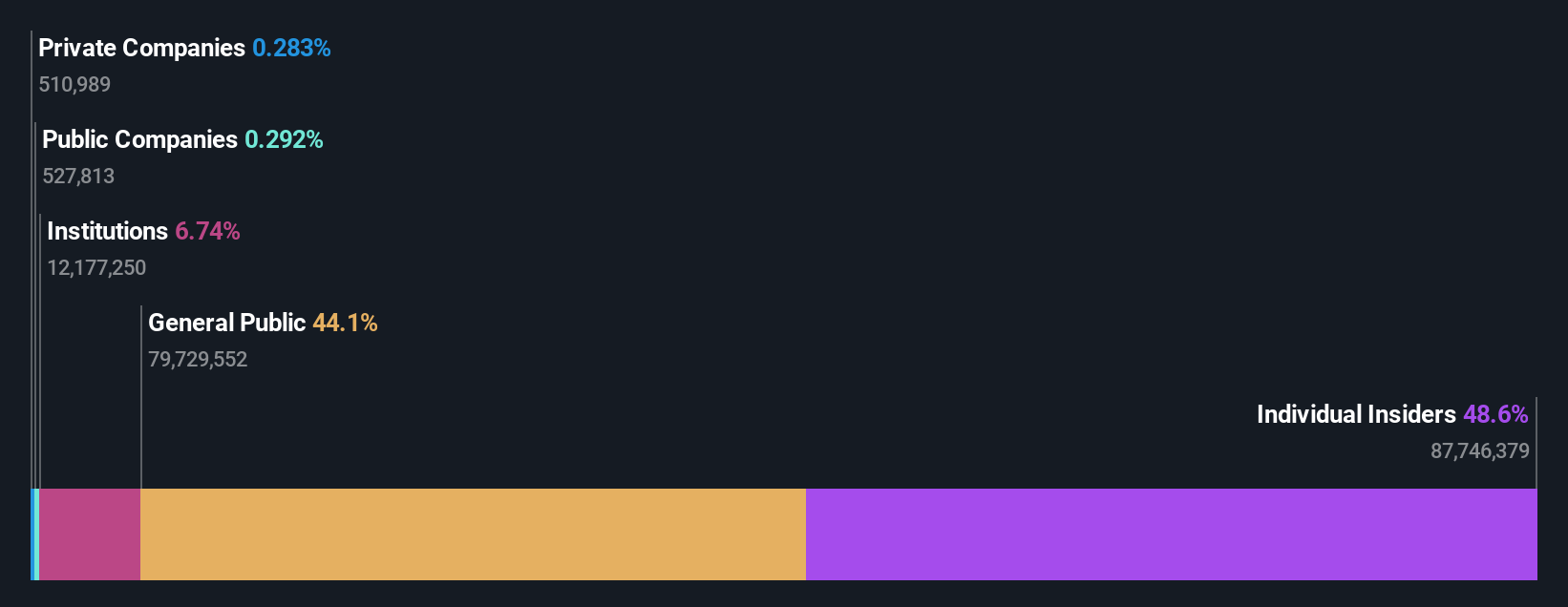

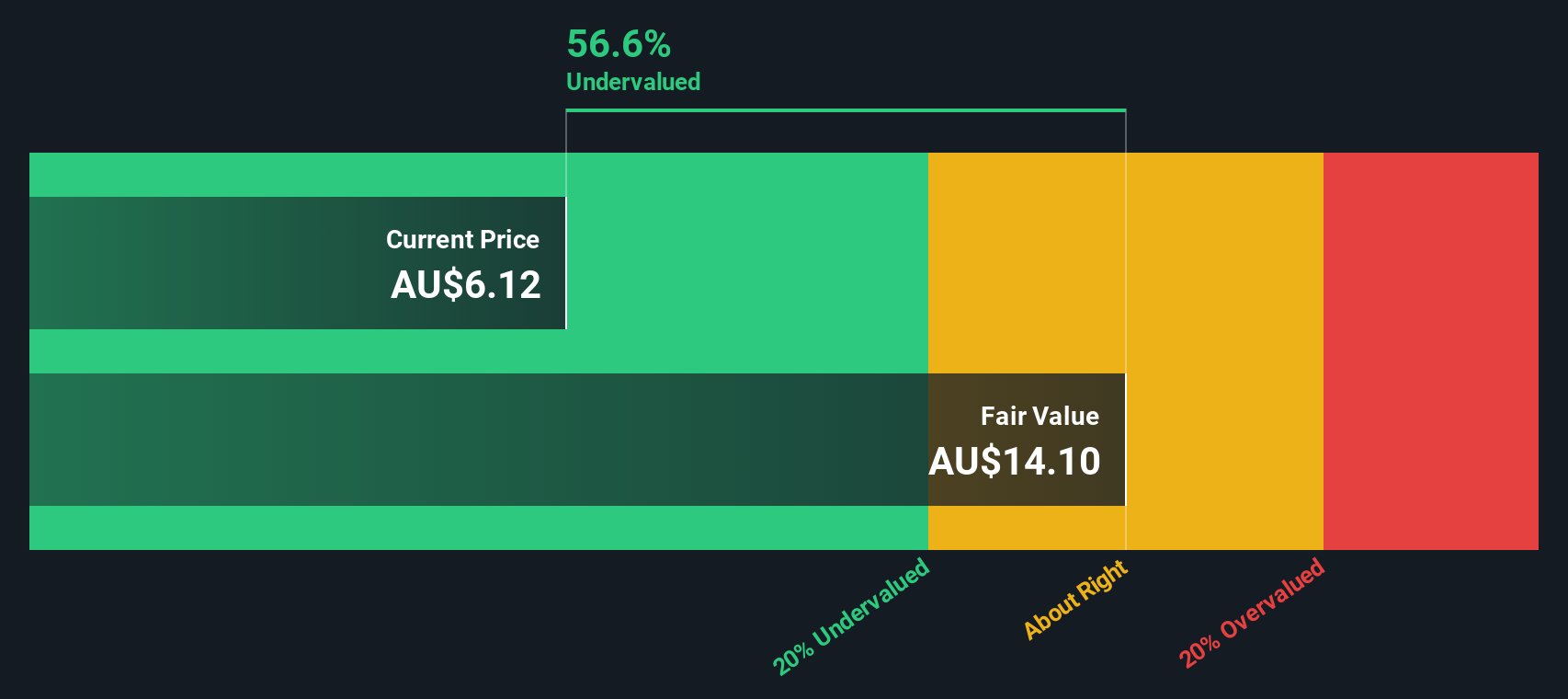

Elders (ASX:ELD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders is an Australian company involved in providing a range of services including branch network operations, wholesale products, feed and processing services, and corporate services.

Operations: The company generates the majority of its revenue from its Branch Network, which brought in A$2.54 billion, supplemented by Wholesale Products and Feed and Processing Services contributing A$341.19 million and A$120.14 million respectively. Over recent periods, it has seen a gross profit margin fluctuation with a notable figure of 20.29% as of September 2016, reflecting variances in cost management and sales performance across its operations.

PE: 21.2x

Elders Limited, reflecting a blend of challenges and potential, recently confirmed its earnings forecast for FY 2024 with an EBIT ranging from A$120 million to A$140 million. Despite a significant revenue drop in the first half of the year to A$1.34 billion from A$1.66 billion and a reduced net income of A$11.59 million, they maintain a dividend payout, signaling stability. Insider confidence is evident as insiders have recently increased their holdings, underscoring their belief in the company's future prospects despite current financial pressures and a high debt level.

- Click here and access our complete valuation analysis report to understand the dynamics of Elders.

Review our historical performance report to gain insights into Elders''s past performance.

Turning Ideas Into Actions

- Reveal the 26 hidden gems among our Undervalued ASX Small Caps With Insider Buying screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elders might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELD

Elders

Provides agricultural products and services to rural and regional customers primarily in Australia.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives