There's Reason For Concern Over Clean Seas Seafood Limited's (ASX:CSS) Massive 29% Price Jump

Clean Seas Seafood Limited (ASX:CSS) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 51% share price drop in the last twelve months.

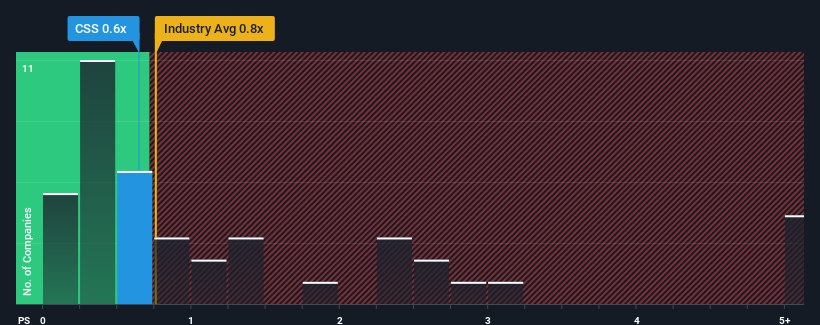

Although its price has surged higher, it's still not a stretch to say that Clean Seas Seafood's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Food industry in Australia, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Clean Seas Seafood

What Does Clean Seas Seafood's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Clean Seas Seafood's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Clean Seas Seafood.Is There Some Revenue Growth Forecasted For Clean Seas Seafood?

The only time you'd be comfortable seeing a P/S like Clean Seas Seafood's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 42% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to climb by 0.8% per annum during the coming three years according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 5.8% per annum, which is noticeably more attractive.

With this in mind, we find it intriguing that Clean Seas Seafood's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Clean Seas Seafood's P/S Mean For Investors?

Clean Seas Seafood's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Clean Seas Seafood's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you take the next step, you should know about the 4 warning signs for Clean Seas Seafood that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CSS

Clean Seas Seafood

Operates in the aquaculture industry in Australia, Europe, North America, Asia, and internationally.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives