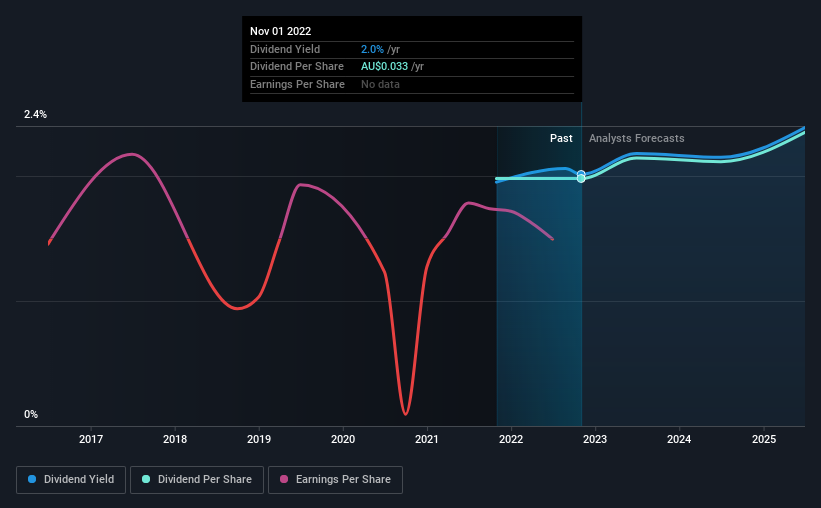

Cobram Estate Olives Limited (ASX:CBO) has announced that it will pay a dividend of A$0.033 per share on the 7th of December. This payment means the dividend yield will be 2.0%, which is below the average for the industry.

Check out the opportunities and risks within the AU Food industry.

Cobram Estate Olives Doesn't Earn Enough To Cover Its Payments

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Even in the absence of profits, Cobram Estate Olives is paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

The next 12 months is set to see EPS grow by 102.6%. Assuming the dividend continues along recent trends, we think the payout ratio could get very high, which probably can't continue without starting to put some pressure on the balance sheet.

Cobram Estate Olives Doesn't Have A Long Payment History

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend's Growth Prospects Are Limited

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Although it's important to note that Cobram Estate Olives' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

We're Not Big Fans Of Cobram Estate Olives' Dividend

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. We don't think that this is a great candidate to be an income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for Cobram Estate Olives (of which 1 is concerning!) you should know about. Is Cobram Estate Olives not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CBO

Cobram Estate Olives

Engages in production and marketing of olive oil in Australia, the United States, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives