The 16% return this week takes Bega Cheese's (ASX:BGA) shareholders one-year gains to 72%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Bega Cheese Limited (ASX:BGA) share price is up 70% in the last 1 year, clearly besting the market return of around 9.5% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! In contrast, the longer term returns are negative, since the share price is 8.3% lower than it was three years ago.

Since the stock has added AU$219m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Bega Cheese

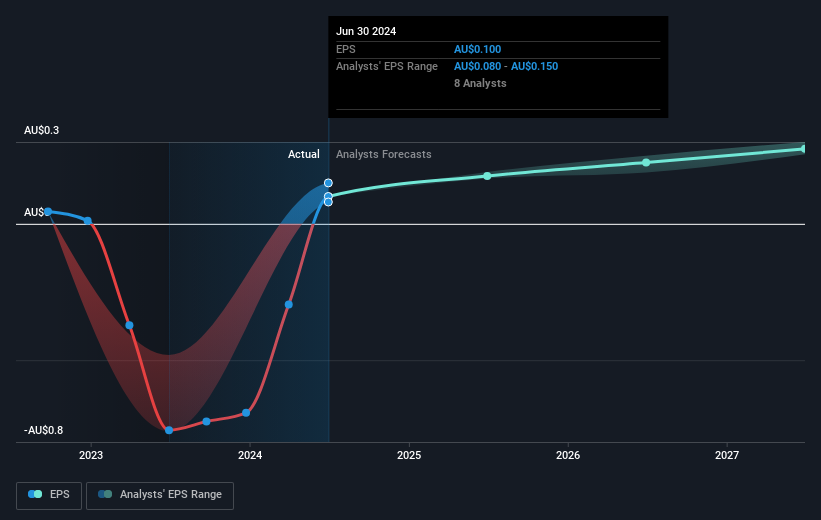

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Bega Cheese went from making a loss to reporting a profit, in the last year.

We think the growth looks very prospective, so we're not surprised the market liked it too. Inflection points like this can be a great time to take a closer look at a company.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Bega Cheese has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

It's good to see that Bega Cheese has rewarded shareholders with a total shareholder return of 72% in the last twelve months. And that does include the dividend. That gain is better than the annual TSR over five years, which is 7%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Bega Cheese is showing 1 warning sign in our investment analysis , you should know about...

Of course Bega Cheese may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bega Cheese might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BGA

Bega Cheese

Bega Cheese Limited receives, processes, manufactures, and distributes dairy and other food-related products in Australia.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives