Is Now The Time To Put Australian Agricultural (ASX:AAC) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Australian Agricultural (ASX:AAC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Australian Agricultural

How Fast Is Australian Agricultural Growing Its Earnings Per Share?

Over the last three years, Australian Agricultural has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Australian Agricultural's EPS shot from AU$0.073 to AU$0.22, over the last year. Year on year growth of 196% is certainly a sight to behold.

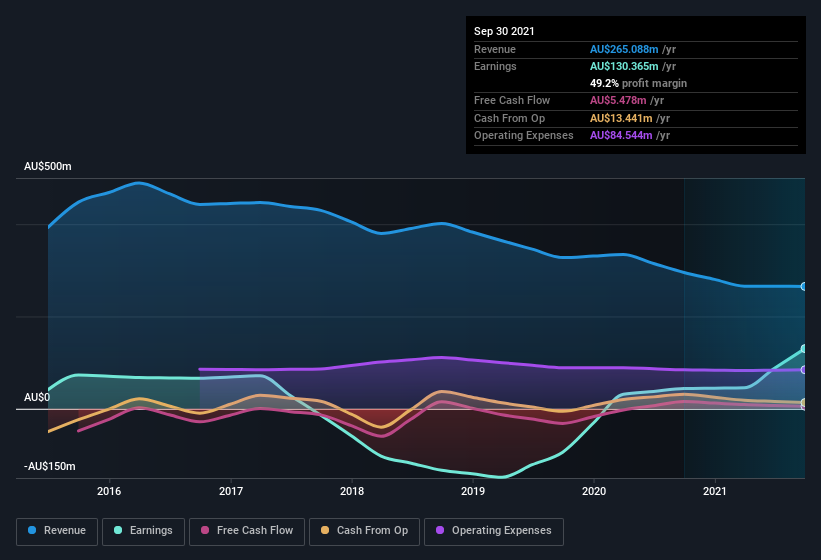

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Australian Agricultural may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Australian Agricultural Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Australian Agricultural insiders spent a whopping AU$35m on stock in just one year, and I didn't see any selling. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the , John Andrew Forrest, who made the biggest single acquisition, paying AU$35m for shares at about AU$1.11 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Australian Agricultural insiders own more than a third of the company. Indeed, with a collective holding of 57%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling AU$632m. Now that's what I call some serious skin in the game!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Hugh Killen, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Australian Agricultural with market caps between AU$577m and AU$2.3b is about AU$1.5m.

The Australian Agricultural CEO received AU$949k in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Australian Agricultural Deserve A Spot On Your Watchlist?

Australian Agricultural's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Australian Agricultural deserves timely attention. However, before you get too excited we've discovered 2 warning signs for Australian Agricultural (1 is a bit concerning!) that you should be aware of.

As a growth investor I do like to see insider buying. But Australian Agricultural isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AAC

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives