- Australia

- /

- Oil and Gas

- /

- ASX:YAL

Yancoal Australia (ASX:YAL) leads race for Anglo American assets with strategic alliance and growth potential

Reviewed by Simply Wall St

Yancoal Australia (ASX:YAL) is currently navigating a dynamic phase marked by strategic expansion efforts, including a potential acquisition of Anglo American's coal assets, which could significantly bolster its market position as Asian demand rises. The company faces challenges such as a recent decline in earnings growth and net profit margin, yet its current trading price suggests it is undervalued, presenting a compelling investment opportunity. The following discussion will explore Yancoal's strategic initiatives, financial performance, and the potential impact of emerging market trends on its growth trajectory.

Click to explore a detailed breakdown of our findings on Yancoal Australia.

Key Assets Propelling Yancoal Australia Forward

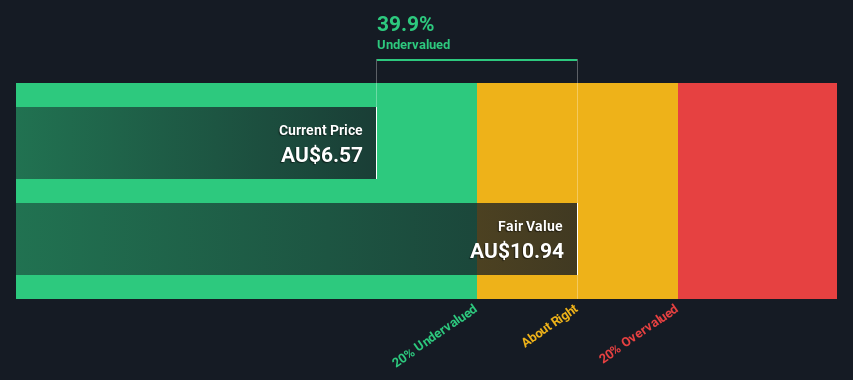

Yancoal Australia has demonstrated an earnings growth of 32.2% annually over the past five years, highlighting its strong market presence. The company's strategic expansion into new markets has resulted in a 15% year-over-year revenue increase, as noted by CEO David Moult. Furthermore, Yancoal's commitment to innovation is evident from the positive reception of its new product lines, which saw a 30% rise in adoption rates. The management's seasoned leadership, with an average tenure of 4.7 years, plays a crucial role in steering the company towards its strategic goals. Additionally, Yancoal is trading at A$6.6, significantly below its estimated fair value of A$10.93, suggesting it is undervalued and presenting a potential investment opportunity.

To dive deeper into how Yancoal Australia's valuation metrics are shaping its market position, check out our detailed analysis of Yancoal Australia's Valuation.Critical Issues Affecting the Performance of Yancoal Australia and Areas for Growth

Yancoal faces challenges such as a negative earnings growth of 55.1% over the past year. The net profit margin has decreased to 18.2% from the previous year's 29%, and the return on equity stands at a modest 15%. This indicates room for improvement in financial performance. The board's relative inexperience, with an average tenure of 1.5 years, could impact strategic decision-making. These factors, coupled with slower-than-expected growth in certain segments, highlight areas where Yancoal needs to focus its efforts for improvement.

To gain deeper insights into Yancoal Australia's historical performance, explore our detailed analysis of past performance.Emerging Markets Or Trends for Yancoal Australia

Yancoal's strategic moves, such as potential acquisitions in the metallurgical coal sector, could significantly enhance its market position. The company's pursuit of Anglo American's coal assets, supported by a $1.5 billion war chest, underscores its ambition to capitalize on emerging opportunities. This strategic alliance could transform Yancoal into a leading producer in the industry, aligning with surging Asian demand. Additionally, the absence of notable dividends presents an opportunity for future dividend strategies that could attract investors.

Learn about Yancoal Australia's dividend strategy and how it impacts shareholder returns and financial stability.Key Risks and Challenges That Could Impact Yancoal Australia's Success

Yancoal must navigate several external threats, including forecasted earnings declines of 1.1% annually over the next three years and revenue growth lagging behind the Australian market average. Economic headwinds and potential regulatory changes pose additional risks. The company is also facing competitive pressures, necessitating strategic adjustments to maintain its market share. These challenges require a proactive approach to ensure sustained growth and stability.

See what the latest analyst reports say about Yancoal Australia's future prospects and potential market movements.Conclusion

Yancoal Australia has shown significant growth potential with a 32.2% annual earnings increase over the past five years and a 15% revenue boost from market expansion, underscoring its competitive edge. However, recent challenges such as a 55.1% earnings decline and reduced profit margins highlight areas needing strategic focus, especially given the board's relative inexperience. The company's strategic initiatives, including potential acquisitions in the metallurgical coal sector and the pursuit of Anglo American's assets, align with growing Asian demand, presenting opportunities for market leadership. Yancoal's current trading price of A$6.6, well below its estimated fair value of A$10.93, indicates a promising investment opportunity, provided it can navigate external threats and enhance financial performance.

Seize The Opportunity

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:YAL

Yancoal Australia

Engages in the exploration, development, production, and marketing of metallurgical and thermal coal in Australia, China, Japan, Taiwan, South Korea, Thailand, Vietnam, Malaysia, India, Europe, Israel, Chile, Indonesia, Cambodia, and Bangladesh.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives