- Australia

- /

- Oil and Gas

- /

- ASX:YAL

Surging Returns on Capital Could Be a Game Changer for Yancoal Australia (ASX:YAL)

Reviewed by Sasha Jovanovic

- In recent days, Yancoal Australia reported a 196% increase in return on capital employed over five years while keeping its capital base largely unchanged.

- An interesting development is that the company’s current return on capital employed stands at 12%, significantly outperforming the Oil and Gas industry average of 5.3%.

- We'll explore how Yancoal Australia's operational efficiencies shape the broader investment narrative for the company amid industry comparisons.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Yancoal Australia's Investment Narrative?

For someone considering Yancoal Australia, the big picture rests on whether you believe the firm's new operational efficiency is sustainable enough to offset industry pressures. The company’s surge in return on capital employed, jumping 196% over five years on a stable capital base, signals a transformation in its ability to extract more value from its assets. This news could reshape investors’ short-term focus, placing more weight on execution and cost control rather than just headline commodity prices. However, while these efficiency metrics are impressive, Yancoal still faces earnings pressure with declining sales and net income, alongside uncertainty from its pending M&A activity and a fresh CEO transition. The news of operational gains is significant, but it may not soften bigger risks such as market demand swings, regulatory obstacles for acquisitions, and board turnover. On the other hand, the impact of board inexperience is something investors should not overlook.

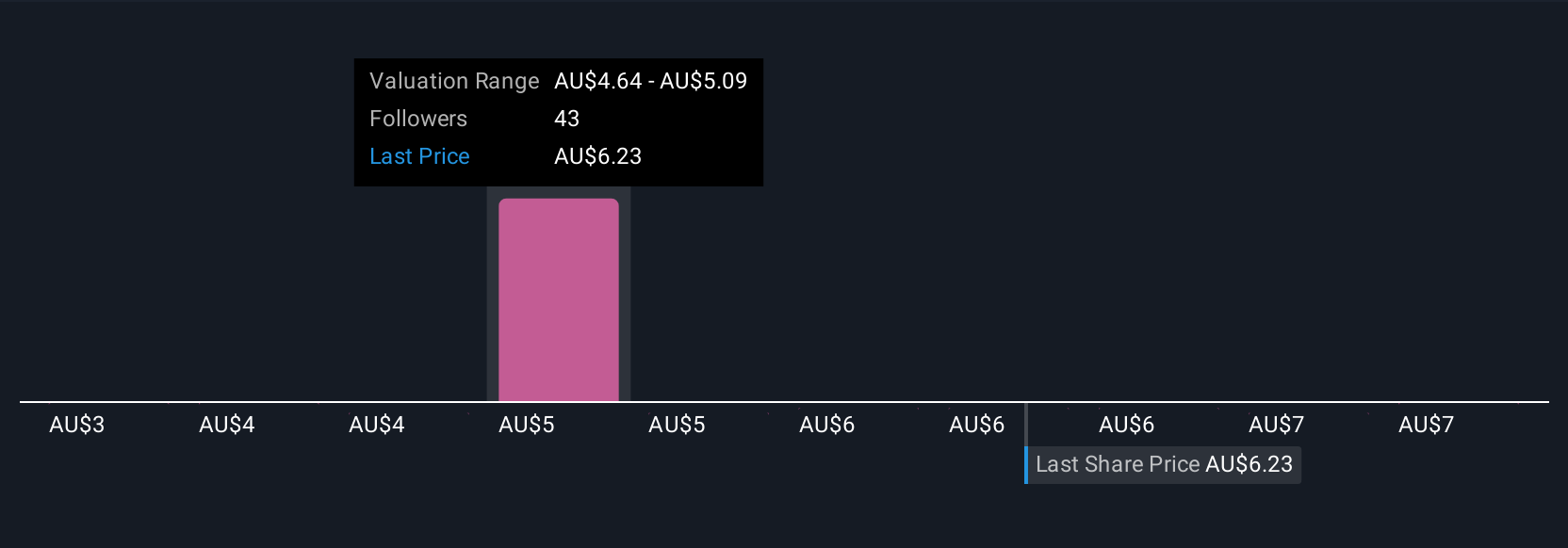

Despite retreating, Yancoal Australia's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 13 other fair value estimates on Yancoal Australia - why the stock might be worth 37% less than the current price!

Build Your Own Yancoal Australia Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yancoal Australia research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Yancoal Australia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yancoal Australia's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:YAL

Yancoal Australia

Engages in the exploration, development, production, and marketing of metallurgical and thermal coal in Australia, China, Japan, Taiwan, South Korea, Thailand, Vietnam, Malaysia, India, Europe, Israel, Chile, Indonesia, Cambodia, and Bangladesh.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026