- Australia

- /

- Oil and Gas

- /

- ASX:WDS

Woodside (ASX:WDS) Valuation in Focus as Share Price Slips With Broad Energy Sector Pullback

Reviewed by Simply Wall St

Woodside Energy Group (ASX:WDS) has been in the spotlight after a dip in its share price, a move largely blamed on slipping oil prices due to concerns of oversupply and softer demand from the US. This wasn’t a Woodside-only story. The entire energy sector on the ASX 200 felt the pinch, making it clear the market was reacting to broader commodity trends, not company-specific troubles. For investors tracking the stock, the latest move is a reminder that macro swings can drive short-term pricing, even for established industry leaders like Woodside.

Despite the latest share price weakness, Woodside’s longer-term performance has been a mixed bag. While the stock is up 7% over the past year, reflecting resilience in the face of recent volatility, it has come off the boil compared to its gains five years ago. Short-term returns have lagged as global energy markets have become more unpredictable. There are glimmers of underlying growth, with annual revenue ticking higher even as net income has edged lower lately. This backdrop sets up a valuation debate as investors gauge whether growth or risk will dominate the next chapter.

With Woodside trading lower after this market-wide energy sector retreat, some may wonder whether this is an opening to buy quality at a discount, or if the market is already looking ahead and pricing in future swings.

Most Popular Narrative: 9.3% Undervalued

According to the most widely followed narrative, Woodside Energy Group is trading below its perceived fair value, with a modest discount that reflects a blend of optimism and caution about future growth and execution risk.

"The current valuation seems to price in flawless execution of large-scale growth projects (Scarborough, Pluto Train 2, Louisiana LNG) and assumes minimal regulatory delays or cost overruns. However, increasing industry complexity, approval uncertainties, and rising decommissioning expenses could elevate capex and weigh on net margins and free cash flow."

Curious what’s behind this “undervalued” call? One key factor shaping the narrative is a bold bet on Woodside’s ability to turn major project ambitions into real profit. Dig into the nitty-gritty and you’ll uncover the controversial expectations for its earnings trajectory, margin squeeze, and the future multiple needed to justify the price target. Want to know which aggressive forecasts analysts are making, and what would have to go right to hit this fair value? The details may surprise you.

Result: Fair Value of $26.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, robust LNG demand in Asia-Pacific or accelerated delivery of major projects could drive stronger revenues and margins than many expect.

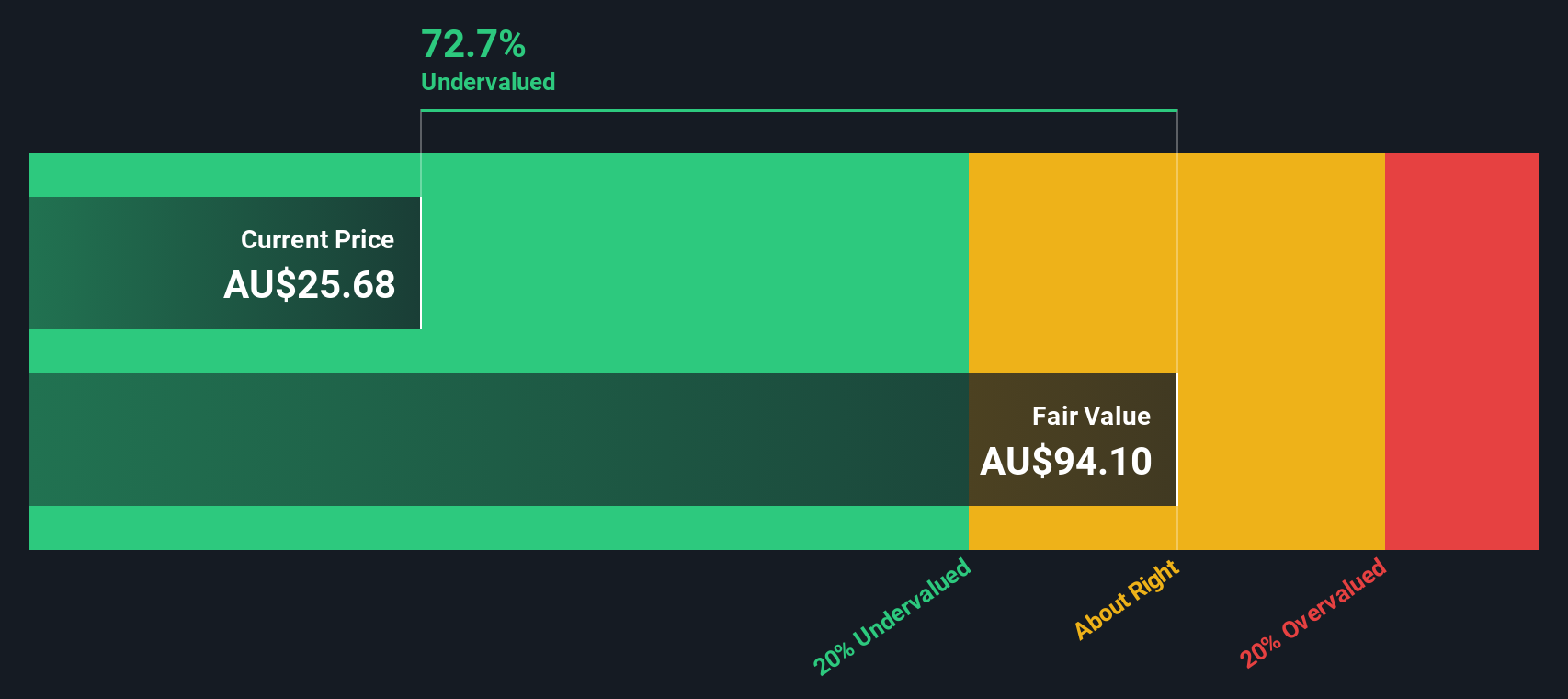

Find out about the key risks to this Woodside Energy Group narrative.Another View: The SWS DCF Model

For a different perspective, our DCF model suggests that Woodside Energy Group is valued quite differently compared to what the market is currently pricing in. Could cash flows tell a story that the multiples miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Woodside Energy Group Narrative

If you see things differently or want to put your own spin on the story, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Woodside Energy Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t watch opportunities pass you by. If you’re serious about staying ahead, use the Simply Wall Street Screener to find tomorrow’s top performers before everyone else.

- Unlock new growth by targeting companies with solid cash flows and attractive value. Jump into undervalued stocks based on cash flows and spot potential gems others overlook.

- Position yourself at the forefront of innovation as artificial intelligence reshapes industries, with insights from the latest AI penny stocks picks.

- Boost your portfolio’s income with standout opportunities. Set your sights on dividend stocks with yields > 3% offering yields above 3% and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woodside Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WDS

Woodside Energy Group

Engages in the exploration, evaluation, development, production, marketing, and sale of hydrocarbons in the Asia Pacific, Africa, the Americas, and the Europe.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives