- Australia

- /

- Oil and Gas

- /

- ASX:ROG

Kairos Minerals Leads The Charge With 2 Other ASX Penny Stocks To Consider

Reviewed by Simply Wall St

The Australian market has recently experienced a downturn, with the ASX200 down by 1.3% amid widespread sector retreats and revised expectations for RBA rate cuts. Despite the broader market challenges, penny stocks continue to attract attention for their potential to deliver growth at lower price points. These smaller or newer companies often offer unique opportunities when they possess strong financials and solid fundamentals, making them an intriguing area of focus for investors seeking hidden gems amidst current market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.865 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.71 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.93 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Kairos Minerals (ASX:KAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kairos Minerals Limited, with a market cap of A$44.73 million, operates as a resource exploration company in Australia through its subsidiaries.

Operations: There are no revenue segments reported for this resource exploration company operating in Australia.

Market Cap: A$44.73M

Kairos Minerals Limited, with a market cap of A$44.73 million, is pre-revenue and has experienced a significant drop in revenue to A$0.097 million for the year ended June 30, 2024. Despite being debt-free for five years and having short-term assets of A$4.8 million that cover liabilities, the company faces challenges with less than a year of cash runway if current cash flow trends persist. The management team is relatively new but considered experienced with an average tenure of 2.4 years; however, the board lacks similar experience levels. Shareholders have not faced meaningful dilution recently despite high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Kairos Minerals.

- Examine Kairos Minerals' past performance report to understand how it has performed in prior years.

MFF Capital Investments (ASX:MFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.27 billion.

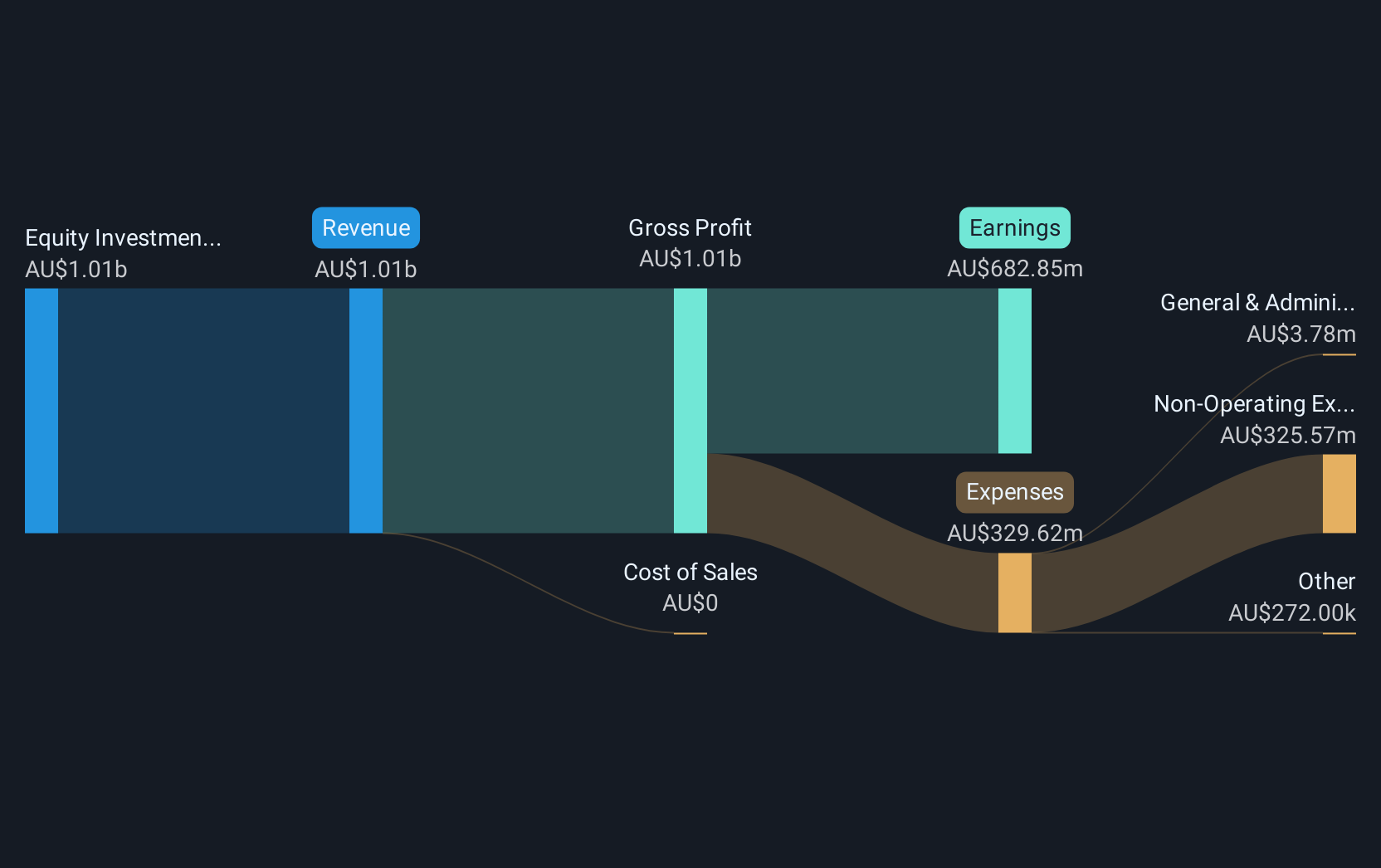

Operations: MFF Capital Investments generates revenue primarily from its equity investment segment, amounting to A$659.96 million.

Market Cap: A$2.27B

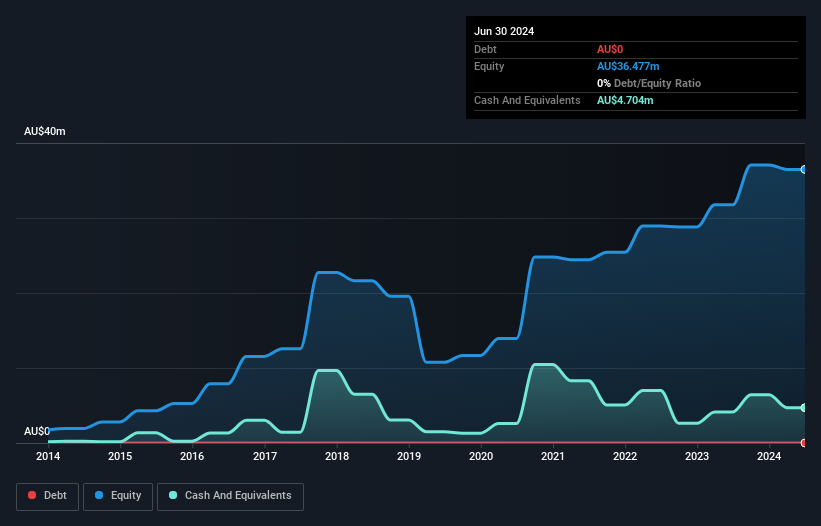

MFF Capital Investments, with a market cap of A$2.27 billion, demonstrates financial stability and growth potential in the penny stock space. The company's revenue increased to A$666.59 million for the year ended June 30, 2024, with net income rising to A$447.36 million from the previous year. MFF's strong balance sheet is evidenced by its short-term assets exceeding both short- and long-term liabilities and a high return on equity of 21.6%. Additionally, it offers an attractive dividend yield of 3.57% without recent shareholder dilution concerns, while maintaining stable weekly volatility over the past year at around 3%.

- Navigate through the intricacies of MFF Capital Investments with our comprehensive balance sheet health report here.

- Evaluate MFF Capital Investments' historical performance by accessing our past performance report.

Red Sky Energy (ASX:ROG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Red Sky Energy Limited is an oil and gas exploration and development company that focuses on acquiring, drilling, and developing resources in the United States and Australia, with a market cap of A$48.80 million.

Operations: Red Sky Energy Limited does not have any reported revenue segments.

Market Cap: A$48.8M

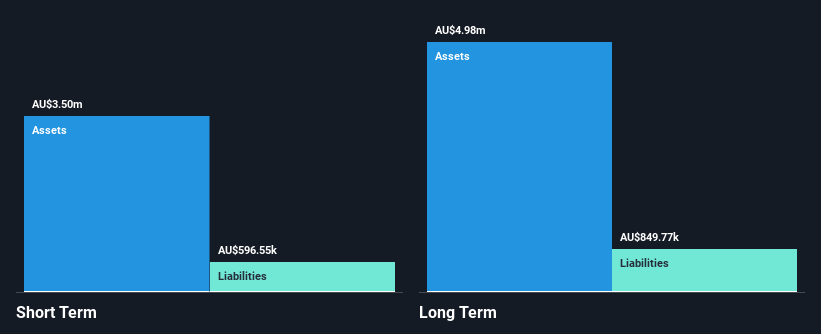

Red Sky Energy Limited, with a market cap of A$48.80 million, has shown significant revenue growth, reporting A$1.85 million for the half-year ended June 30, 2024, up from A$0.0587 million a year ago. Despite being unprofitable, it reduced losses over five years by 5.1% annually and achieved net income of A$0.32 million compared to a prior net loss. The company is debt-free with sufficient cash runway exceeding three years even if free cash flow shrinks by 14.6% annually and maintains short-term assets (A$3.5M) that exceed its liabilities while experiencing high share price volatility recently.

- Click to explore a detailed breakdown of our findings in Red Sky Energy's financial health report.

- Review our historical performance report to gain insights into Red Sky Energy's track record.

Make It Happen

- Investigate our full lineup of 1,026 ASX Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Red Sky Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ROG

Red Sky Energy

An oil and gas exploration and development company, acquires, drills, and develops oil and gas resources in the United States, the British Virgin Islands, and Australia.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives