- Australia

- /

- Oil and Gas

- /

- ASX:PDN

Does a Director's Share Sale Raise New Questions About Paladin's Long-term Strategy (ASX:PDN)?

Reviewed by Sasha Jovanovic

- In recent days, Paladin Energy director Peter Watson sold 66,000 shares in an on-market transaction, reducing his holding to 34,000 shares.

- This insider sale occurs as the company continues to develop the Patterson Lake South project, which is seen as central to Paladin's long-term production plans but faces risks from regulatory delays and cost uncertainties.

- We'll examine how investor attention triggered by this director sale could reshape the company's investment narrative and future outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Paladin Energy Investment Narrative Recap

Investing in Paladin Energy hinges on conviction that global uranium demand will outpace supply, underpinning the company's multi-asset production strategy through assets like Langer Heinrich and future development at Patterson Lake South (PLS). The recent insider share sale by director Peter Watson appears immaterial to near-term catalysts, namely the successful ramp-up at Langer Heinrich; however, it puts a spotlight on persistent risks such as regulatory hurdles and cost overruns tied to the PLS project.

Of the recent announcements, the August 2025 operational update on PLS stands out, spotlighting a life-of-mine production target of 90.9 million pounds U3O8 and an updated NPV of US$1.33 billion. These project economics are central to long-term value, but the project’s long permitting timeline and rising cost base remain important watchpoints as investors assess whether short-term share moves reflect evolving fundamentals.

Yet, set against these ambitions, investors need to remain conscious of uncertainties around Canadian project approvals and the impact of any...

Read the full narrative on Paladin Energy (it's free!)

Paladin Energy's outlook projects $519.5 million in revenue and $175.2 million in earnings by 2028. This implies a 43.0% annual revenue growth rate and a $219.8 million increase in earnings from the current level of -$44.6 million.

Uncover how Paladin Energy's forecasts yield a A$8.03 fair value, a 7% downside to its current price.

Exploring Other Perspectives

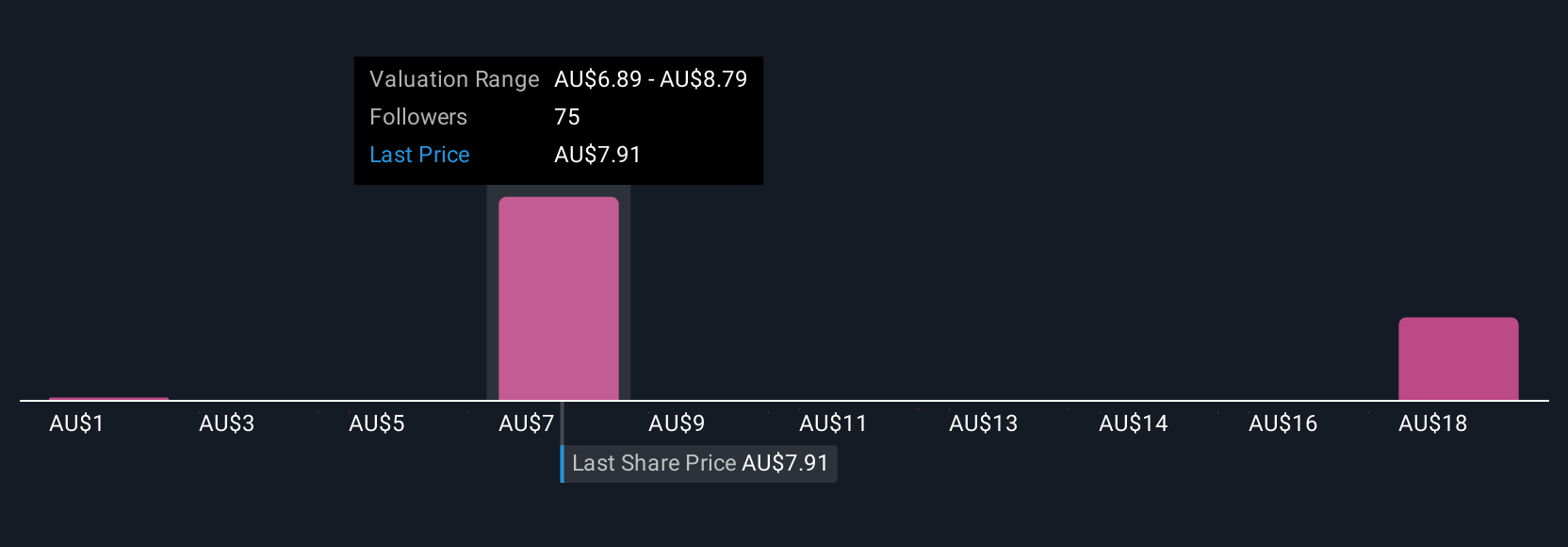

Fifteen members of the Simply Wall St Community estimate Paladin’s fair value between A$1.18 and A$13 per share. With such a wide spread, you can see just how much opinions can diverge when PLS permitting risks and production forecasts are at the center of the company’s outlook, explore other perspectives to inform your own view.

Explore 15 other fair value estimates on Paladin Energy - why the stock might be worth as much as 51% more than the current price!

Build Your Own Paladin Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paladin Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Paladin Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paladin Energy's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PDN

Paladin Energy

Through its subsidiaries, engages in the development and exploration of mineral properties in Australia, Canada, and Namibia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives