- Australia

- /

- Metals and Mining

- /

- ASX:FMG

Top ASX Dividend Stocks To Watch In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, yet it is up 17% over the past year with earnings expected to grow by 12% annually in coming years. In this context of steady growth, dividend stocks that offer consistent payouts and potential capital appreciation can be particularly appealing to investors seeking reliable returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.55% | ★★★★★☆ |

| Perenti (ASX:PRN) | 7.58% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.63% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.12% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.19% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.53% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.56% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.44% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.40% | ★★★★★☆ |

| Australian United Investment (ASX:AUI) | 3.35% | ★★★★☆☆ |

Click here to see the full list of 38 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Fortescue (ASX:FMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd is involved in the exploration, development, production, processing, and sale of iron ore across Australia, China, and international markets with a market cap of A$62.97 billion.

Operations: Fortescue Ltd generates its revenue primarily from Metals, contributing $18.13 billion, and also has a segment in Energy with $91 million.

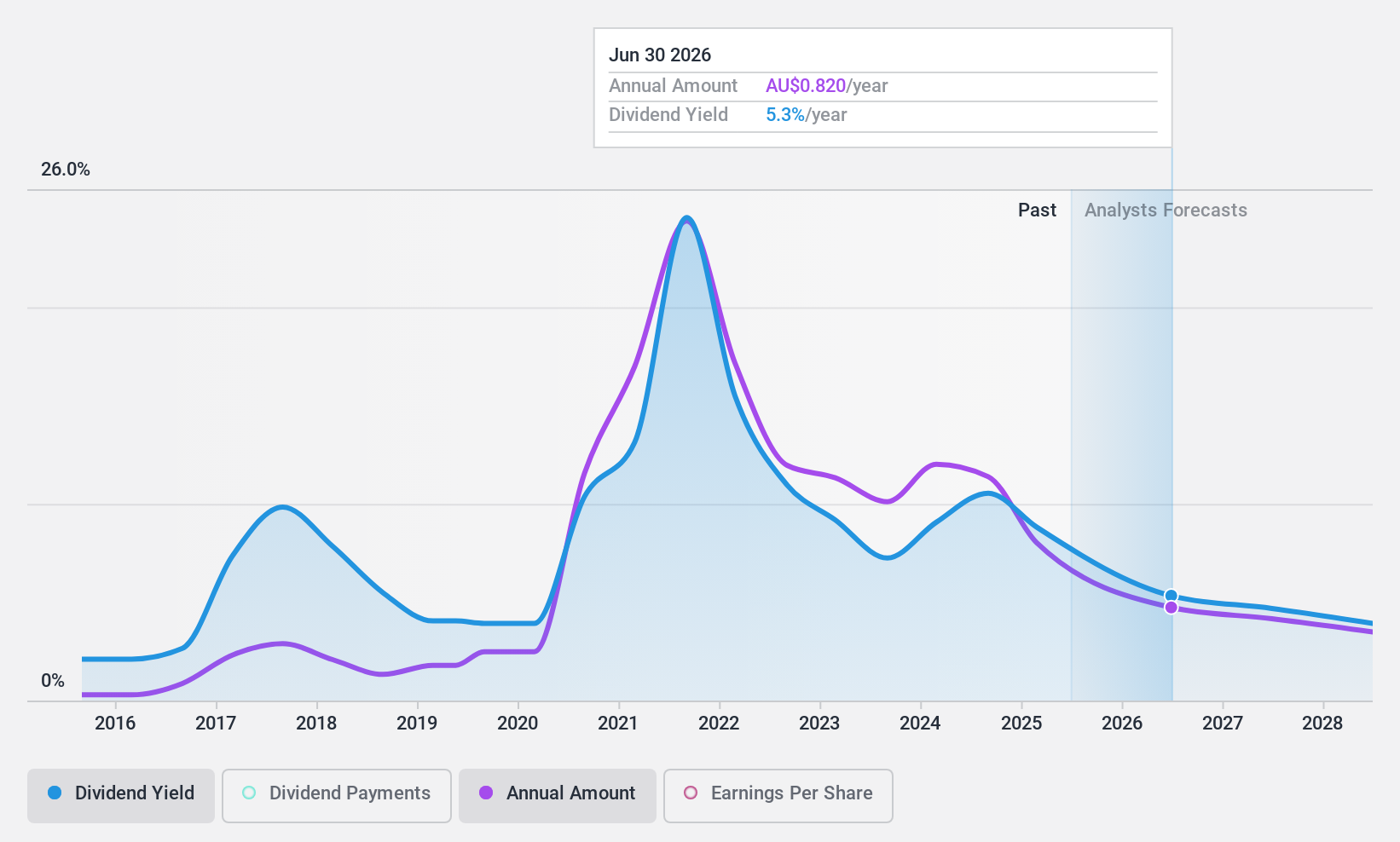

Dividend Yield: 9.5%

Fortescue's dividend yield of 9.55% ranks in the top 25% among Australian dividend payers, supported by a payout ratio of 71.1%, indicating earnings coverage. However, its dividends have been volatile over the past decade and are considered unreliable due to inconsistency in growth. Recent board changes include Dr. Larry Marshall as Lead Independent Director, which may influence future strategic decisions impacting dividends. Earnings rose to US$5.68 billion for FY2024 from US$4.80 billion previously, reflecting strong financial performance despite upcoming challenges with forecasted earnings decline.

- Take a closer look at Fortescue's potential here in our dividend report.

- Our expertly prepared valuation report Fortescue implies its share price may be lower than expected.

Nine Entertainment Holdings (ASX:NEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nine Entertainment Co. Holdings Limited operates in the broadcasting and program production sectors, offering free-to-air television, video on demand, and metropolitan radio services in Australia, with a market cap of A$1.99 billion.

Operations: Nine Entertainment Co. Holdings Limited generates revenue from several segments, including Stan (A$447.73 million), Publishing (A$558.63 million), Broadcasting (A$1.23 billion), and Domain Group (A$395.73 million).

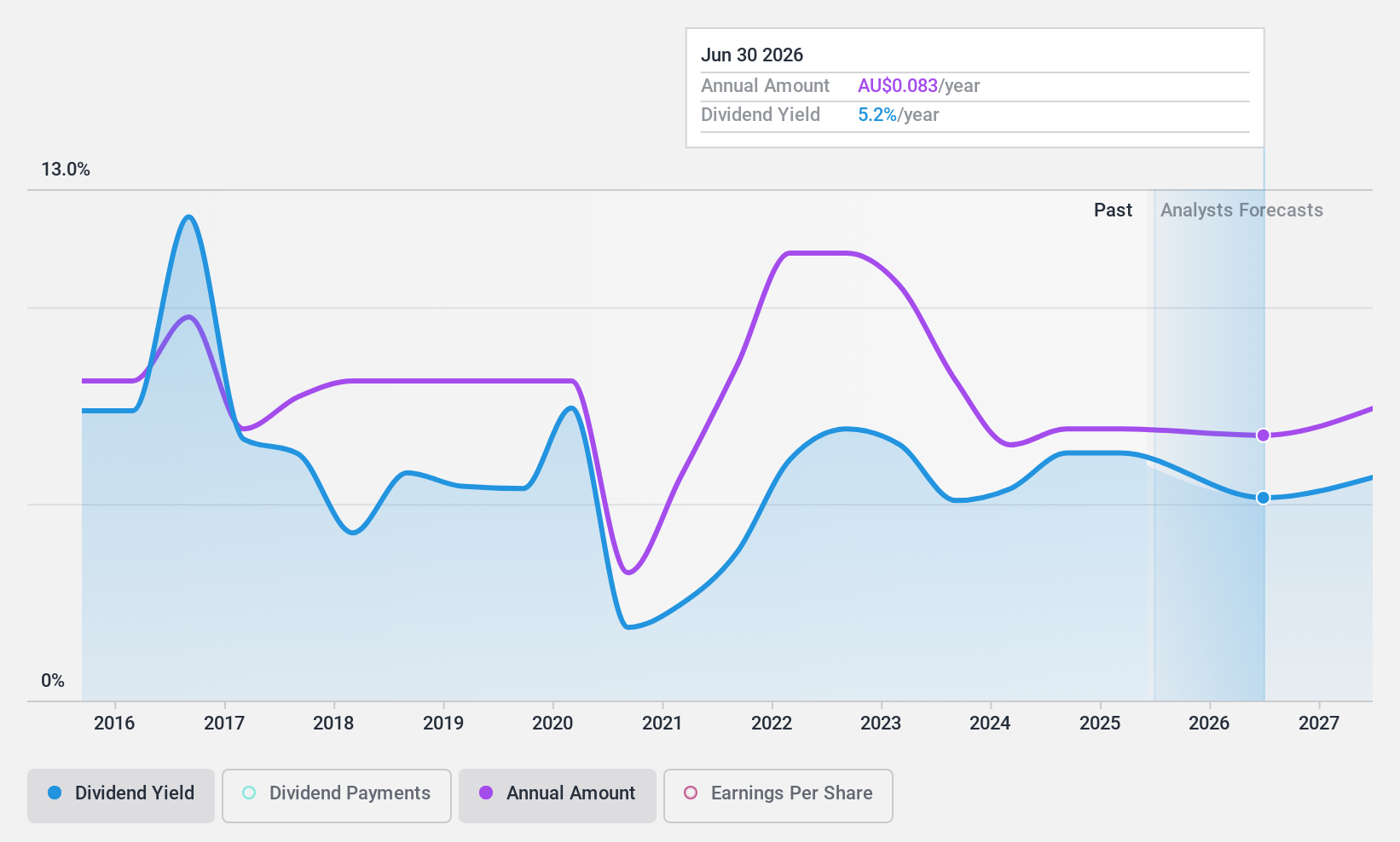

Dividend Yield: 6.8%

Nine Entertainment Holdings offers a dividend yield of 6.77%, placing it in the top 25% of Australian dividend payers, but its high payout ratio of 123.8% raises sustainability concerns as dividends are not fully covered by earnings. Despite being supported by cash flows with an 86% cash payout ratio, dividends have been volatile over the past decade. Recent executive changes and strategic considerations regarding Domain Holdings may impact future dividend stability and corporate direction.

- Click to explore a detailed breakdown of our findings in Nine Entertainment Holdings' dividend report.

- The analysis detailed in our Nine Entertainment Holdings valuation report hints at an deflated share price compared to its estimated value.

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited engages in the exploration, development, production, and processing of coal and oil and gas properties with a market cap of A$4.36 billion.

Operations: New Hope Corporation Limited's revenue is primarily derived from its Coal Mining operations in New South Wales (A$1.56 billion) and Queensland, including Treasury and Investments (A$166.52 million).

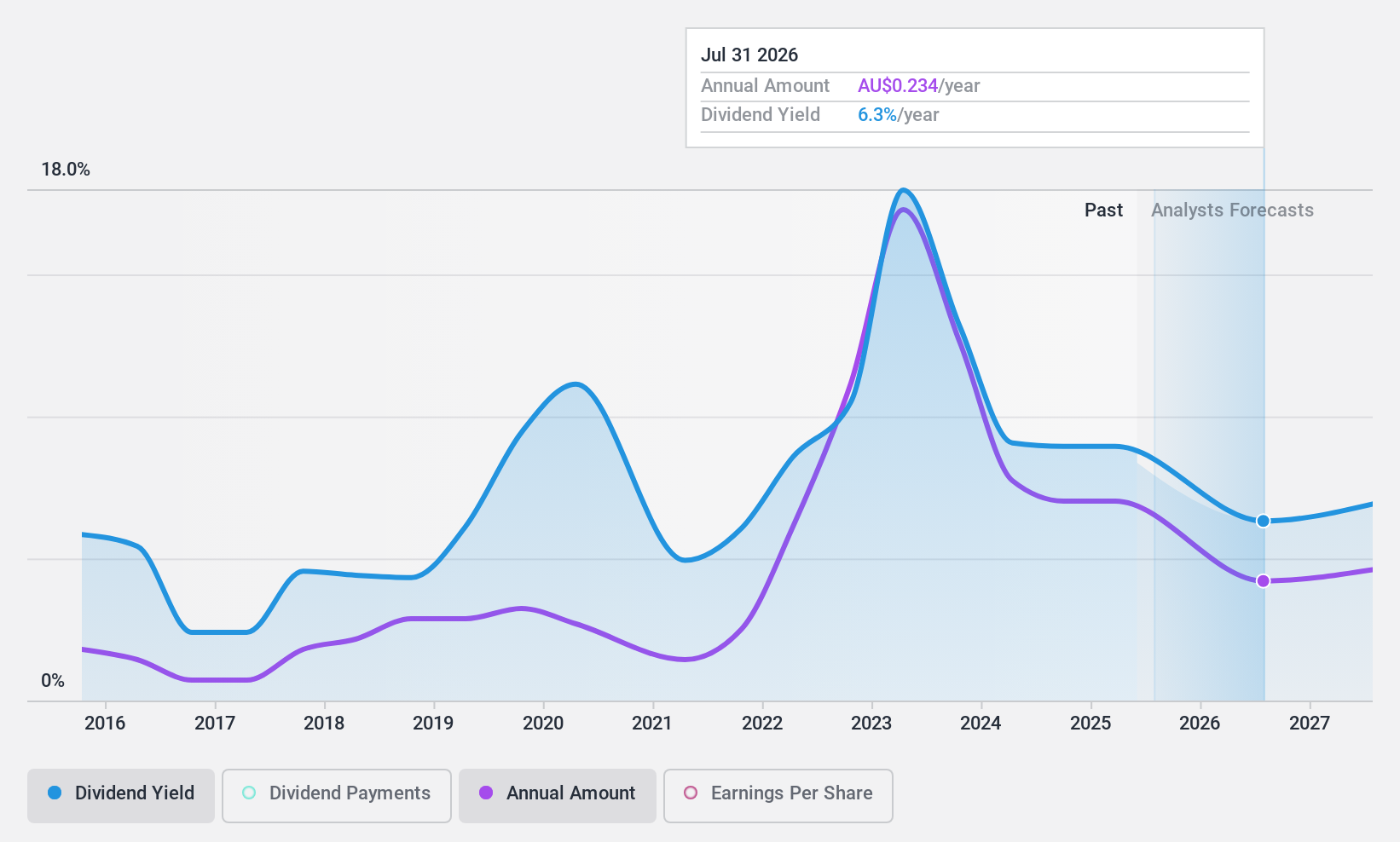

Dividend Yield: 7.6%

New Hope Corporation's dividend yield of 7.56% ranks it among the top 25% of Australian dividend payers, yet sustainability is questionable due to a high cash payout ratio of 113.7%, indicating dividends are not well covered by free cash flows. While dividends have grown over the past decade, they remain volatile and unreliable. Recent earnings showed a decline in net income to A$475.86 million from A$1,087.4 million, highlighting potential challenges for future payouts.

- Click here to discover the nuances of New Hope with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that New Hope is trading behind its estimated value.

Next Steps

- Unlock our comprehensive list of 38 Top ASX Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FMG

Fortescue

Engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives