- Australia

- /

- Oil and Gas

- /

- ASX:NHC

ASX Dividend Stocks GWA Group And 2 More Top Picks

Reviewed by Simply Wall St

As the Australian market experiences fluctuations, with shares expected to dip slightly following a recent strong trading day, investors are closely watching global economic cues and local developments. In this environment, dividend stocks like GWA Group offer potential stability and income, making them appealing options for those seeking consistent returns amid market uncertainty.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| IPH (ASX:IPH) | 7.81% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.24% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.49% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.74% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.95% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.10% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.68% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.58% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.26% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.54% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

GWA Group (ASX:GWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GWA Group Limited is involved in the research, design, manufacture, import, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, and international markets with a market cap of A$615.28 million.

Operations: GWA Group Limited generates revenue primarily from its Water Solutions segment, which accounts for A$417.40 million.

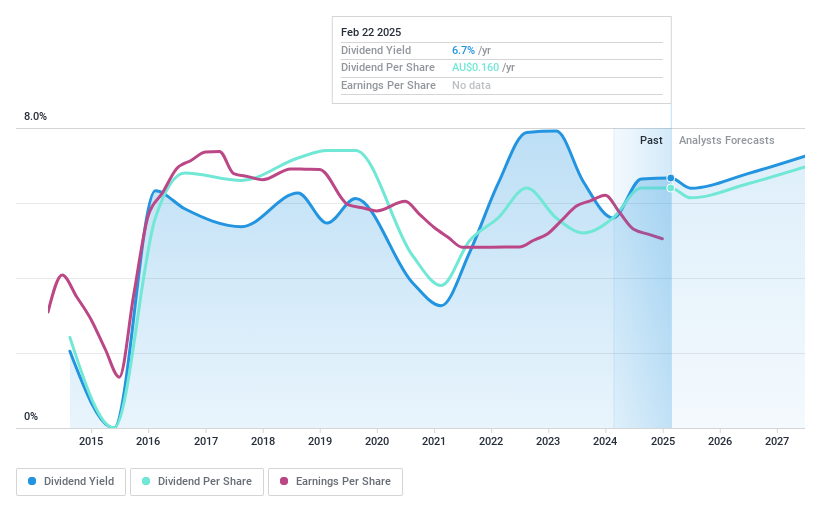

Dividend Yield: 6.7%

GWA Group's dividend yield of 6.68% ranks in the top 25% of Australian dividend payers, yet its sustainability is questionable with a high payout ratio of 111.7%, indicating dividends are not covered by earnings. However, cash flows reasonably cover dividends with a cash payout ratio of 71.9%. Despite recent increases, dividends have been volatile over the past decade. GWA trades at a significant discount to estimated fair value but faces challenges in maintaining reliable payouts amidst fluctuating profits and recent executive changes.

- Navigate through the intricacies of GWA Group with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that GWA Group is trading behind its estimated value.

IPH (ASX:IPH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IPH Limited, along with its subsidiaries, offers intellectual property services and products, with a market capitalization of A$1.23 billion.

Operations: IPH Limited generates revenue through its intellectual property services, with A$121 million from Asia, A$259.20 million from Canada, and A$300.30 million from Australia & New Zealand.

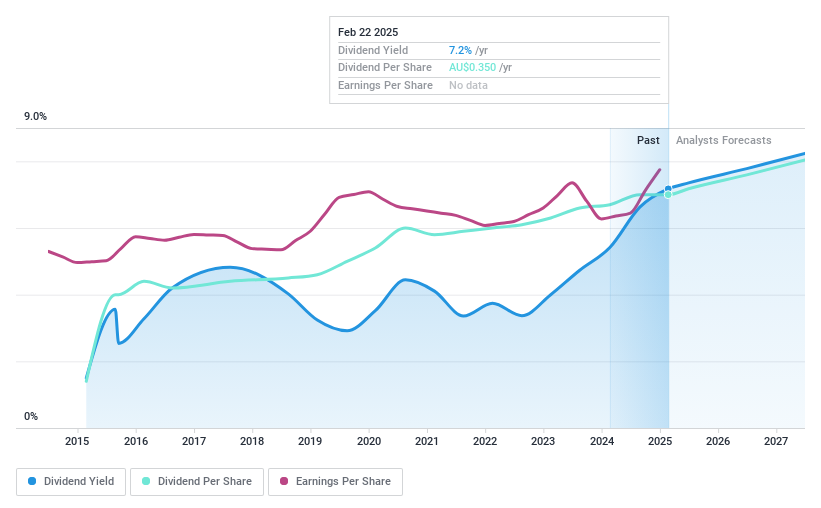

Dividend Yield: 7.8%

IPH's dividend yield of 7.81% places it among the top 25% of Australian payers, yet its sustainability is challenged by a high payout ratio of 119.5%, indicating dividends are not covered by earnings, though cash flows cover them at an 87% ratio. Dividends have grown steadily over the past decade with little volatility. Recent earnings growth supports potential for future payouts despite CFO changes and trading significantly below fair value estimates at A$347 million in revenue for H1 2025.

- Click to explore a detailed breakdown of our findings in IPH's dividend report.

- Upon reviewing our latest valuation report, IPH's share price might be too pessimistic.

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: New Hope Corporation Limited is involved in the exploration, development, production, and processing of coal and oil and gas properties with a market cap of A$3.47 billion.

Operations: New Hope Corporation Limited generates revenue primarily from its Coal Mining operations in New South Wales, amounting to A$1.58 billion, and in Queensland (including Treasury and Investments), contributing A$315.68 million.

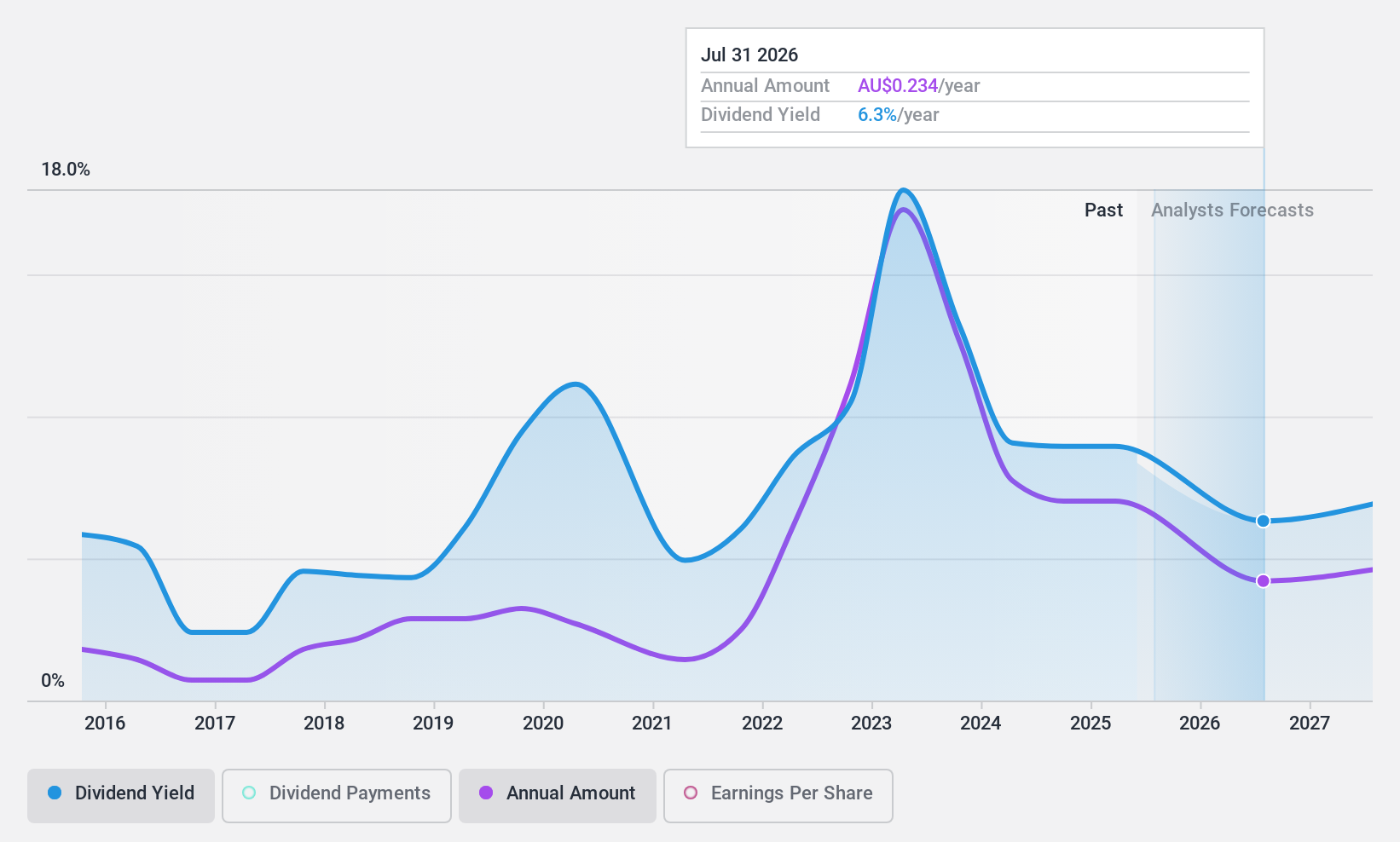

Dividend Yield: 9.5%

New Hope Corporation's dividend yield is among the top 25% in Australia, supported by a payout ratio of 61.4%, indicating dividends are covered by earnings and cash flows. Despite a volatile dividend history, recent increases include an interim dividend of A$0.19 per share. The company announced a buyback program worth A$100 million to enhance shareholder returns. Recent earnings showed significant growth with net income rising to A$340.31 million for H1 2025, though future earnings may decline slightly over the next three years.

- Get an in-depth perspective on New Hope's performance by reading our dividend report here.

- Our expertly prepared valuation report New Hope implies its share price may be lower than expected.

Next Steps

- Get an in-depth perspective on all 32 Top ASX Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade New Hope, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if New Hope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHC

New Hope

Explores for, develops, produces, and processes coal, and oil and gas properties.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives