- Australia

- /

- Construction

- /

- ASX:SXE

ASX Dividend Stocks Featuring New Hope And Two More Top Picks

Reviewed by Simply Wall St

The Australian market remained flat over the last week, but it has shown a robust 17% increase over the past year, with earnings projected to grow by 13% annually. In this context of steady growth, dividend stocks like New Hope and others can offer investors an attractive blend of income and potential capital appreciation.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.67% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.84% | ★★★★★☆ |

| Perenti (ASX:PRN) | 6.64% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.29% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.32% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.33% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.42% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.09% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.42% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.41% | ★★★★☆☆ |

Click here to see the full list of 33 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited engages in the exploration, development, production, and processing of coal, oil, and gas properties with a market capitalization of A$4.06 billion.

Operations: New Hope Corporation Limited's revenue primarily comes from its Coal Mining NSW segment, which generated A$1.56 billion, and its Coal Mining QLD (including Treasury and Investments) segment, which contributed A$166.52 million.

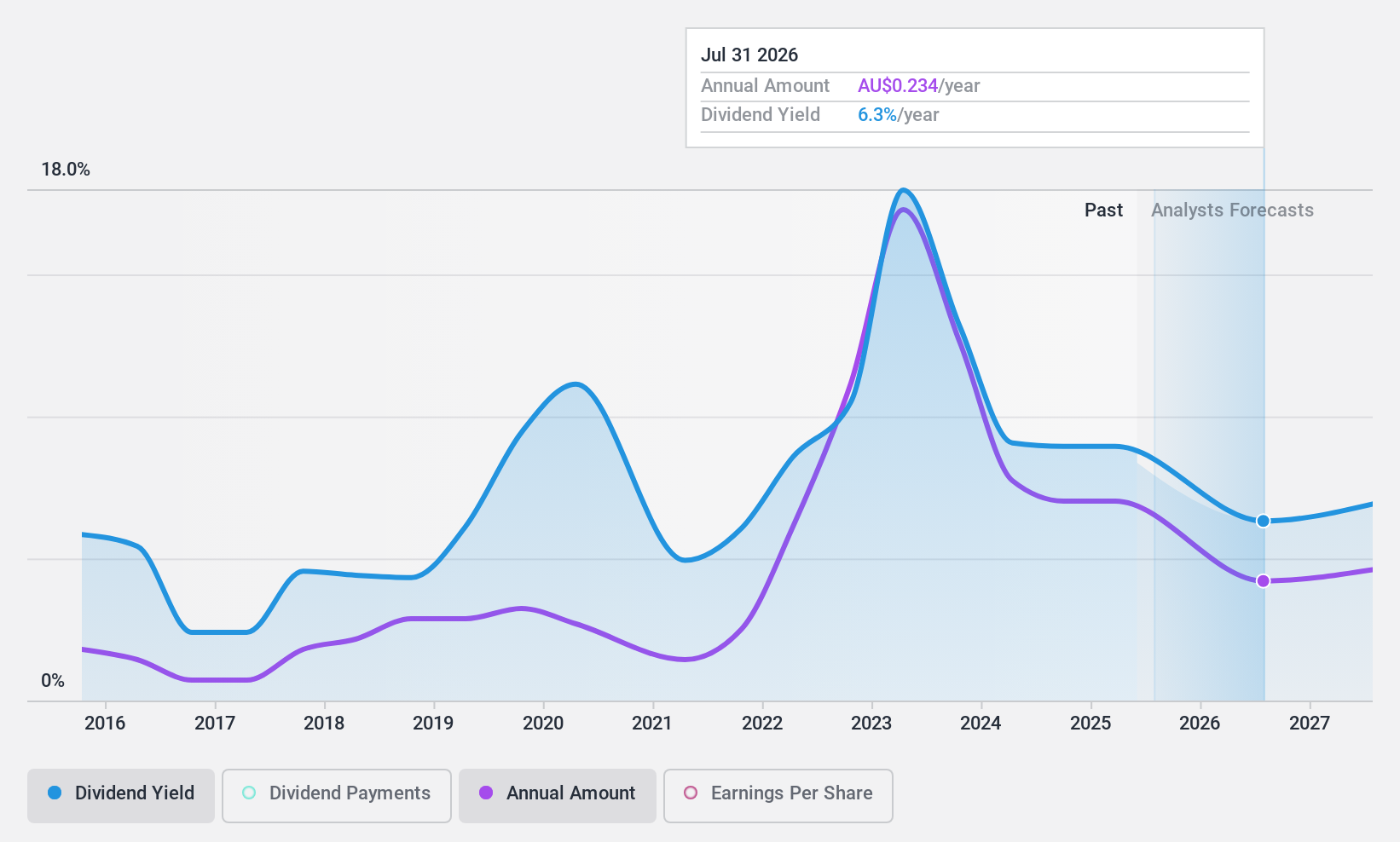

Dividend Yield: 8.1%

New Hope's dividend yield of 8.11% ranks in the top 25% of Australian dividend payers, but it faces sustainability concerns due to a high cash payout ratio of 113.7%. Despite recent earnings declines, with net income dropping to A$475.86 million from A$1.09 billion last year, dividends have increased over the past decade. However, their volatility and lack of coverage by free cash flows suggest caution for investors prioritizing stable income streams.

- Navigate through the intricacies of New Hope with our comprehensive dividend report here.

- Our expertly prepared valuation report New Hope implies its share price may be lower than expected.

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$493.33 million.

Operations: Servcorp Limited generates revenue primarily from its Real Estate - Rental segment, amounting to A$314.89 million.

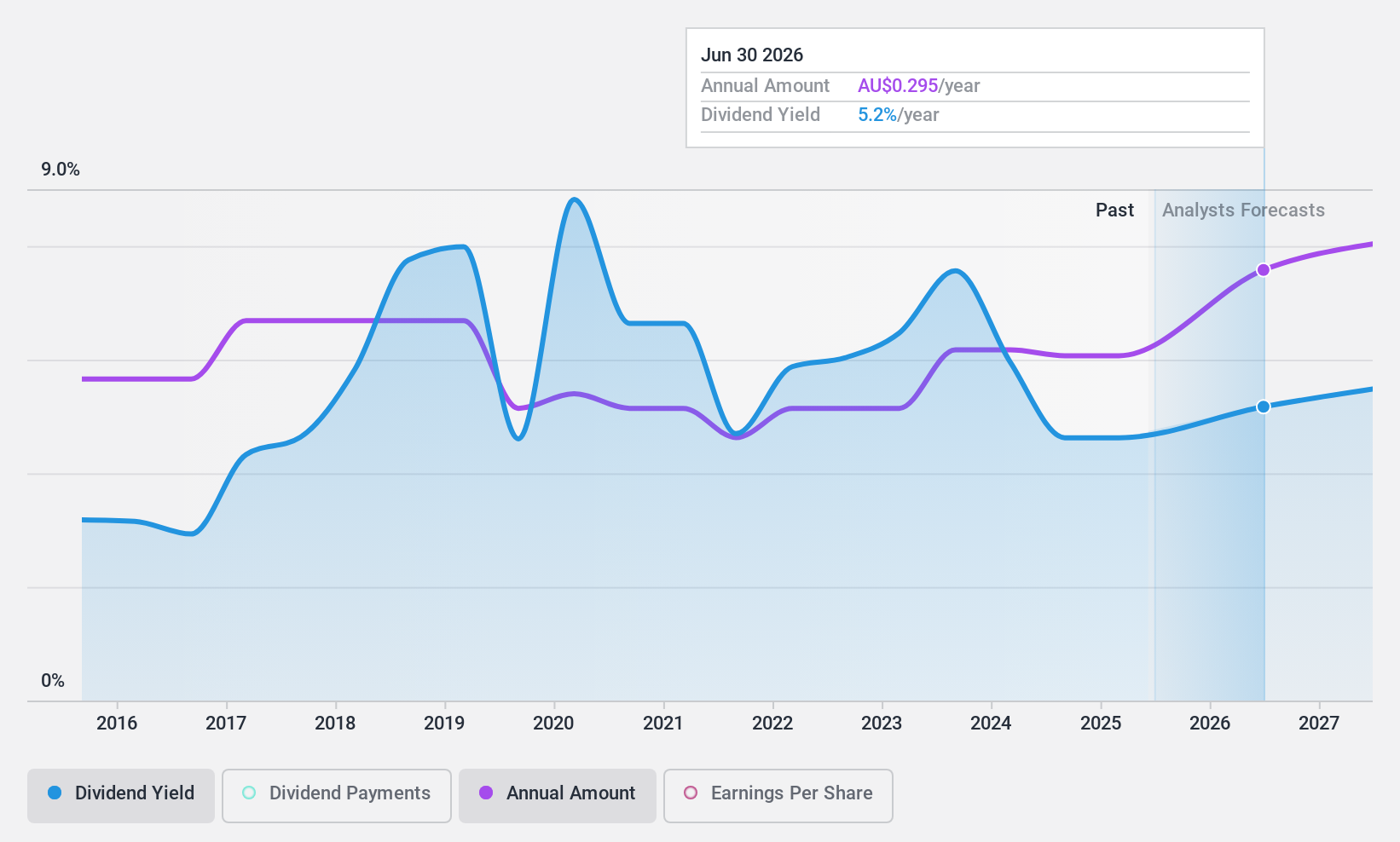

Dividend Yield: 4.7%

Servcorp's dividend profile shows a mixed picture, with recent increases including a 14% rise in fiscal year 2024 dividends to 25.0 cents per share and plans for at least 26.0 cents in fiscal year 2025. Despite past volatility, current payouts are well-covered by earnings (59.7% payout ratio) and cash flows (14.2% cash payout ratio). Trading below estimated fair value, its dividend yield of 4.72% is lower than the top quartile of Australian payers but remains sustainable given robust earnings growth and coverage metrics.

- Get an in-depth perspective on Servcorp's performance by reading our dividend report here.

- According our valuation report, there's an indication that Servcorp's share price might be on the cheaper side.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$428.12 million.

Operations: Southern Cross Electrical Engineering Limited generates revenue primarily from the provision of electrical services, amounting to A$551.87 million.

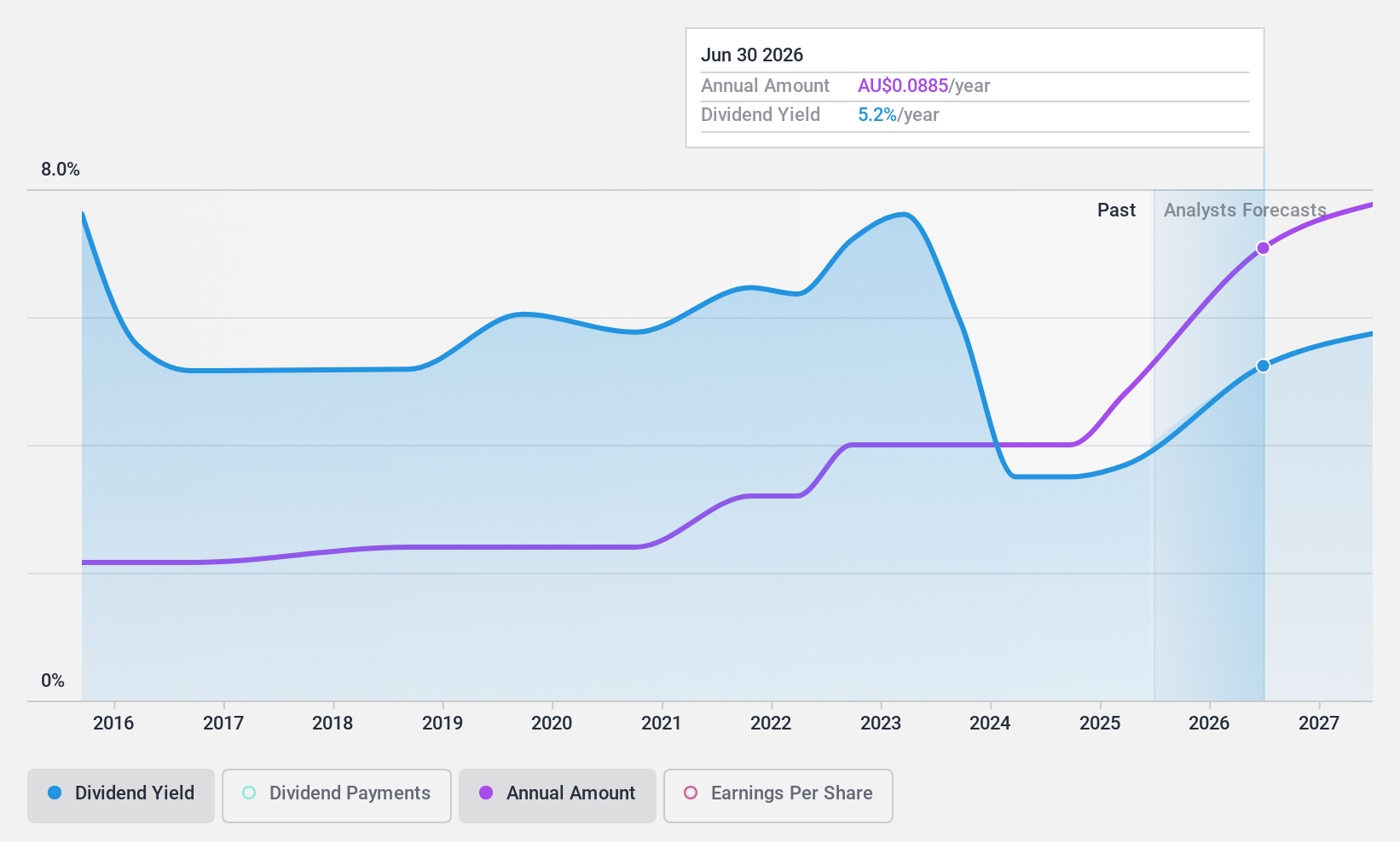

Dividend Yield: 3.7%

Southern Cross Electrical Engineering's dividend profile is characterized by a reasonable payout ratio of 72%, ensuring coverage by earnings, and a cash payout ratio of 46.7%, indicating strong cash flow support. Despite recent increases, dividends have been volatile over the past decade, with a current yield of 3.7% falling short compared to top-tier Australian dividend payers. The stock trades below estimated fair value and was recently added to the S&P Global BMI Index, reflecting potential investor interest.

- Delve into the full analysis dividend report here for a deeper understanding of Southern Cross Electrical Engineering.

- Insights from our recent valuation report point to the potential undervaluation of Southern Cross Electrical Engineering shares in the market.

Next Steps

- Unlock our comprehensive list of 33 Top ASX Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, and maintenance services and products to resources, commercial, and infrastructure sectors in Australia.

Flawless balance sheet, good value and pays a dividend.