NuEnergy Gas Limited (ASX:NGY) posted some decent earnings, but shareholders didn't react strongly. Our analysis has found some concerning factors which weaken the profit's foundation.

View our latest analysis for NuEnergy Gas

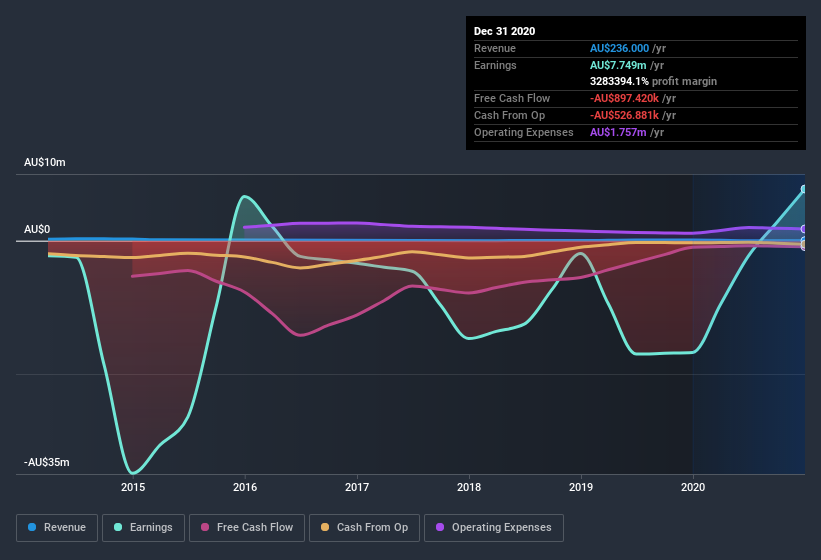

Examining Cashflow Against NuEnergy Gas' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to December 2020, NuEnergy Gas had an accrual ratio of 0.36. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. Even though it reported a profit of AU$7.75m, a look at free cash flow indicates it actually burnt through AU$897k in the last year. We also note that NuEnergy Gas' free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of AU$897k. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part. The good news for shareholders is that NuEnergy Gas' accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of NuEnergy Gas.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by AU$9.6m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. NuEnergy Gas had a rather significant contribution from unusual items relative to its profit to December 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On NuEnergy Gas' Profit Performance

NuEnergy Gas had a weak accrual ratio, but its profit did receive a boost from unusual items. Considering all this we'd argue NuEnergy Gas' profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into NuEnergy Gas, you'd also look into what risks it is currently facing. For example, NuEnergy Gas has 4 warning signs (and 2 which are concerning) we think you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading NuEnergy Gas or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade NuEnergy Gas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NuEnergy Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:NGY

NuEnergy Gas

An independent clean energy company, engages in the exploration, appraisal, and development of coal bed methane gas projects in Indonesia.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives