- Australia

- /

- Metals and Mining

- /

- ASX:NH3

Discovering Opportunities: Environmental Group Among 3 ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 closing up 0.51% at 8,416 points, buoyed by positive sentiment following China's response to tariffs and strong performances in sectors like Materials and IT. In such a climate, investors often seek opportunities in smaller or newer companies that can offer both affordability and growth potential. While the term "penny stocks" may seem outdated, these stocks continue to attract attention for their potential value when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.505 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$2.02 | A$322.38M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.5425 | A$105.06M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$247.9M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$106.21M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.18 | A$334.56M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$235.35M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.315 | A$61.65M | ★★★★★☆ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Environmental Group (ASX:EGL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Environmental Group Limited designs, applies, and services gas, vapor, and dust emission control systems as well as inlet and exhaust systems for gas turbines in Australia and internationally, with a market cap of A$104.64 million.

Operations: The company's revenue is primarily derived from its segments, which include EGL Waste (A$0.85 million), EGL Energy (A$37.86 million), Egl Clean Air Tapc (A$17.40 million), Egl Clean Air Airtight (A$15.54 million), and EGL Turbine Enhancement (A$27.13 million).

Market Cap: A$104.64M

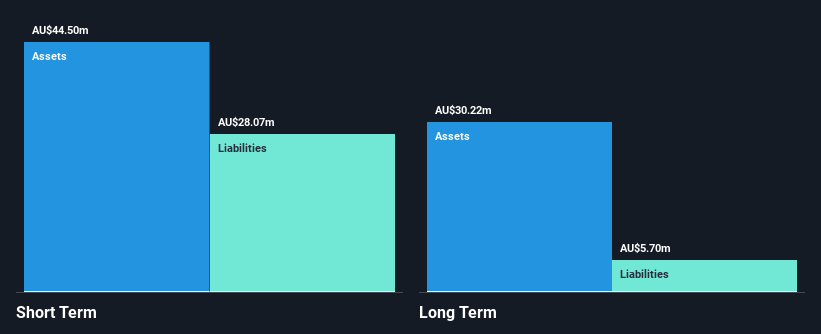

Environmental Group Limited, with a market cap of A$104.64 million, has shown robust financial health and growth potential. Its debt is well covered by operating cash flow and interest payments are comfortably managed, indicating strong fiscal management. Despite a relatively inexperienced board, the company's earnings have grown significantly by 46% per year over the past five years and surged 68% in the last year alone. Trading at nearly half its estimated fair value, it presents a potentially undervalued opportunity in the penny stock segment. However, its Return on Equity remains low at 10.7%, which could be a concern for some investors.

- Navigate through the intricacies of Environmental Group with our comprehensive balance sheet health report here.

- Explore Environmental Group's analyst forecasts in our growth report.

Melbana Energy (ASX:MAY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Melbana Energy Limited is involved in oil and gas exploration activities in Cuba and Australia, with a market cap of A$94.37 million.

Operations: Melbana Energy Limited does not report specific revenue segments.

Market Cap: A$94.37M

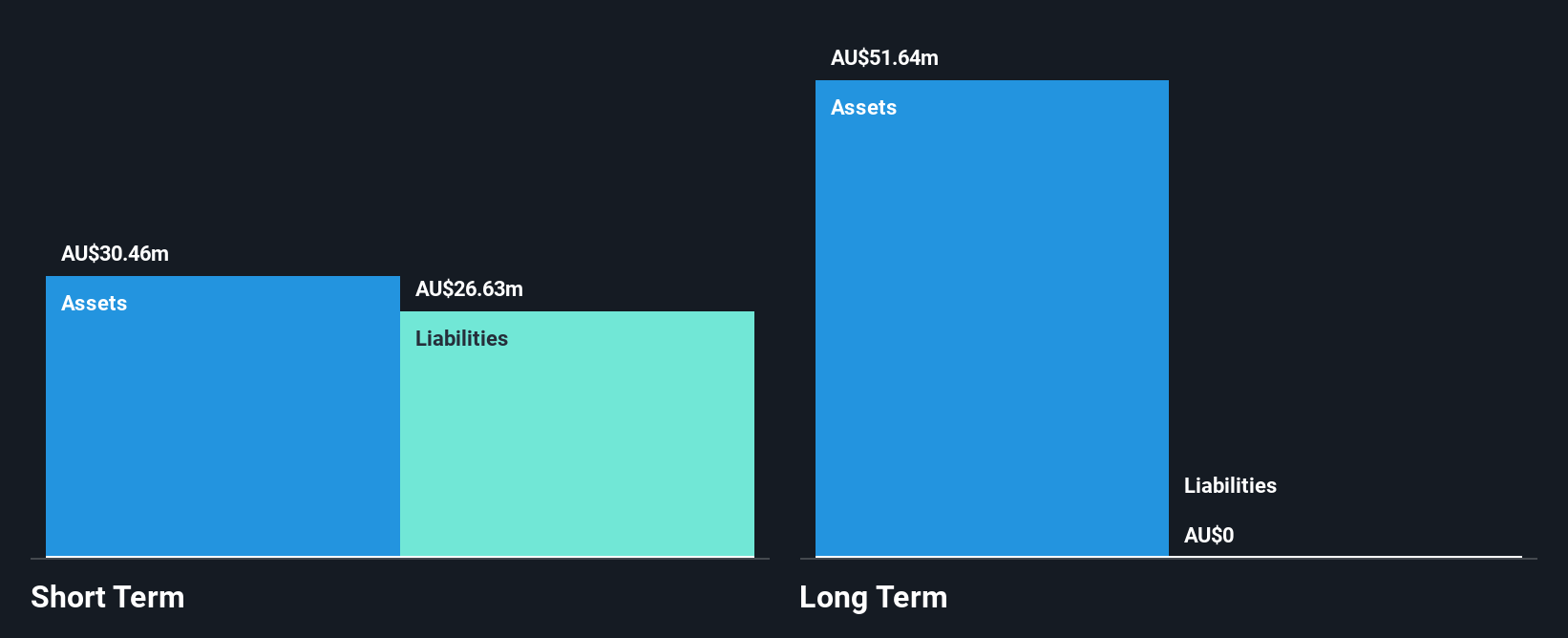

Melbana Energy Limited, with a market cap of A$94.37 million, is pre-revenue, indicating its speculative nature in the penny stock segment. The company recently achieved profitability, marking a significant milestone in its financial journey. It remains debt-free and has no long-term liabilities, which can be appealing for risk-averse investors. Short-term assets of A$51.3 million comfortably cover short-term liabilities of A$40.4 million, suggesting sound liquidity management. Despite this progress, Melbana's Return on Equity is low at 5.8%, and non-cash earnings are high—factors that potential investors should carefully consider when evaluating growth prospects and financial health.

- Unlock comprehensive insights into our analysis of Melbana Energy stock in this financial health report.

- Review our historical performance report to gain insights into Melbana Energy's track record.

NH3 Clean Energy (ASX:NH3)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NH3 Clean Energy Limited, with a market cap of A$11.54 million, explores and develops clean energy and energy materials projects in Australia and the United States.

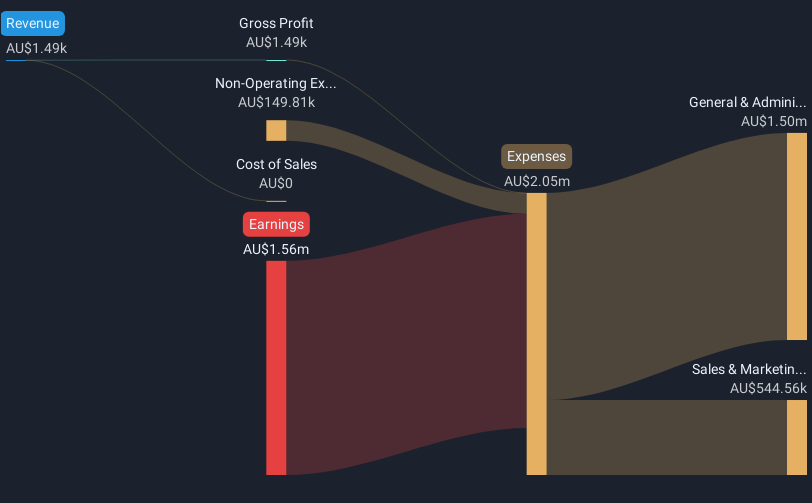

Operations: NH3 Clean Energy Limited has not reported any specific revenue segments.

Market Cap: A$11.54M

NH3 Clean Energy Limited, with a market cap of A$11.54 million, is pre-revenue and operates in the clean energy sector. The company recently completed a follow-on equity offering, raising A$0.725 million to bolster its cash position. Despite having sufficient short-term assets to cover immediate liabilities, NH3's long-term liabilities exceed its short-term assets by A$1.3 million. The debt-to-equity ratio has increased significantly over five years but remains at a satisfactory 1.5%. The board's average tenure of 5.6 years indicates experience; however, the company's high volatility and limited cash runway may pose challenges for investors seeking stability in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of NH3 Clean Energy.

- Learn about NH3 Clean Energy's historical performance here.

Key Takeaways

- Unlock our comprehensive list of 1,032 ASX Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NH3 Clean Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NH3

NH3 Clean Energy

Explores for and develops clean energy and energy materials projects in Australia and the United States.

Adequate balance sheet low.

Market Insights

Community Narratives