- Australia

- /

- Oil and Gas

- /

- ASX:HZN

Horizon Oil Limited's (ASX:HZN) 29% Dip In Price Shows Sentiment Is Matching Earnings

Horizon Oil Limited (ASX:HZN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 39% in the last year.

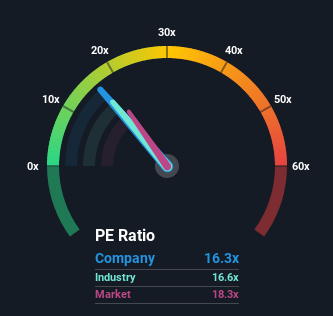

Following the heavy fall in price, Horizon Oil may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.3x, since almost half of all companies in Australia have P/E ratios greater than 19x and even P/E's higher than 38x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

As an illustration, earnings have deteriorated at Horizon Oil over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Horizon Oil

Is There Any Growth For Horizon Oil?

There's an inherent assumption that a company should underperform the market for P/E ratios like Horizon Oil's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 71%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 18% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Horizon Oil is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Horizon Oil's P/E

The softening of Horizon Oil's shares means its P/E is now sitting at a pretty low level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Horizon Oil maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Horizon Oil, and understanding them should be part of your investment process.

If you're unsure about the strength of Horizon Oil's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade Horizon Oil, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Horizon Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:HZN

Horizon Oil

Engages in the exploration, development, and production of oil and gas properties in China, New Zealand, and Australia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives