- Australia

- /

- Oil and Gas

- /

- ASX:BTL

Shareholders May Be More Conservative With Empire Energy Group Limited's (ASX:EEG) CEO Compensation For Now

In the past three years, shareholders of Empire Energy Group Limited (ASX:EEG) have seen a loss on their investment. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 27 May 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Empire Energy Group

Comparing Empire Energy Group Limited's CEO Compensation With the industry

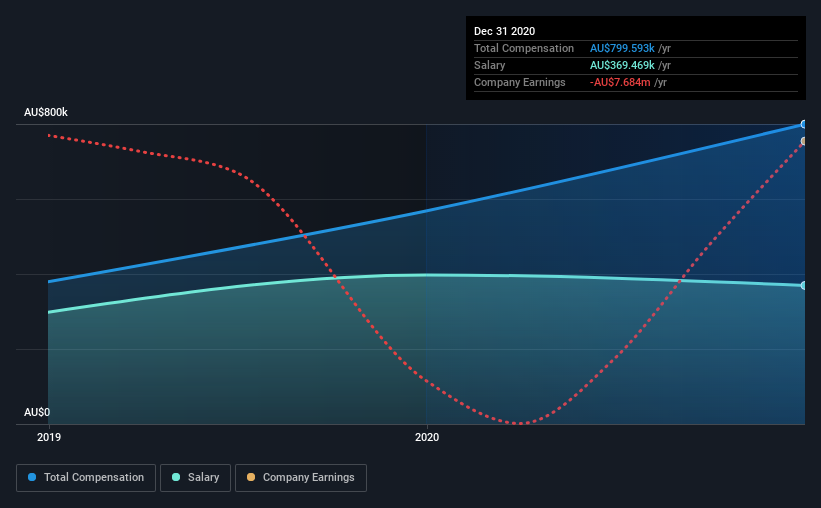

At the time of writing, our data shows that Empire Energy Group Limited has a market capitalization of AU$117m, and reported total annual CEO compensation of AU$800k for the year to December 2020. Notably, that's an increase of 41% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$369k.

On comparing similar-sized companies in the industry with market capitalizations below AU$258m, we found that the median total CEO compensation was AU$324k. This suggests that Alex Underwood is paid more than the median for the industry. Moreover, Alex Underwood also holds AU$725k worth of Empire Energy Group stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$369k | AU$398k | 46% |

| Other | AU$430k | AU$171k | 54% |

| Total Compensation | AU$800k | AU$568k | 100% |

On an industry level, roughly 68% of total compensation represents salary and 32% is other remuneration. In Empire Energy Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Empire Energy Group Limited's Growth

Empire Energy Group Limited's earnings per share (EPS) grew 60% per year over the last three years. In the last year, its revenue is down 17%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Empire Energy Group Limited Been A Good Investment?

Since shareholders would have lost about 10.0% over three years, some Empire Energy Group Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 4 warning signs for Empire Energy Group that investors should look into moving forward.

Switching gears from Empire Energy Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Empire Energy Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Beetaloo Energy Australia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BTL

Beetaloo Energy Australia

Together its subsidiaries, engages in the production and sale of oil and natural gas in Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.