- Australia

- /

- Oil and Gas

- /

- ASX:EDE

Eden Innovations'(ASX:EDE) Share Price Is Down 78% Over The Past Three Years.

This month, we saw the Eden Innovations Ltd (ASX:EDE) up an impressive 50%. But the last three years have seen a terrible decline. To wit, the share price sky-dived 78% in that time. So we're relieved for long term holders to see a bit of uplift. The thing to think about is whether the business has really turned around.

Check out our latest analysis for Eden Innovations

Eden Innovations recorded just AU$2,431,139 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Eden Innovations finds fossil fuels with an exploration program, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. We can see that they needed to raise more capital, and took that step recently despite the fact that it would have been dilutive to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Eden Innovations has already given some investors a taste of the bitter losses that high risk investing can cause.

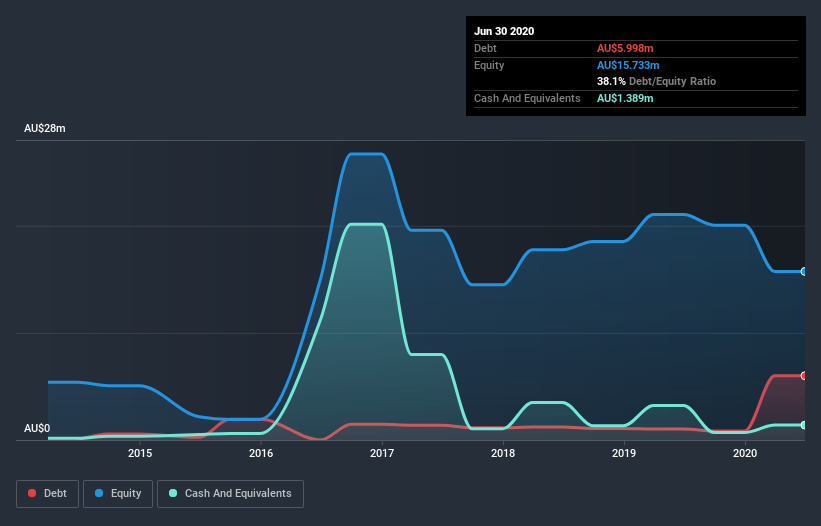

Our data indicates that Eden Innovations had more in total liabilities than it had cash, when it last reported. That made it extremely high risk, in our view. But since the share price has dived 39% per year, over 3 years , it looks like some investors think it's time to abandon ship, so to speak, even though the cash reserves look a little better with the capital raising. The image below shows how Eden Innovations' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Eden Innovations shareholders are down 16% for the year, but the market itself is up 3.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Eden Innovations is showing 5 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

We will like Eden Innovations better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade Eden Innovations, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eden Innovations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EDE

Slight with mediocre balance sheet.

Market Insights

Community Narratives