Leon Devaney has been the CEO of Central Petroleum Limited (ASX:CTP) since 2018, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Central Petroleum pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Central Petroleum

Comparing Central Petroleum Limited's CEO Compensation With the industry

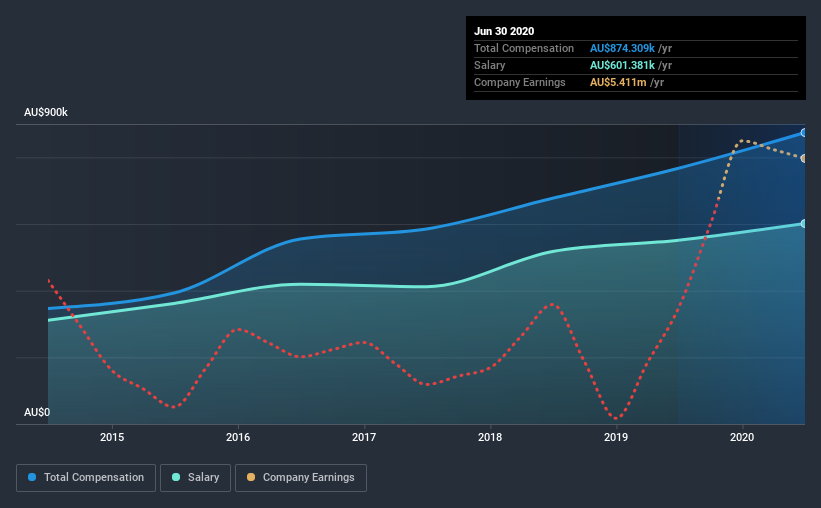

At the time of writing, our data shows that Central Petroleum Limited has a market capitalization of AU$94m, and reported total annual CEO compensation of AU$874k for the year to June 2020. We note that's an increase of 14% above last year. In particular, the salary of AU$601.4k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below AU$257m, reported a median total CEO compensation of AU$353k. Hence, we can conclude that Leon Devaney is remunerated higher than the industry median. Furthermore, Leon Devaney directly owns AU$339k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$601k | AU$551k | 69% |

| Other | AU$273k | AU$216k | 31% |

| Total Compensation | AU$874k | AU$767k | 100% |

On an industry level, around 76% of total compensation represents salary and 24% is other remuneration. Although there is a difference in how total compensation is set, Central Petroleum more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Central Petroleum Limited's Growth

Central Petroleum Limited has seen its earnings per share (EPS) increase by 78% a year over the past three years. It achieved revenue growth of 9.4% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Central Petroleum Limited Been A Good Investment?

With a total shareholder return of 24% over three years, Central Petroleum Limited shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

As we noted earlier, Central Petroleum pays its CEO higher than the norm for similar-sized companies belonging to the same industry. But the company has impressed us with its EPS growth, over three years. We also note that, over the same time frame, shareholder returns haven't been bad. You might wish to research management further, but on this analysis, considering the EPS growth, we wouldn't say CEO compensation problematic.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 4 warning signs for Central Petroleum (of which 2 are significant!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Central Petroleum, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CTP

Central Petroleum

Engages in the development, production, processing, and marketing of hydrocarbons in Australia.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives