- Australia

- /

- Oil and Gas

- /

- ASX:BPT

Investors Continue Waiting On Sidelines For Beach Energy Limited (ASX:BPT)

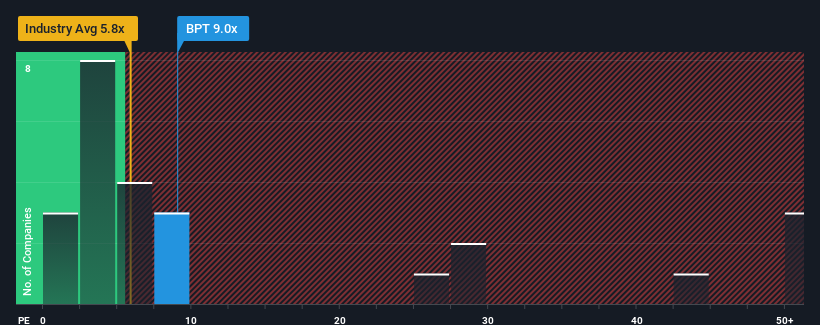

Beach Energy Limited's (ASX:BPT) price-to-earnings (or "P/E") ratio of 9x might make it look like a strong buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 19x and even P/E's above 37x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Beach Energy has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Beach Energy

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Beach Energy's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. This means it has also seen a slide in earnings over the longer-term as EPS is down 20% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the analysts watching the company. That's shaping up to be materially higher than the 17% per annum growth forecast for the broader market.

In light of this, it's peculiar that Beach Energy's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Beach Energy's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Beach Energy with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Beach Energy. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beach Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BPT

Beach Energy

Operates as an oil and gas exploration and production company.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives