- Australia

- /

- Oil and Gas

- /

- ASX:BPT

Beach Energy (ASX:BPT) Is Up 9.5% After Strong Waitsia Gas Plant Progress and Higher Sales Volumes

Reviewed by Sasha Jovanovic

- Beach Energy Limited reported a strong start to fiscal 2026 with an 8% increase in total production, a 15% rise in sales volumes, and an 18% uplift in sales revenue following the commissioning progress at the Waitsia Gas Plant, despite Western Flank production being hampered by flooding and natural decline.

- The imminent start-up of the Waitsia Gas Plant is particularly significant, as it is set to transform Beach Energy's export capabilities by enabling access to higher international LNG prices and supporting future production growth.

- We'll look at how Waitsia Gas Plant's progress and increased sales volumes could reshape Beach Energy's growth and earnings outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Beach Energy Investment Narrative Recap

For investors interested in Beach Energy, the core belief is that ramping up the Waitsia Gas Plant will boost LNG export revenues and offset declining legacy production, supporting a return to profitability. The latest production results show overall growth despite Western Flank disruptions, and Waitsia remains the most important short-term catalyst; crucially, these setbacks have not materially derailed the expected timeline or earnings potential from Waitsia, though operational risks remain elevated.

The announcement on October 20, 2025, reported a strong first quarter for fiscal 2026, driven by higher demand and Waitsia commissioning progress, leading to improved sales volumes and revenue. This positive update directly reflects Waitsia’s role as a growth lever, which is front and center for those tracking Beach Energy’s turnaround and future earnings recovery.

Yet, with optimism about Waitsia's potential, investors should not overlook the ongoing risk from field declines and...

Read the full narrative on Beach Energy (it's free!)

Beach Energy's outlook anticipates A$2.0 billion in revenue and A$537.5 million in earnings by 2028. This is based on an assumed annual revenue decline of 1.6% and an earnings increase of A$581.3 million from the current A$-43.8 million.

Uncover how Beach Energy's forecasts yield a A$1.23 fair value, in line with its current price.

Exploring Other Perspectives

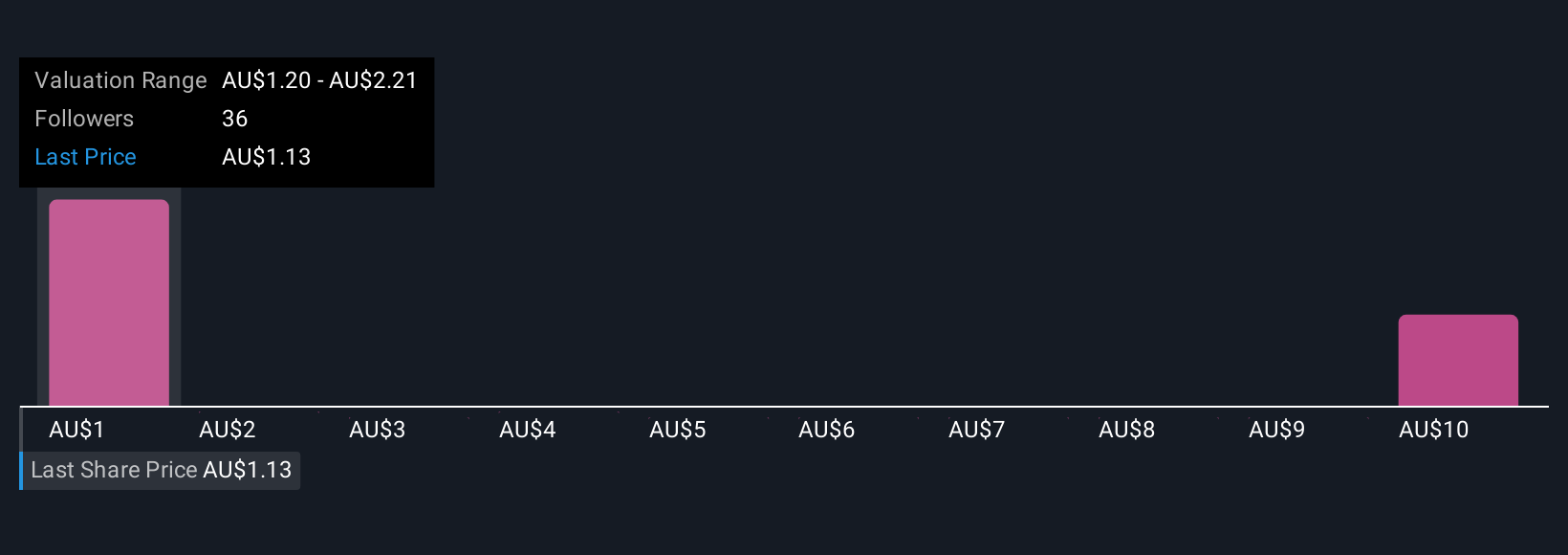

Simply Wall St Community members have published 8 fair value estimates for Beach Energy, ranging from A$1.20 to A$9.19 per share. While Waitsia's ramp-up is a key focus for many, these views reflect just how differently investors weigh long-term production risks and recovery prospects.

Explore 8 other fair value estimates on Beach Energy - why the stock might be worth just A$1.20!

Build Your Own Beach Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beach Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Beach Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beach Energy's overall financial health at a glance.

No Opportunity In Beach Energy?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beach Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BPT

Beach Energy

Operates as an oil and gas exploration and production company.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives