- Australia

- /

- Oil and Gas

- /

- ASX:BOE

Will Boss Energy's (ASX:BOE) Conference Spotlight Reveal a New Strategic Direction for Investors?

Reviewed by Sasha Jovanovic

- Boss Energy Limited has announced it will present at the Global Uranium Conference in Adelaide on October 21, 2025, with CEO Matthew Dusci scheduled to speak, and it plans to propose amendments to its constitution at the upcoming Annual General Meeting on November 20, 2025.

- This conference appearance provides Boss Energy with a significant platform to share operational insights and strategy updates directly with industry stakeholders.

- We'll examine how anticipation around Boss Energy's industry conference presentation could influence its investment narrative and future direction.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Boss Energy's Investment Narrative?

To be a Boss Energy shareholder today, an investor needs conviction in the company's long-term uranium demand story, along with confidence in management’s ability to navigate operational ramp-up and recent board changes. The upcoming Global Uranium Conference presentation may offer a timely platform for CEO Matt Dusci to establish credibility following his recent appointment and communicate the firm’s strategy to a broader audience amid uncertain recent performance. However, given current analysis and steep price declines in the last quarter, this news event isn’t expected to materially alter the most pressing short-term catalysts, such as progress at Honeymoon operations and achieving profitability in line with forecasts. The biggest risks remain a lack of sustained operating profitability, a largely inexperienced management team, and further volatility as the market awaits clearer financial results and the impact of proposed amendments to the company’s constitution. On the other hand, new management experience is still being put to the test.

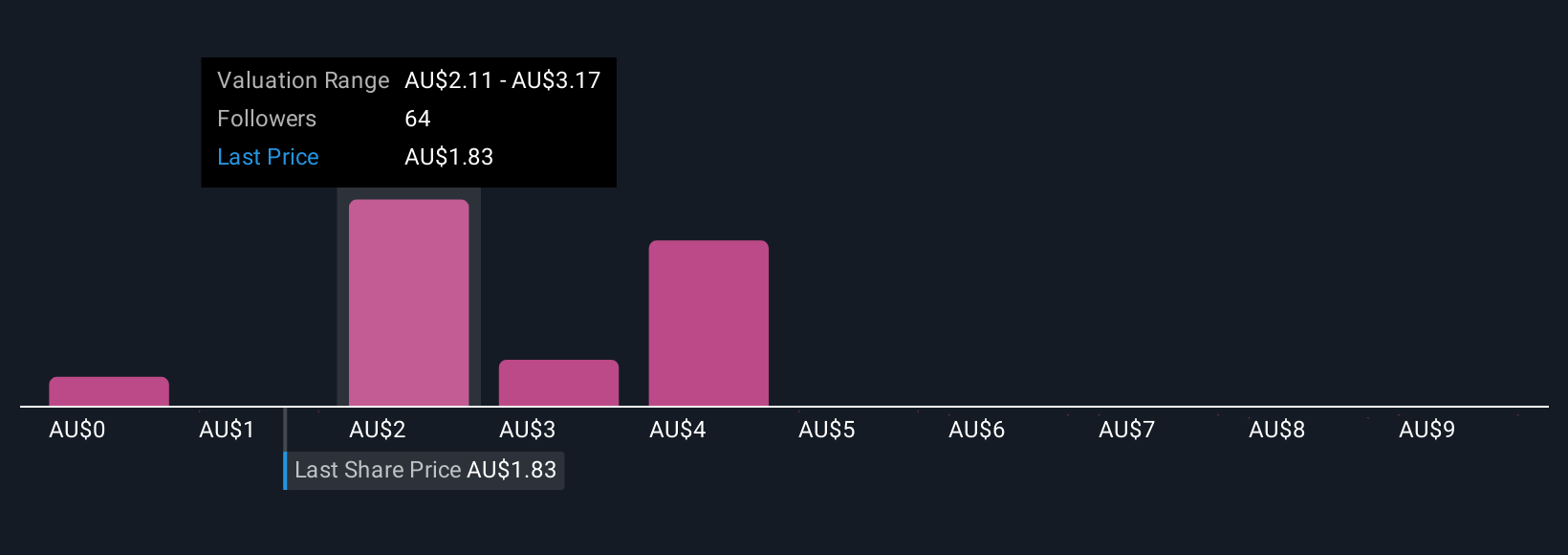

Despite retreating, Boss Energy's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 29 other fair value estimates on Boss Energy - why the stock might be worth 37% less than the current price!

Build Your Own Boss Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boss Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boss Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boss Energy's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives