- Australia

- /

- Oil and Gas

- /

- ASX:BOE

Boss Energy (ASX:BOE): Valuation Insights as Alta Mesa Project Reveals New Mineralisation and Expansion Progress

Reviewed by Kshitija Bhandaru

Boss Energy (ASX:BOE) is sparking conversation after its Alta Mesa uranium project revealed new mineralisation. Expansion efforts are moving toward permitting. Investors are also eyeing the company ahead of its upcoming quarterly results announcement.

See our latest analysis for Boss Energy.

Boss Energy’s share price has been under pressure, with a 1-year total shareholder return of -48.5% and a sharp 51.6% fall over the past 90 days. Despite positive news about the Alta Mesa project and changes in major shareholders, momentum has faded, even as the company positions itself for future growth in uranium supply.

If this mix of uncertainty and opportunity has you curious, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets and growth prospects starting to take shape, the key question for investors is whether Boss Energy is now undervalued or if the market already reflects future gains.

Most Popular Narrative: 53.8% Undervalued

Boss Energy’s narrative fair value sits at A$3.95, nearly double its last close at A$1.83. This large gap highlights what some investors see as a breakout opportunity if the company can deliver on its long-term uranium vision.

Boss Energy’s flagship asset is the Honeymoon Project, located in remote South Australia. The project is now fully commissioned, with first uranium production achieved in 2024 and ramp-up to full capacity underway. It has a current mine life estimate of over 10 years, based on only a portion of its JORC-compliant resource of 71.6 million pounds of U₃O₈, suggesting strong potential for mine life extension and production scale-up.

Curious what bold financial assumptions underpin such a steep upside? The valuation story here hinges on breakout growth, cash strength, and the company’s aggressive scale-up of production. Find out which spark is driving this high-conviction target. If you want to see what might surprise the market next, read on.

Result: Fair Value of $3.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant regulatory changes or further volatility in uranium prices could quickly undermine the current bullish outlook for Boss Energy’s future.

Find out about the key risks to this Boss Energy narrative.

Another View: Multiples Paint a Cautious Picture

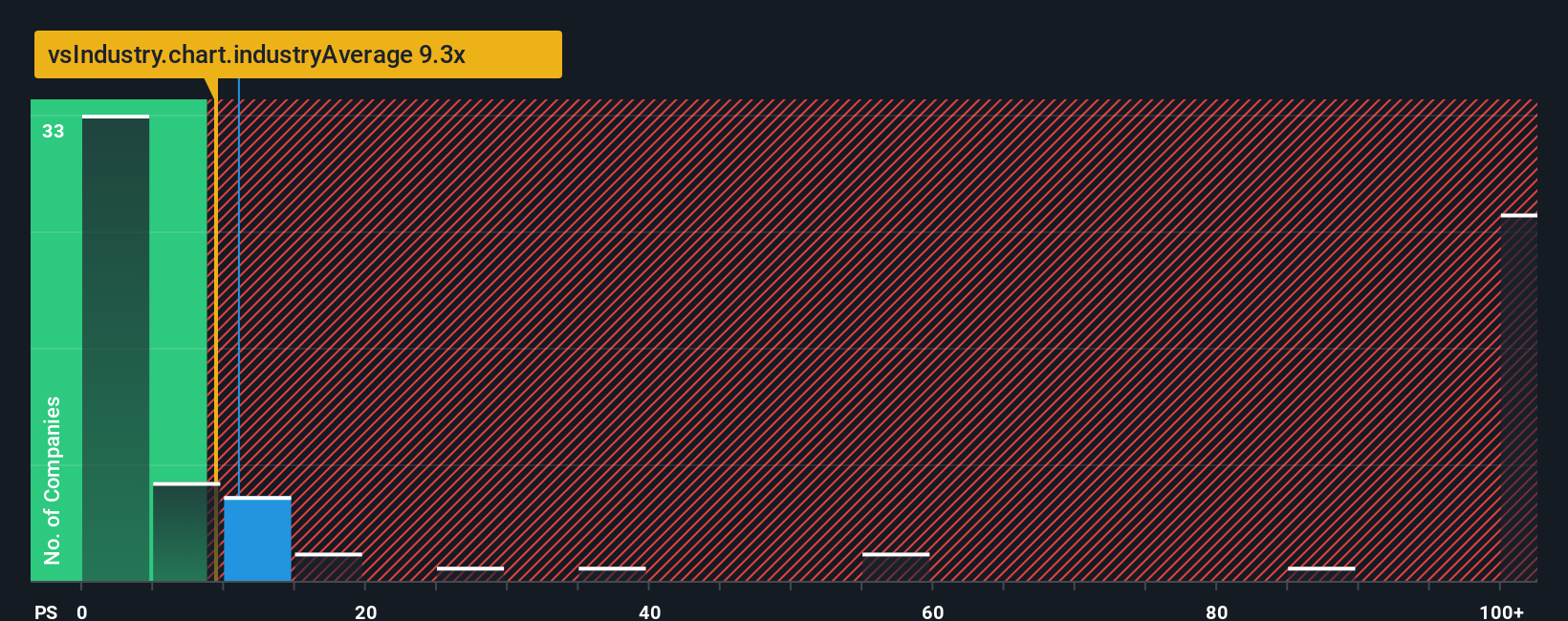

While the fair value narrative suggests Boss Energy is deeply undervalued, not all models agree. Looking at the price-to-sales ratio, the company trades at 10x, which is well above the industry average of 9.2x, the peer average of 9.4x, and even further from the fair ratio of just 0.8x. This significant premium suggests investors are already pricing in a lot of future growth, adding real risk if those expectations do not play out. With such a wide gap, is the optimism justified or are markets getting ahead of themselves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boss Energy Narrative

If you want to dig deeper or chart your own path using the latest data, you can build a personalized view of Boss Energy’s story in just a few minutes. Do it your way

A great starting point for your Boss Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Ready to upgrade your portfolio strategy? You’re only a click away from tapping into stocks with huge upside, steady income, or disruptive potential right now.

- Boost your potential for big returns by targeting these 3597 penny stocks with strong financials that are rapidly gaining traction and shaking up their industries.

- Maximize passive income and stability. Start with these 18 dividend stocks with yields > 3% offering market-beating yields above 3% for reliable long-term growth.

- Stay ahead of the curve by following these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs and market-defining innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives