- Australia

- /

- Oil and Gas

- /

- ASX:BOE

Boss Energy (ASX:BOE) Valuation in Focus After CEO Transition and Honeymoon Project Review

Reviewed by Kshitija Bhandaru

Boss Energy (ASX:BOE) is in the spotlight after appointing Matthew Dusci as its new CEO and launching a detailed operational review of the Honeymoon project. Investors are watching closely for updates on production guidance and resource assessments.

See our latest analysis for Boss Energy.

Boss Energy’s recent CEO transition and resource review come at a time when investor sentiment is cautious. The share price has softened over the past several months, reflecting uncertainty around new production targets and operational costs. Despite these headwinds, longer-term total shareholder returns are still positive, which hints at underlying growth potential if the Honeymoon project can deliver improved results.

If you’re keen to see what other companies exhibit strong insider signals and momentum, now’s the time to discover fast growing stocks with high insider ownership

With shares down over the past year, but management promising changes and the stock trading below analyst targets, is this a rare chance to buy undervalued potential, or has the market already priced in future growth?

Most Popular Narrative: 49.4% Undervalued

Boss Energy’s most widely followed narrative puts its fair value nearly double the current share price, setting up a deep value case as the market lags expectations. A global pivot towards non-fossil power and recent ramp-up in the Honeymoon project are key ingredients driving this viewpoint.

"Boss Energy’s flagship asset is the Honeymoon Project, located in remote South Australia. The project is now fully commissioned, with first uranium production achieved in 2024 and ramp-up to full capacity underway. It has a current mine life estimate of over 10 years, based on only a portion of its JORC-compliant resource of 71.6 million pounds of U₃O₈, suggesting strong potential for mine life extension and production scale-up."

How did one resource asset ignite this bullish thesis? The secret sauce blends long-haul production plans, global decarbonisation trends, and a balance sheet few rivals can claim. What numbers are being projected to support it? Only by reading the narrative will you uncover the growth expectations and future profitability woven into this standout fair value estimate.

Result: Fair Value of $3.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sudden shifts in government policy or persistent price volatility could quickly dampen investor optimism about Boss Energy’s long-term value story.

Find out about the key risks to this Boss Energy narrative.

Another View: Valuation Based on Sales Ratio

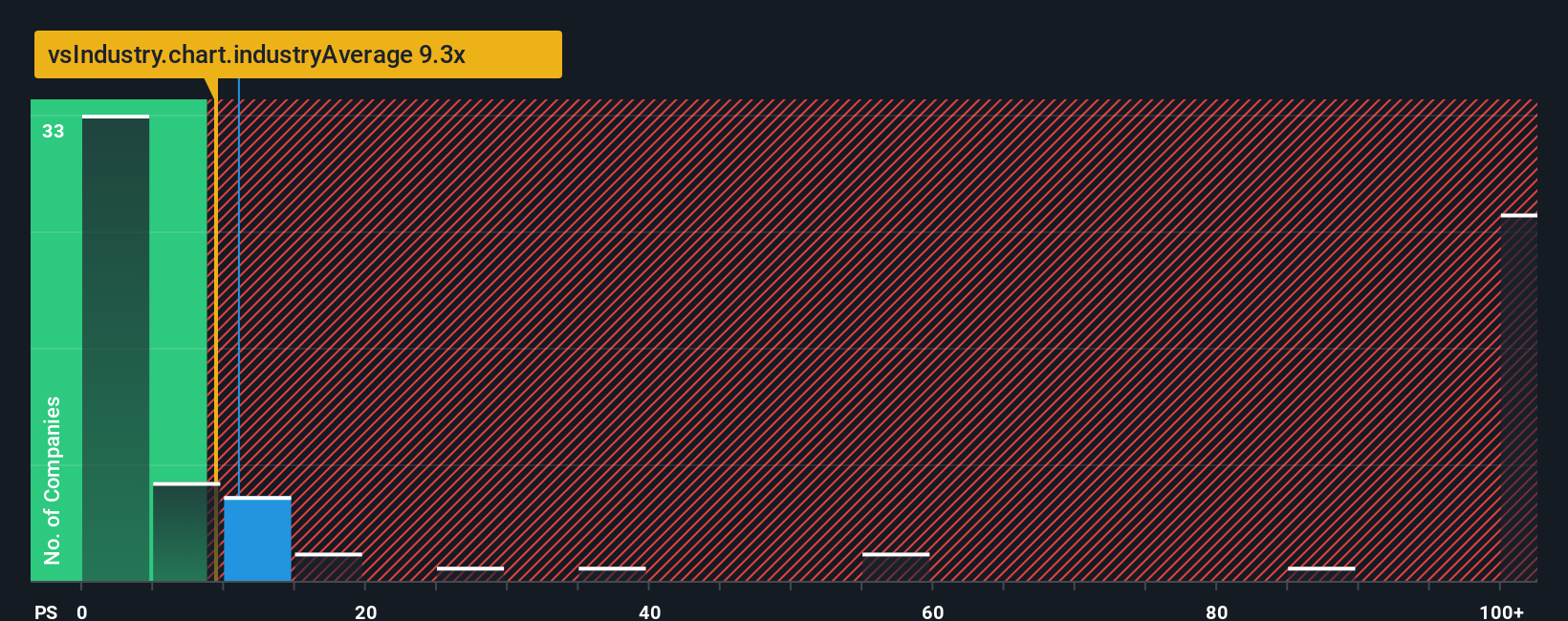

While the fair value story paints Boss Energy as deeply undervalued, a look at the price-to-sales ratio signals caution. Shares trade at 11 times sales, which is above both the industry average of 9.3 and a much lower fair ratio of 0.8. This significant difference suggests the market may be running ahead of fundamentals. Could this mean valuation risks are higher than they appear?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boss Energy Narrative

If you think there is more to the story, or want to dig into the numbers and craft your own angle, you can create a narrative yourself in just a few minutes. Do it your way

A great starting point for your Boss Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd by seizing unique opportunities. Simply Wall St’s screener highlights what busy investors might otherwise overlook. If you’re looking to spot the next big winner, don’t pass up these hand-picked trends:

- Power up your portfolio with future-ready companies leading breakthroughs in healthcare by checking out these 31 healthcare AI stocks advancing cutting-edge medical AI.

- Capture reliable returns from leading businesses by exploring these 19 dividend stocks with yields > 3% that offer attractive yields above 3% and robust financial foundations.

- Uncover the innovators shaping decentralised finance and blockchain solutions by tapping into these 78 cryptocurrency and blockchain stocks pushing the boundaries of digital markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives