- Australia

- /

- Oil and Gas

- /

- ASX:BOE

3 ASX Penny Stocks With Market Caps Over A$50M To Consider

Reviewed by Simply Wall St

The Australian stock market is currently experiencing a surge, driven by the global enthusiasm for artificial intelligence investments, with the ASX 200 reflecting this positive momentum. While the term 'penny stock' might seem outdated, these smaller or newer companies continue to present intriguing opportunities for investors seeking potential growth. This article will explore three penny stocks that combine robust financial health with promising prospects, offering a chance to uncover value beyond the major players.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.465 | A$133.26M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.19 | A$103.31M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.805 | A$50.13M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.70 | A$417.04M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.41 | A$251.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.042 | A$49.13M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.076 | A$39.35M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.75 | A$358.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.32 | A$1.42B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 425 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Boss Energy (ASX:BOE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boss Energy Limited explores for and produces uranium deposits in Australia and the United States, with a market cap of A$846.44 million.

Operations: Boss Energy Limited currently does not report any specific revenue segments.

Market Cap: A$846.44M

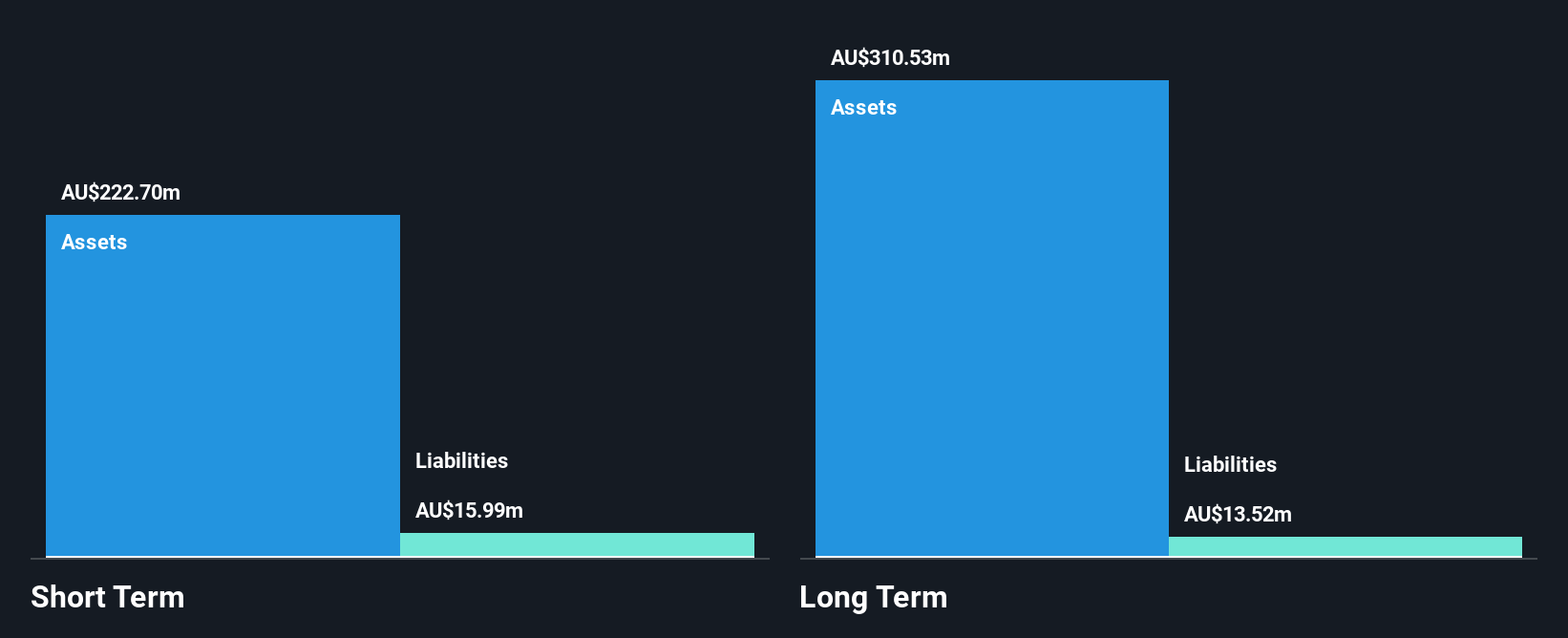

Boss Energy Limited, with a market cap of A$846.44 million, is transitioning under new leadership as Matt Dusci takes over from Duncan Craib as CEO. The company recently reported sales of A$75.6 million for the fiscal year ending June 30, 2025, but incurred a net loss of A$34.17 million compared to the previous year's profit. Despite its unprofitability and high share price volatility, Boss Energy's short-term assets comfortably cover both its short and long-term liabilities while maintaining a debt-free status. The company's earnings are forecasted to grow significantly at 37.33% per year according to analyst estimates.

- Take a closer look at Boss Energy's potential here in our financial health report.

- Review our growth performance report to gain insights into Boss Energy's future.

Peel Mining (ASX:PEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Peel Mining Limited is an Australian company focused on exploring economic mineral deposits, with a market cap of A$53.46 million.

Operations: Peel Mining Limited does not report any revenue segments.

Market Cap: A$53.46M

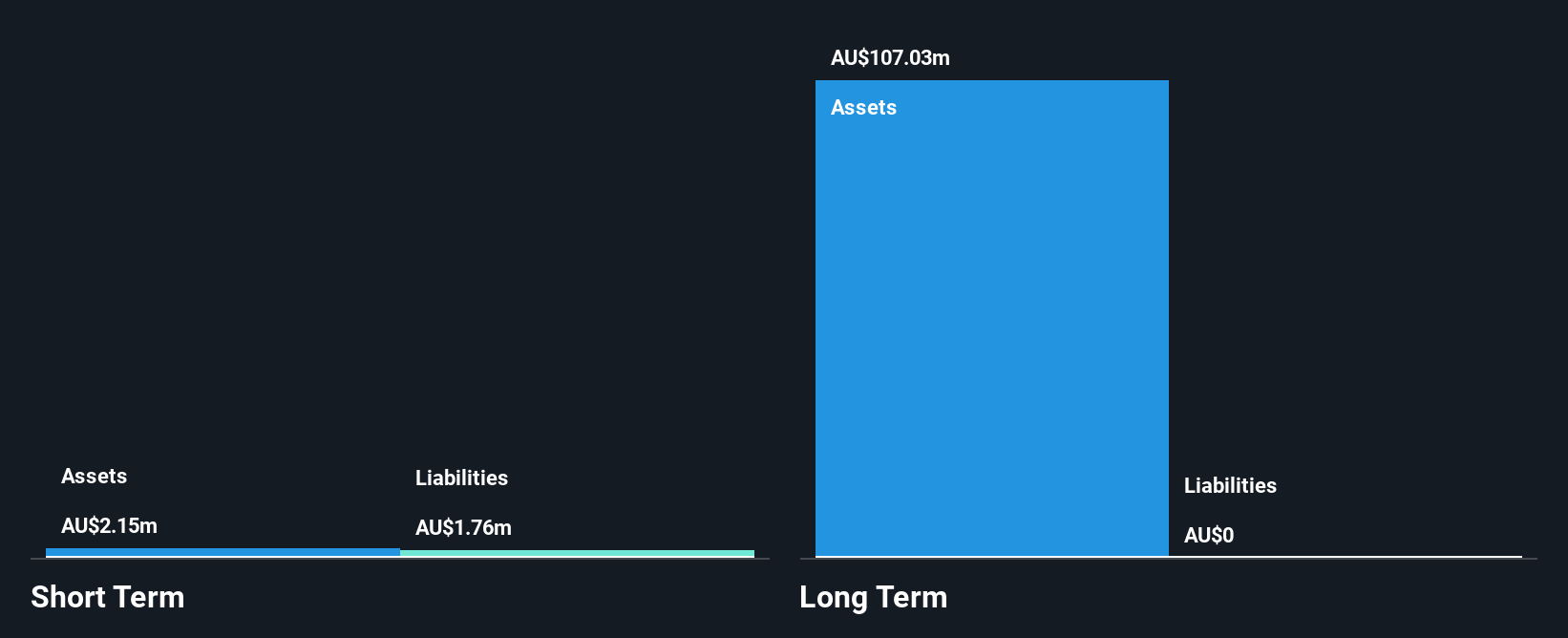

Peel Mining Limited, with a market cap of A$53.46 million, remains pre-revenue despite reporting modest sales growth to A$0.67 million for the year ending June 30, 2025. The company is debt-free and its short-term assets slightly exceed liabilities, although it faces less than a year of cash runway. Peel's board is experienced with an average tenure of over 15 years; however, recent executive changes include the departure of CEO Jim Simpson in August 2025. Despite stable weekly volatility at 11%, the company continues to incur losses, reporting a net loss of A$2.1 million for the fiscal year.

- Jump into the full analysis health report here for a deeper understanding of Peel Mining.

- Gain insights into Peel Mining's past trends and performance with our report on the company's historical track record.

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market capitalization of A$2.45 billion.

Operations: Perenti's revenue is primarily derived from Contract Mining Services at A$2.52 billion, followed by Drilling Services at A$778.13 million, and Mining and Technology Services contributing A$225.71 million.

Market Cap: A$2.45B

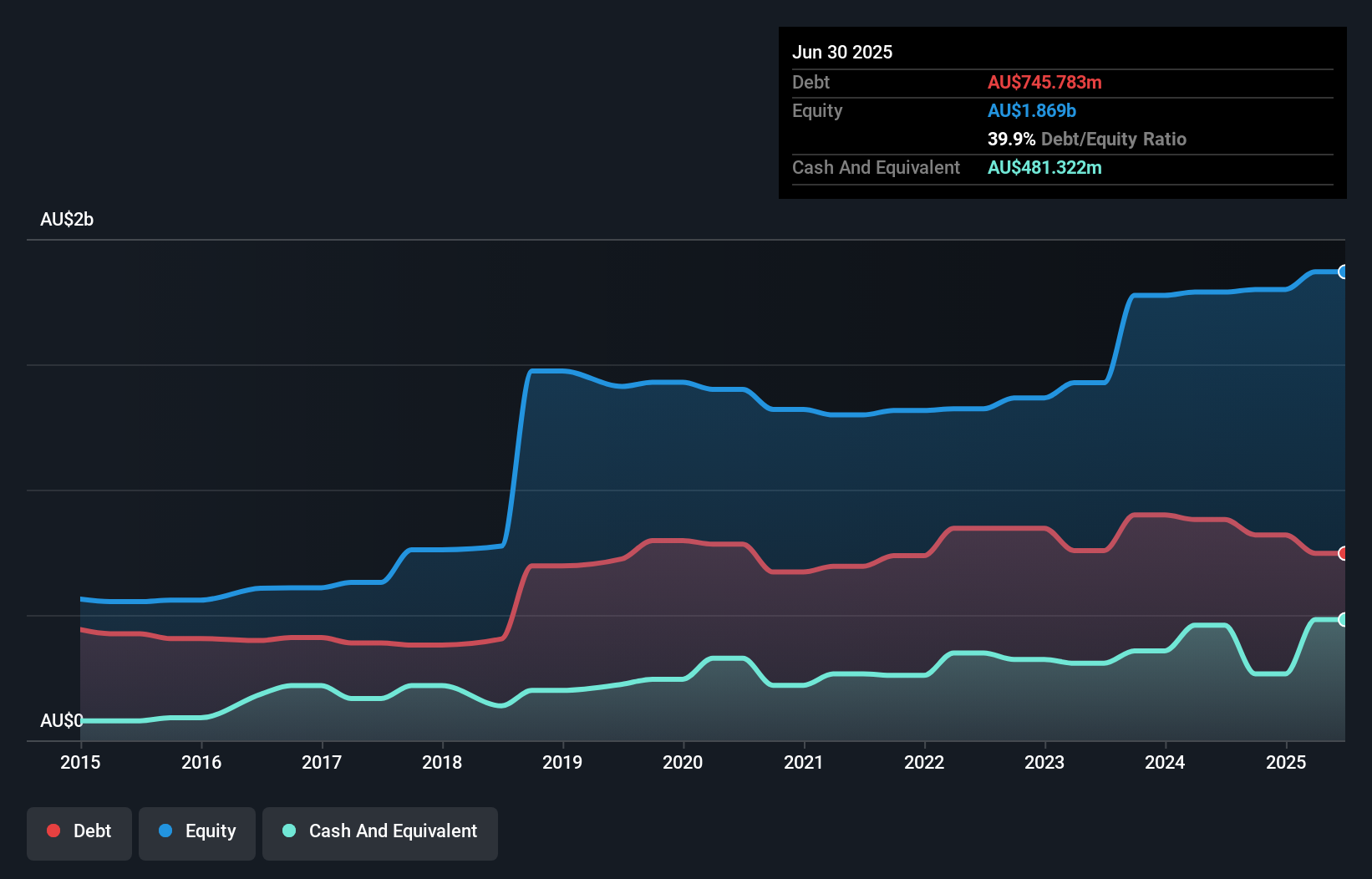

Perenti Limited, with a market cap of A$2.45 billion, has recently been added to the S&P/ASX 200 Index and announced a share buyback program representing 9.09% of its issued capital. The company's revenue reached A$3.49 billion for the fiscal year ending June 30, 2025, with net income at A$120.62 million despite a large one-off gain impacting results. Perenti's debt management is strong with a net debt to equity ratio of 14.1%, and its short-term assets cover both short- and long-term liabilities effectively. Earnings are forecasted to grow annually by over 17%.

- Navigate through the intricacies of Perenti with our comprehensive balance sheet health report here.

- Evaluate Perenti's prospects by accessing our earnings growth report.

Seize The Opportunity

- Jump into our full catalog of 425 ASX Penny Stocks here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives