- Australia

- /

- Capital Markets

- /

- ASX:AFI

Unveiling 3 ASX Dividend Stocks With Yields Up To 9.9%

Reviewed by Simply Wall St

The Australian stock market has shown resilience with a 7.0% increase over the past year, despite a flat performance in the last week, and earnings are expected to grow by 13% annually. In this context, dividend stocks can be particularly appealing as they offer potential for steady income streams and can serve as a buffer in varied market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 6.59% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.12% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.99% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.05% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.90% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.73% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.09% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.68% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.24% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.08% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

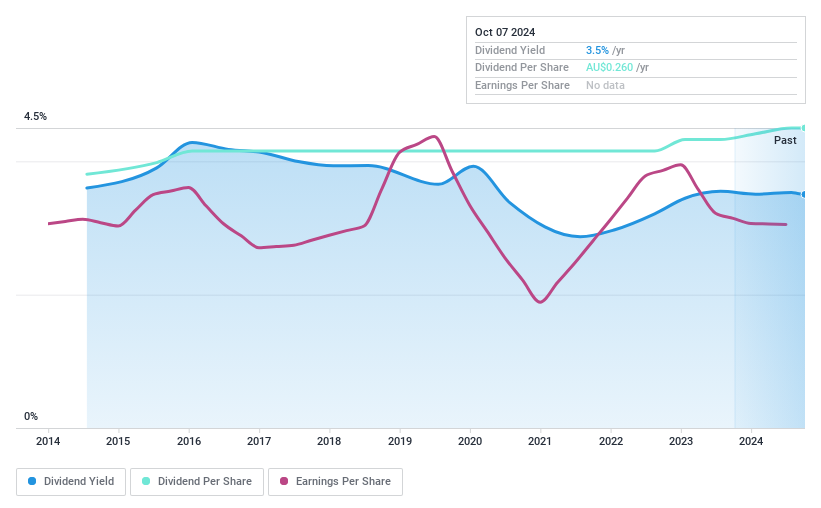

Australian Foundation Investment (ASX:AFI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian Foundation Investment Company Limited, a publicly owned investment manager, operates with a market capitalization of approximately A$9.26 billion.

Operations: Australian Foundation Investment Company Limited does not have detailed revenue segments provided in the text.

Dividend Yield: 3.4%

Australian Foundation Investment (AFI) offers a dividend yield of 3.45%, which is lower than the top Australian dividend payers. Despite a stable history over the past decade, AFI's dividends are not well covered by free cash flow or earnings, with payout ratios of 110.3% and 77.7% respectively, indicating potential sustainability issues. Recent financials show a decline in revenue and net income from A$350.01 million and A$309.76 million to A$339.26 million and A$296.17 million respectively, year-over-year.

- Get an in-depth perspective on Australian Foundation Investment's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Australian Foundation Investment's current price could be inflated.

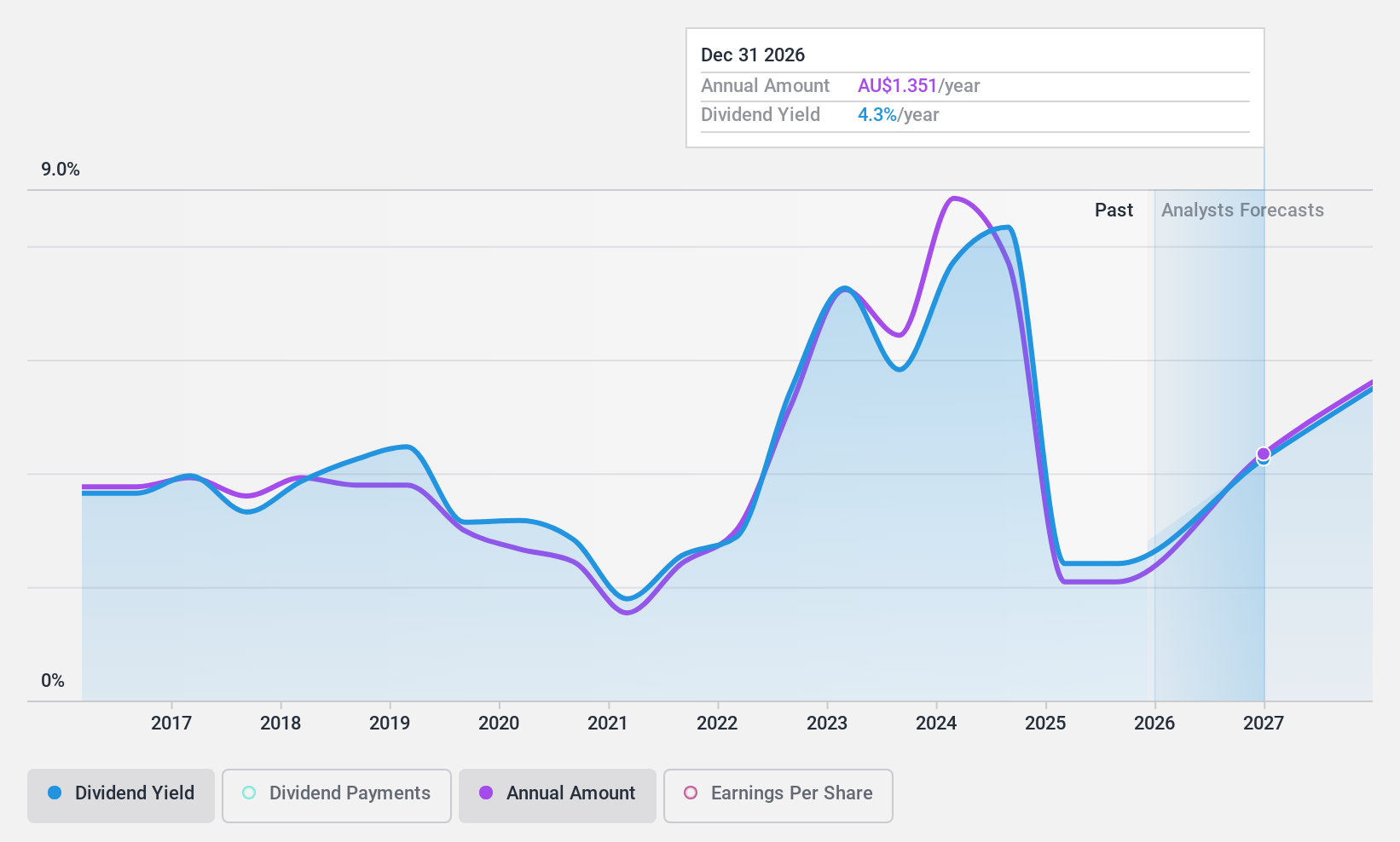

Ampol (ASX:ALD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited, operating in Australia, New Zealand, Singapore, and the United States, engages in the purchasing, refining, distribution, and marketing of petroleum products with a market capitalization of A$7.94 billion.

Operations: Ampol Limited generates revenue through its Z Energy segment at A$5.51 billion, Convenience Retail at A$5.99 billion, and Fuels and Infrastructure at A$33.63 billion.

Dividend Yield: 8.3%

Ampol Limited, despite a dividend yield of 8.26%, faces challenges with sustainability and reliability in its dividend distributions. The company's dividends are not well covered by earnings, with a high payout ratio of 93.3%, and have shown volatility over the past decade. Additionally, Ampol trades at 24.3% below estimated fair value and carries a high level of debt, which could impact future financial stability and dividend payments. Recent board changes also add an element of uncertainty to the governance landscape.

- Click to explore a detailed breakdown of our findings in Ampol's dividend report.

- In light of our recent valuation report, it seems possible that Ampol is trading beyond its estimated value.

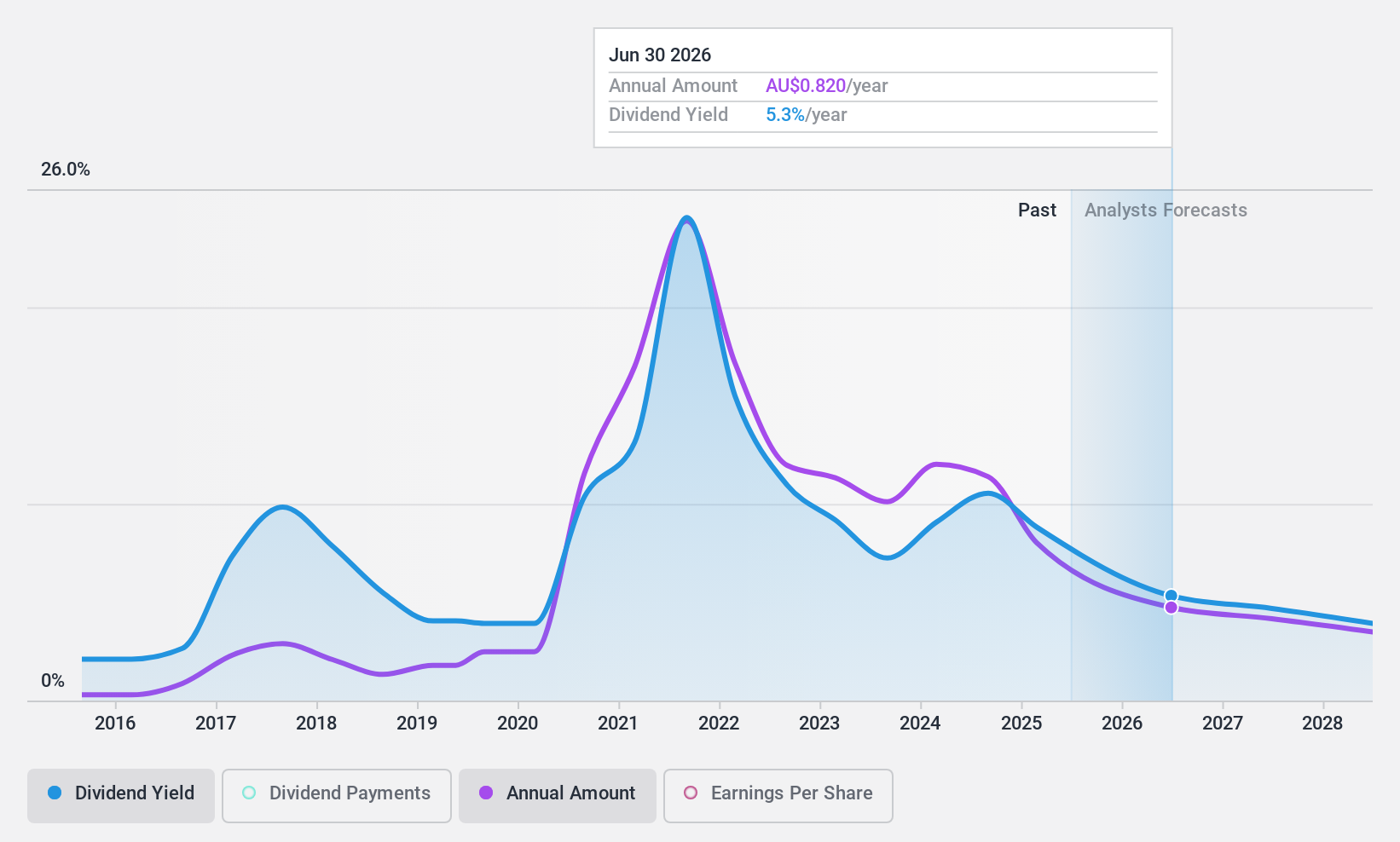

Fortescue (ASX:FMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd is a global iron ore company based in Australia, focusing on the exploration, development, production, and processing of iron ore, with a market capitalization of approximately A$62.60 billion.

Operations: Fortescue Ltd generates revenue primarily from its metals segment, which brought in A$18.47 billion, and a smaller contribution from the energy sector at A$79 million.

Dividend Yield: 10%

Fortescue's dividend history shows growth over the last decade, but with volatile payments. Currently trading 21.2% below its fair value, it offers a yield of 9.99%, placing it in the top quartile of Australian dividend stocks. However, forecasts suggest a potential earnings decline averaging 22.9% annually over the next three years. Dividends are supported by both earnings and cash flows with payout ratios at 74.2% and 73.1%, respectively, though this could be challenged by future earnings decreases.

- Take a closer look at Fortescue's potential here in our dividend report.

- Our valuation report unveils the possibility Fortescue's shares may be trading at a discount.

Taking Advantage

- Explore the 31 names from our Top ASX Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Australian Foundation Investment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AFI

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives