- Australia

- /

- Metals and Mining

- /

- ASX:GRR

Top ASX Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, yet it has shown a robust performance with a 20% increase over the past year and earnings forecasted to grow by 12% annually. In this context of steady growth, identifying dividend stocks that offer reliable income and potential for capital appreciation can be an attractive strategy for investors seeking stability and returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 6.67% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.59% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.86% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.33% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.57% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.25% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.45% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.53% | ★★★★★☆ |

| Santos (ASX:STO) | 6.70% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 7.27% | ★★★★☆☆ |

Click here to see the full list of 36 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

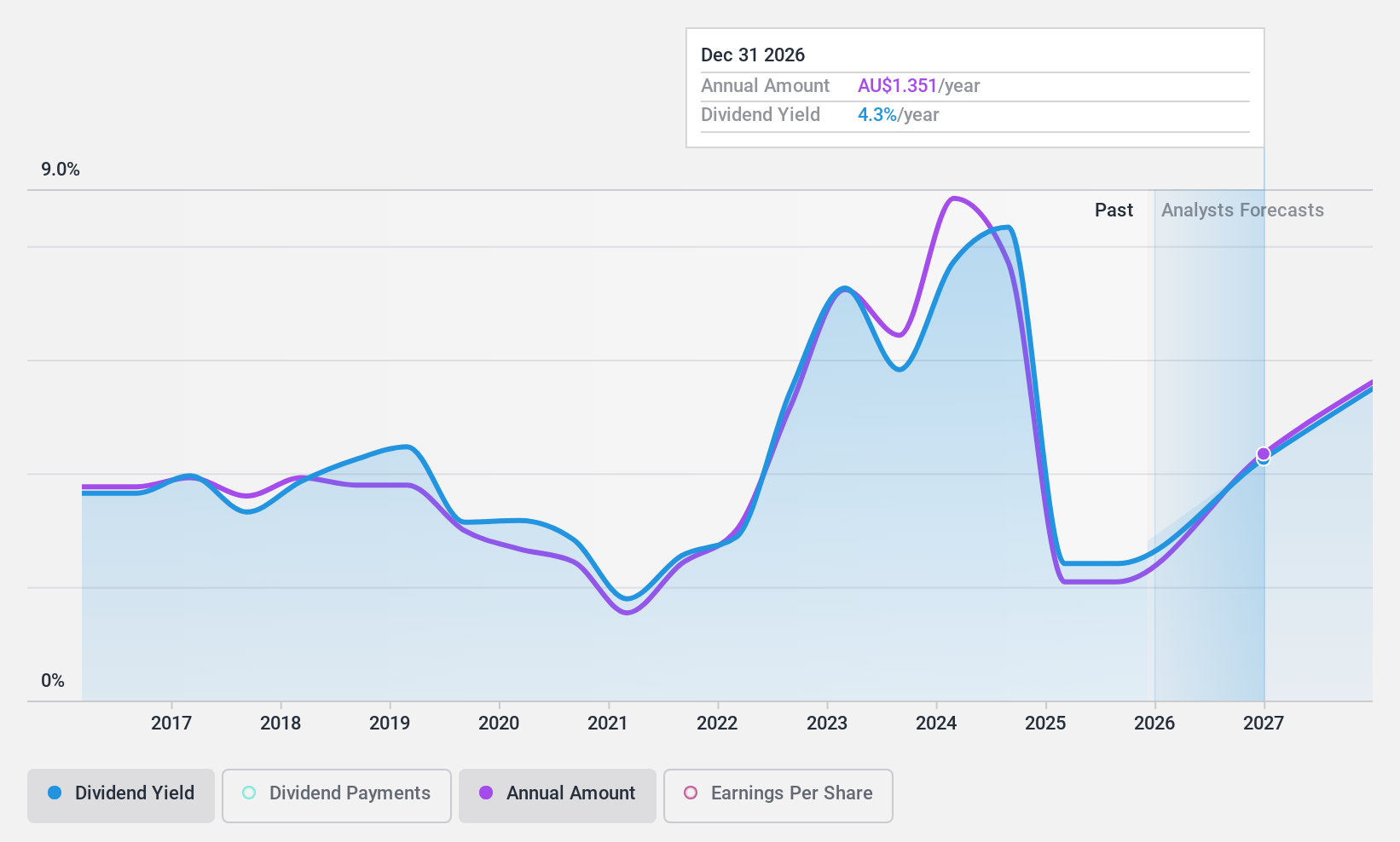

Ampol (ASX:ALD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited is involved in the purchasing, refining, distributing, and marketing of petroleum products across Australia, New Zealand, Singapore, and the United States with a market cap of A$6.76 billion.

Operations: Ampol Limited's revenue is derived from its segments in New Zealand (A$5.49 billion), Convenience Retail (A$5.97 billion), and Fuels and Infrastructure (A$34.46 billion).

Dividend Yield: 8.5%

Ampol's dividend landscape presents a mixed scenario. Despite a recent interim dividend of A$0.60 per share, covered by a 61% payout ratio from earnings, its dividends have historically been volatile and not well-covered by free cash flows, with a high cash payout ratio of 115.2%. Earnings surged significantly to A$235.2 million in H1 2024, up from A$79.1 million the previous year, potentially supporting future payouts if sustained.

- Click here and access our complete dividend analysis report to understand the dynamics of Ampol.

- Our comprehensive valuation report raises the possibility that Ampol is priced lower than what may be justified by its financials.

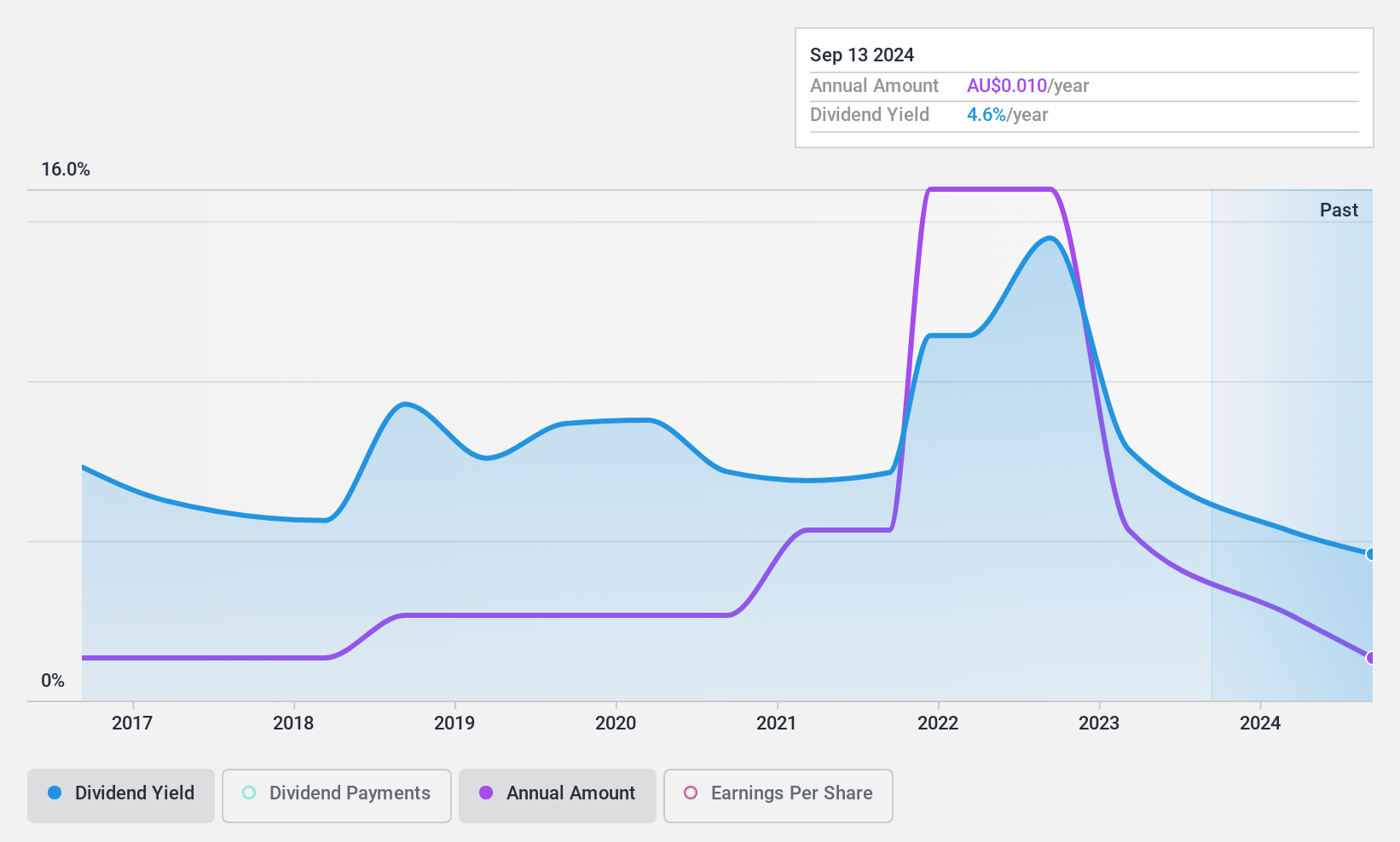

Grange Resources (ASX:GRR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grange Resources Limited operates an integrated iron ore mining and pellet production business in Australia and internationally, with a market cap of A$318.27 million.

Operations: Grange Resources Limited generates revenue primarily from its ore mining segment, amounting to A$570.41 million.

Dividend Yield: 7.3%

Grange Resources offers a compelling dividend yield of 7.27%, ranking in the top 25% among Australian dividend payers, with payments well-covered by earnings and cash flows, boasting low payout ratios of 21.8% and 11.6%, respectively. However, its dividends have been unstable over the past decade without growth or consistency. Recent financials show a decline in sales to A$234.05 million and net income to A$26.53 million for H1 2024, alongside board changes potentially influencing future strategies.

- Dive into the specifics of Grange Resources here with our thorough dividend report.

- Our expertly prepared valuation report Grange Resources implies its share price may be lower than expected.

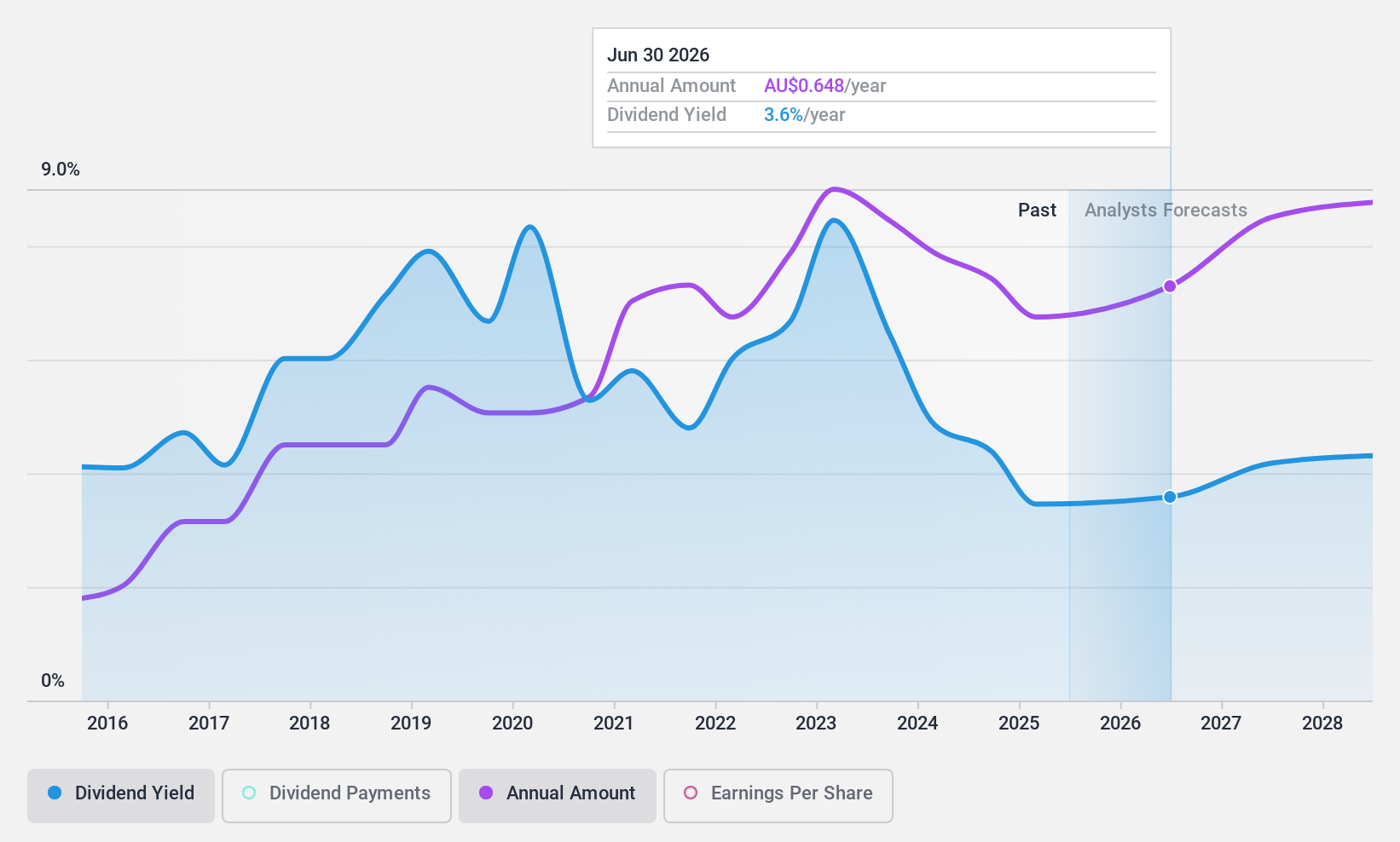

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited, with a market cap of A$1.23 billion, is involved in the sourcing and retailing of household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: Nick Scali Limited generates revenue primarily from the retailing of furniture, amounting to A$468.19 million.

Dividend Yield: 4.6%

Nick Scali's dividend payments have been reliable and stable over the past decade, with a current yield of 4.59%. While this is below the top tier in Australia, dividends are well-covered by earnings and cash flows, with payout ratios of 68.9% and 55%, respectively. Despite recent declines in sales to A$468.19 million and net income to A$80.61 million for FY2024, the company maintains a good value relative to peers without significant volatility in dividend growth.

- Unlock comprehensive insights into our analysis of Nick Scali stock in this dividend report.

- Our valuation report unveils the possibility Nick Scali's shares may be trading at a discount.

Seize The Opportunity

- Embark on your investment journey to our 36 Top ASX Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GRR

Grange Resources

Owns and operates integrated iron ore mining and pellet production business in Australia and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives