- Australia

- /

- Oil and Gas

- /

- ASX:AEE

ASX Penny Stocks Spotlight Aura Energy Among 3 Key Picks

Reviewed by Simply Wall St

The Australian market has been navigating a complex landscape, with the recent rise in inflation to 3.2% sparking concerns and influencing investor sentiment, particularly as it falls outside the Reserve Bank of Australia's target range. Despite these broader economic challenges, there remains interest in niche investment areas like penny stocks, which continue to offer intriguing opportunities for those willing to explore smaller or newer companies. These stocks may carry a vintage label but can still present potential value when underpinned by strong financial fundamentals; we will spotlight three such examples that stand out for their resilience and growth potential amidst current market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Dusk Group (ASX:DSK) | A$0.915 | A$56.98M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.77 | A$425.72M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.76 | A$277.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.048 | A$56.15M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.535 | A$63.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.27 | A$1.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.97 | A$274.23M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$646.81M | ✅ 5 ⚠️ 1 View Analysis > |

| Clover (ASX:CLV) | A$0.675 | A$112.72M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 418 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Aura Energy (ASX:AEE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aura Energy Limited, along with its subsidiaries, focuses on exploring and evaluating mineral properties in Mauritania and Sweden, with a market capitalization of A$202.12 million.

Operations: Aura Energy does not report any specific revenue segments.

Market Cap: A$202.12M

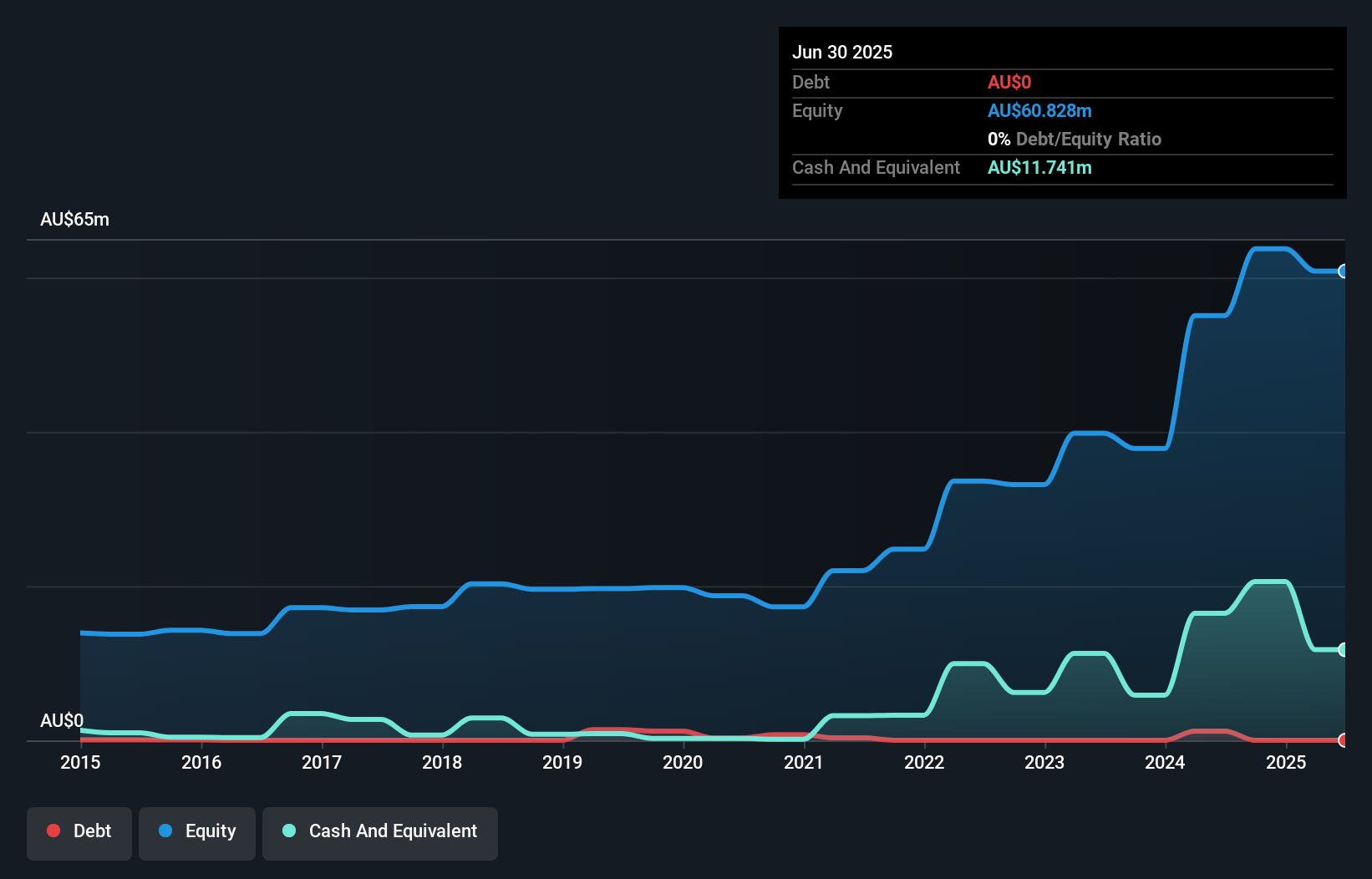

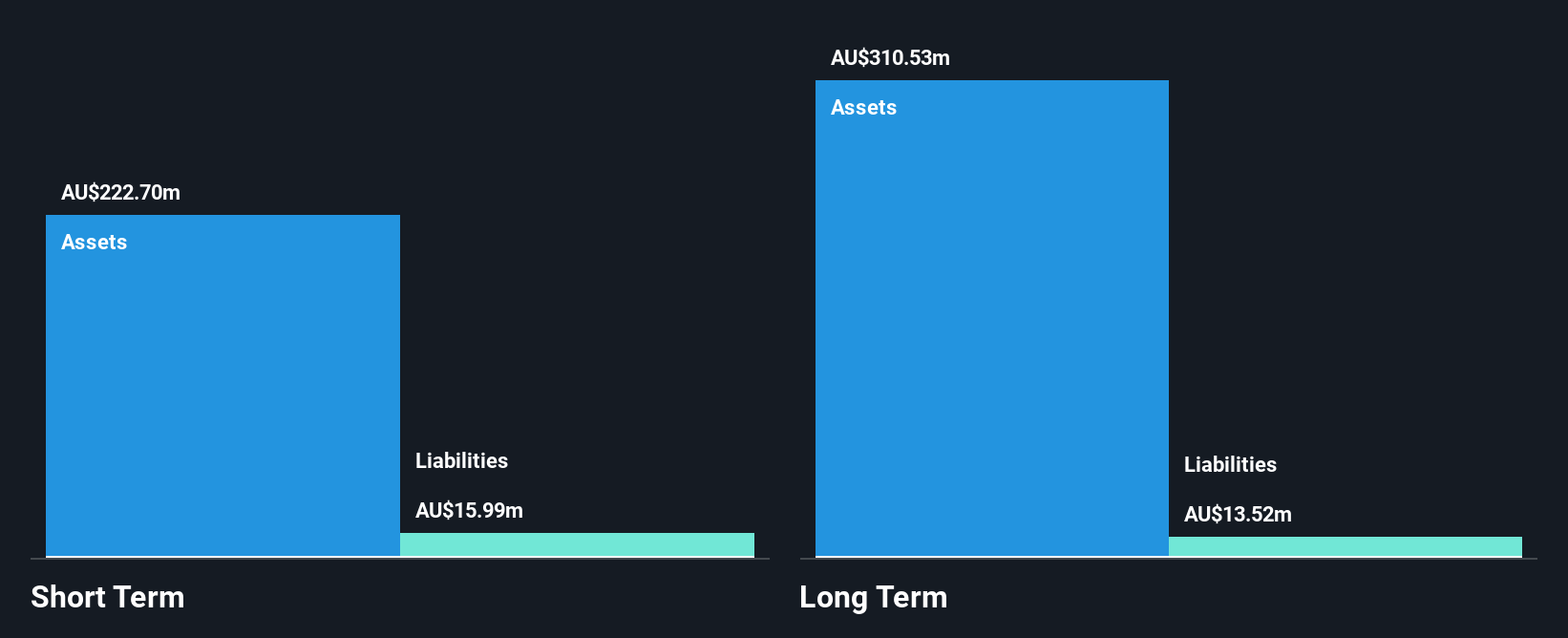

Aura Energy, with a market cap of A$202.12 million, is pre-revenue and faces financial challenges, including a net loss of A$15.15 million for the year ending June 2025 and auditor concerns about its ability to continue as a going concern. Despite these hurdles, the company has secured significant agreements for future uranium sales from its Tiris Project in Mauritania, contingent on project financing by December 2025. Recent executive changes include Andrew Grove's resignation as CEO and Michelle Ash's appointment to the board, enhancing strategic capabilities at this critical development stage. Aura remains debt-free but has limited cash runway.

- Dive into the specifics of Aura Energy here with our thorough balance sheet health report.

- Gain insights into Aura Energy's outlook and expected performance with our report on the company's earnings estimates.

Boss Energy (ASX:BOE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boss Energy Limited engages in the exploration and production of uranium deposits in Australia and the United States, with a market capitalization of A$790.43 million.

Operations: Boss Energy Limited does not report specific revenue segments.

Market Cap: A$790.43M

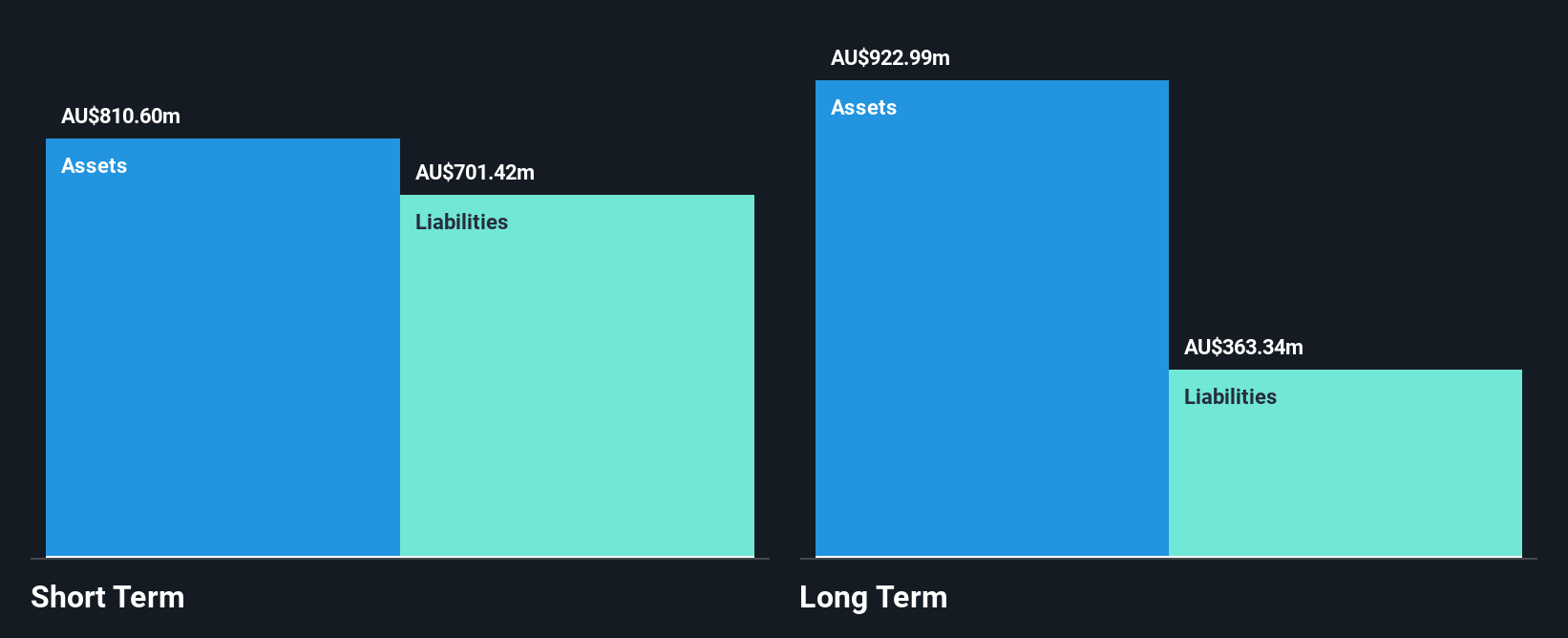

Boss Energy, with a market cap of A$790.43 million, is not pre-revenue and reported sales of A$75.6 million for the year ending June 2025, though it remains unprofitable with a net loss of A$34.17 million. The company benefits from strong short-term asset coverage over liabilities and operates debt-free, reducing financial risk. However, its management and board are relatively inexperienced with average tenures under two years. Recent developments include upcoming Q1 2026 earnings results and proposed amendments to its constitution at the AGM in November 2025, potentially impacting governance structures going forward.

- Take a closer look at Boss Energy's potential here in our financial health report.

- Assess Boss Energy's future earnings estimates with our detailed growth reports.

Macmahon Holdings (ASX:MAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining services, as well as mining support and civil infrastructure solutions to companies in Australia and Southeast Asia, with a market cap of A$1.03 billion.

Operations: The company's revenue is primarily derived from its Mining segment, which accounts for A$1.97 billion, followed by the Civil segment contributing A$436.97 million.

Market Cap: A$1.03B

Macmahon Holdings, with a market cap of A$1.03 billion, has demonstrated robust financial performance, reporting sales of A$2.43 billion and net income of A$73.94 million for the year ending June 2025. The company's short-term and long-term liabilities are well-covered by its assets, indicating solid financial health. Earnings have grown significantly by 38.9% over the past year, surpassing industry averages, although its return on equity remains low at 10.7%. Recent board changes include the appointment of Ms Suzan Pervan as an Independent Non-Executive Director, which may bring fresh perspectives to governance amid stable weekly volatility in stock performance.

- Navigate through the intricacies of Macmahon Holdings with our comprehensive balance sheet health report here.

- Understand Macmahon Holdings' earnings outlook by examining our growth report.

Seize The Opportunity

- Jump into our full catalog of 418 ASX Penny Stocks here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AEE

Aura Energy

Explores and evaluates mineral properties in Mauritania and Sweden.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives