- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

Zip Co's Wonderful 367% Share Price Increase Shows How Capitalism Can Build Wealth

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

For us, stock picking is in large part the hunt for the truly magnificent stocks. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One bright shining star stock has been Zip Co Limited (ASX:Z1P), which is 367% higher than three years ago. On top of that, the share price is up 44% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

Check out our latest analysis for Zip Co

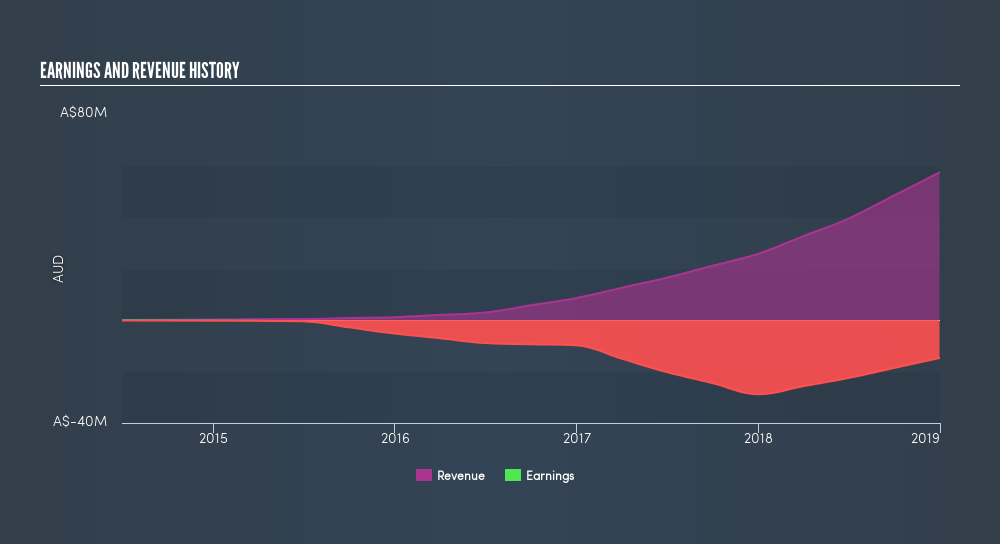

Zip Co isn't yet profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't yet make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Zip Co saw its revenue grow at 88% per year. That's well above most other pre-profit companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 67% per year, over the same period. It's always tempting to take profits after a share price gain like that, but high-growth companies like Zip Co can sometimes sustain strong growth for many years. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this freereport showing consensus forecasts

A Different Perspective

Pleasingly, Zip Co's total shareholder return last year was 43%. The TSR has been even better over three years, coming in at 67% per year. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Zip Co may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance and payments solutions to consumers, and small and medium sized merchants (SMEs) in Australia, New Zealand, Canada, and the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives