- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

The Zip Co (ASX:Z1P) Share Price Has Soared 357%, Delighting Many Shareholders

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. But when you hold the right stock for the right time period, the rewards can be truly huge. One bright shining star stock has been Zip Co Limited (ASX:Z1P), which is 357% higher than three years ago. It's also good to see the share price up 15% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

Check out our latest analysis for Zip Co

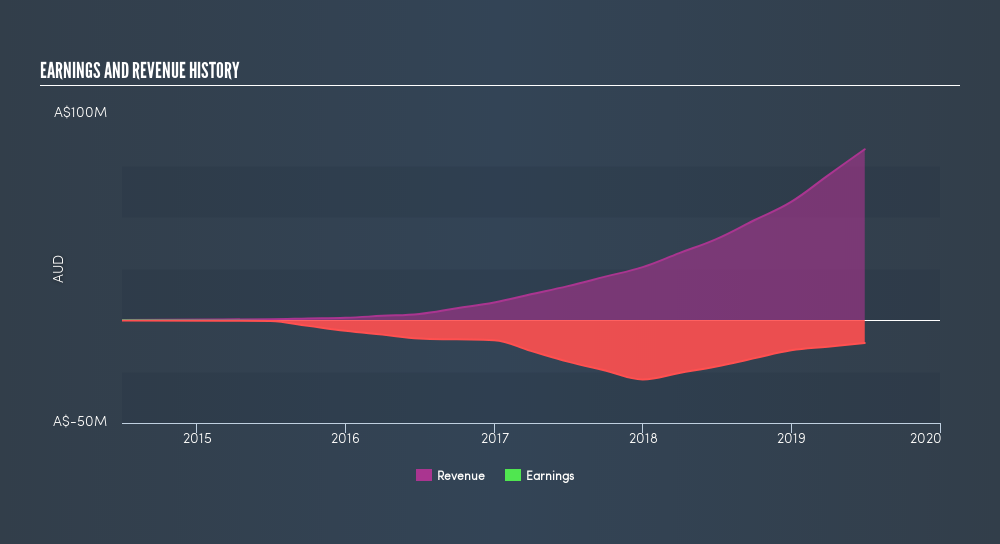

Zip Co isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Zip Co's revenue trended up 78% each year over three years. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 66% per year, over the same period. Despite the strong run, top performers like Zip Co have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Zip Co in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Zip Co shareholders have gained 202% (in total) over the last year. That gain actually surpasses the 66% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Zip Co on your watchlist. Before spending more time on Zip Co it might be wise to click here to see if insiders have been buying or selling shares.

But note: Zip Co may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance and payments solutions to consumers, and small and medium sized merchants (SMEs) in Australia, New Zealand, Canada, and the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives