As Australian shares head for a positive close to the first half of the trading year, buoyed by Wall Street's rally towards all-time highs, investors are turning their attention to promising opportunities in the market. Penny stocks, despite their somewhat outdated moniker, continue to offer intriguing prospects for those seeking growth at lower price points. In this article, we explore several penny stocks that exhibit financial strength and potential long-term promise amidst current market dynamics.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.40 | A$113.22M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$118.24M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.79 | A$430.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.76 | A$465.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.60 | A$848.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$352.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.655 | A$811.08M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.705 | A$223.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.47 | A$164.65M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.755 | A$141.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 470 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Credit Clear (ASX:CCR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Credit Clear Limited develops and implements a receivables management platform and provides receivable collection services in Australia and New Zealand, with a market cap of A$99.79 million.

Operations: The company generates revenue through two main segments: Collections, which accounts for A$39.52 million, and Legal Services, contributing A$5.80 million.

Market Cap: A$99.79M

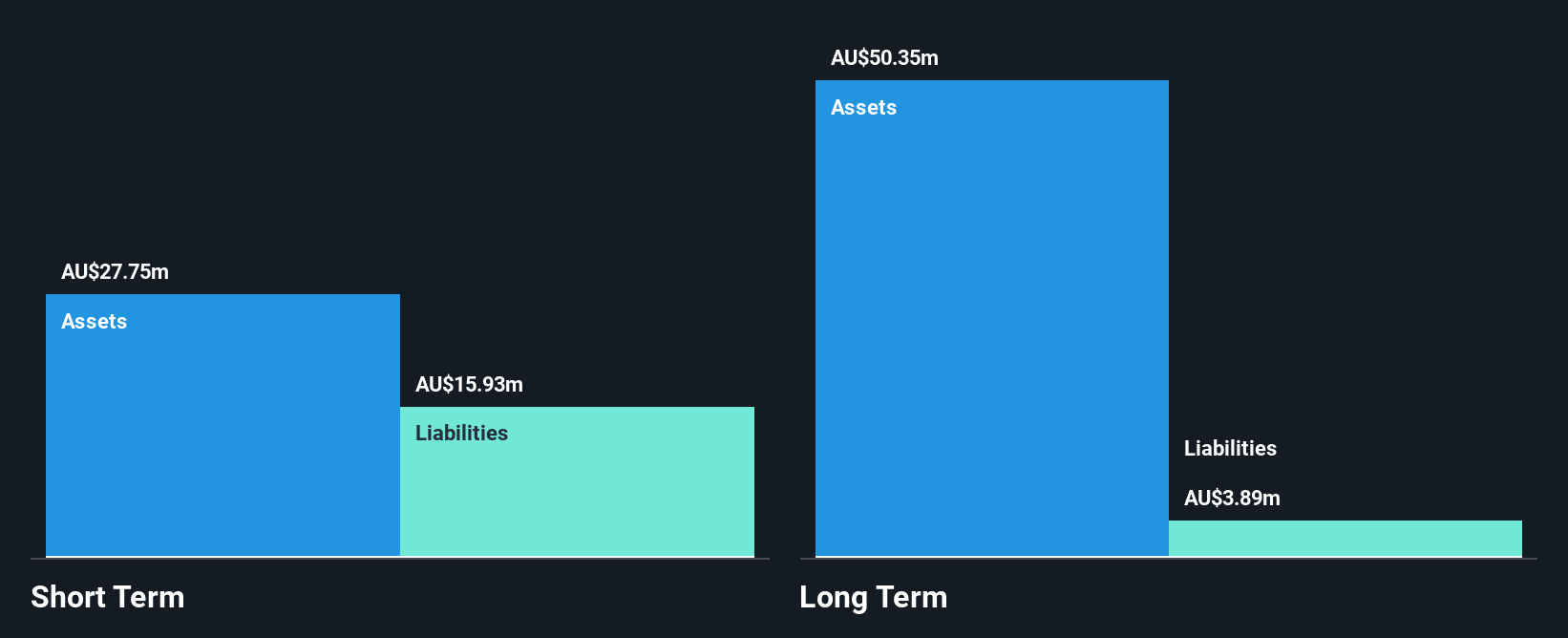

Credit Clear Limited, with a market cap of A$99.79 million, operates in the receivables management sector and is currently trading at 69.3% below its estimated fair value. Despite being unprofitable, it has no debt and boasts a positive free cash flow sufficient to sustain operations for over three years. The company’s short-term assets exceed both its short- and long-term liabilities, providing financial stability. While earnings have grown by 3.2% annually over the past five years, future growth is forecasted at a significant rate of 60.55% per year, reflecting potential upside for investors mindful of volatility risks (11%).

- Get an in-depth perspective on Credit Clear's performance by reading our balance sheet health report here.

- Gain insights into Credit Clear's outlook and expected performance with our report on the company's earnings estimates.

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.48 billion.

Operations: Perenti generates revenue from Drilling Services (A$750.65 million), Contract Mining Services (A$2.50 billion), and Mining Services and Idoba (A$229.77 million).

Market Cap: A$1.48B

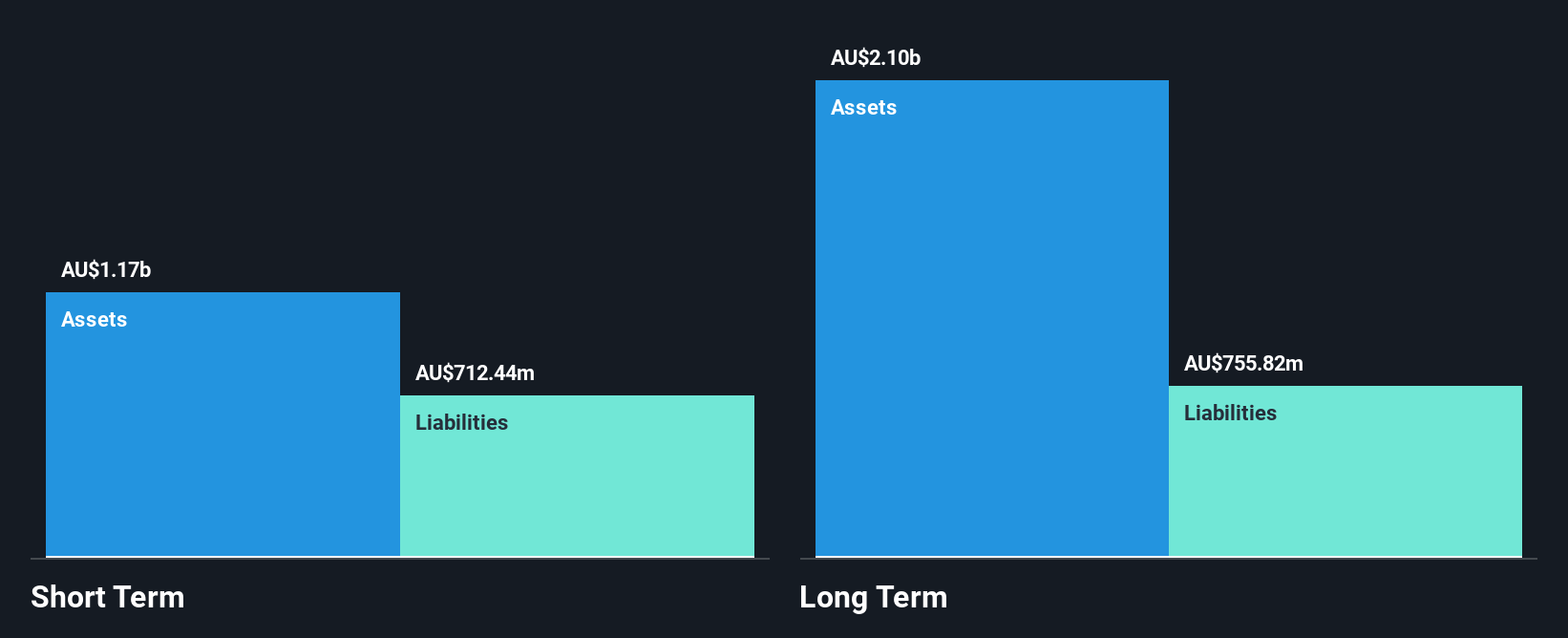

Perenti Limited, with a market cap of A$1.48 billion, is trading at 71.8% below its estimated fair value, presenting potential upside for investors. The company has diversified revenue streams from Drilling Services (A$750.65 million), Contract Mining Services (A$2.50 billion), and Mining Services and Idoba (A$229.77 million). Despite a decrease in profit margins to 2.5% from last year's 3.9%, Perenti's financials show stability with satisfactory net debt levels and well-covered interest payments by EBIT (3.1x). Recent developments include an extension of the buyback plan until September 2025, indicating strategic capital management efforts amidst negative earnings growth challenges over the past year (-28.1%).

- Navigate through the intricacies of Perenti with our comprehensive balance sheet health report here.

- Assess Perenti's future earnings estimates with our detailed growth reports.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited provides payment solutions to merchants in Australia and has a market cap of A$456.11 million.

Operations: Tyro's revenue is primarily derived from its Payments segment, which generated A$464.66 million, complemented by A$14.88 million from Banking.

Market Cap: A$456.11M

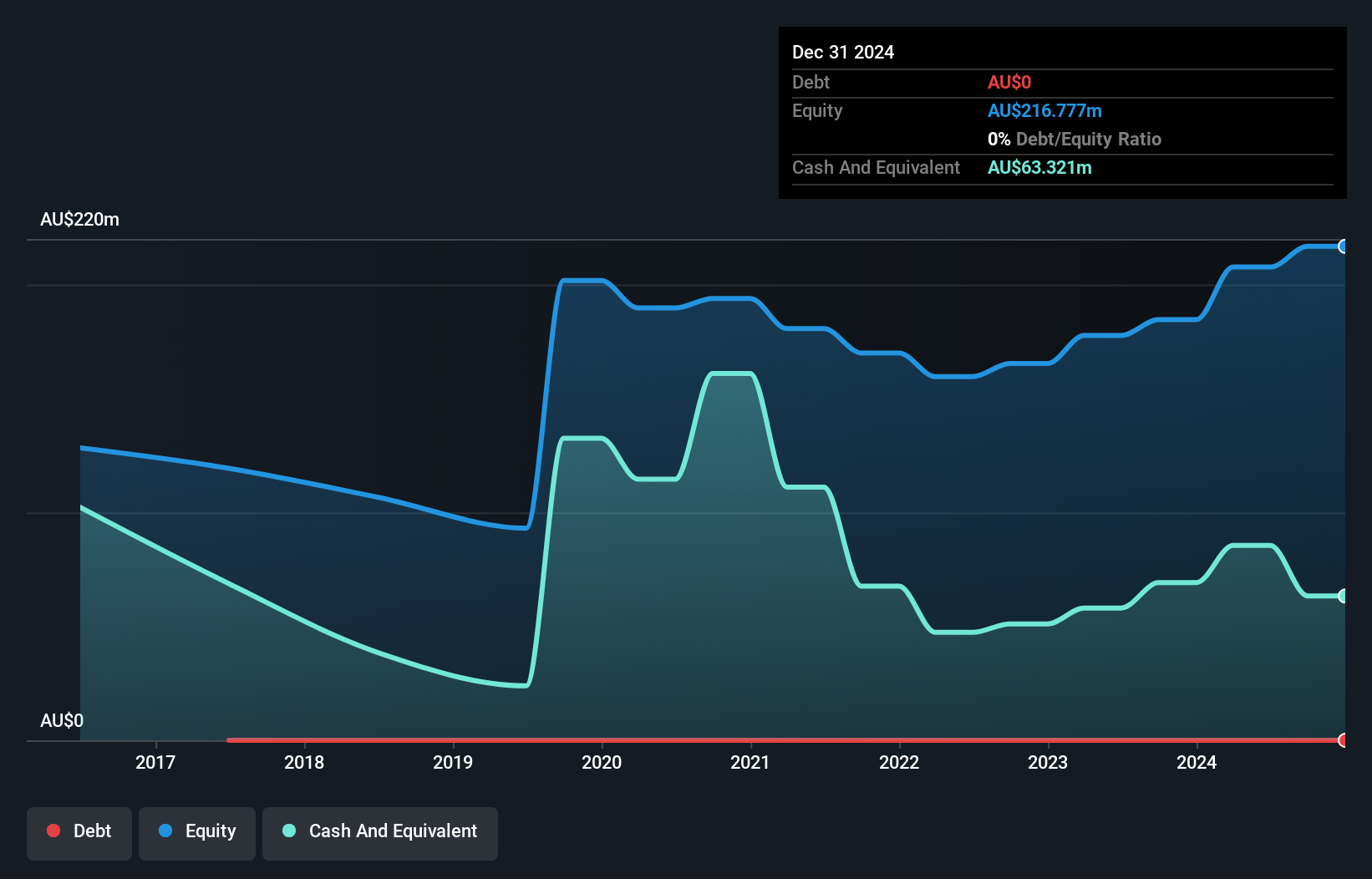

Tyro Payments Limited, with a market cap of A$456.11 million, has shown robust earnings growth over the past year at 206.7%, significantly outpacing the industry average. The company remains debt-free, enhancing its financial stability and eliminating interest payment concerns. Tyro's price-to-earnings ratio of 14.8x suggests it may be undervalued relative to the broader Australian market (18.1x). Recent board changes include the appointment of Steven Holmes, bringing substantial fintech expertise that could strategically benefit Tyro's operations and international expansion efforts. However, earnings are forecast to decline by an average of 2.8% annually over the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Tyro Payments.

- Gain insights into Tyro Payments' future direction by reviewing our growth report.

Turning Ideas Into Actions

- Dive into all 470 of the ASX Penny Stocks we have identified here.

- Curious About Other Options? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCR

Credit Clear

Engages in the provision of debt resolution services and technology development and implementation of the digital engagement platform in Australia and New Zealand.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives